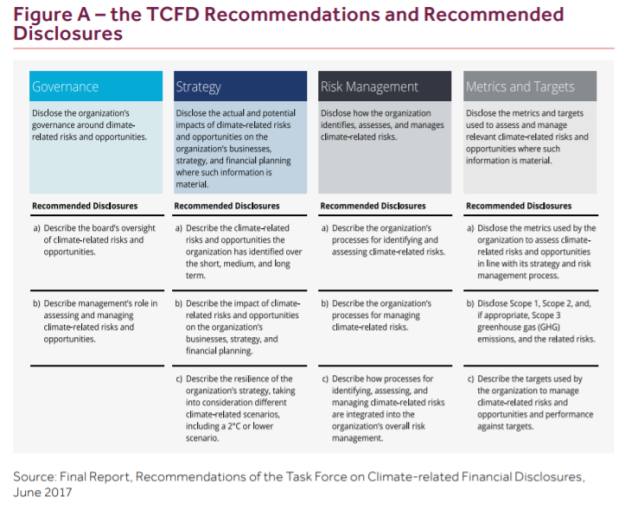

The regulator has today (June 22) published two consultations looking at introducing disclosure rules, which are aligned with the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD), for both listed companies and certain firms, for example FCA-regulated pension providers.

It comes after the Department of Work and Pensions brought forward draft regulations which will see the largest occupational pension schemes and master trusts report in line with the TCFD’s recommendations from October 2021.

The proposed rules aim to make sure that the right information on climate-related risks is available along the investment chain – from companies, to financial services firms, to clients and consumers. They will force firms to issue disclosures at firm and product level.

Sheldon Mills, executive director of consumer and competition at the FCA, said: “The climate change challenge affects the whole of society. It is vital that the financial services sector plays a leading role in addressing this challenge.

“Managing the risks of climate change and transitioning to a cleaner and less carbon-intensive economy will require high quality information on how climate-related risks and opportunities are being managed throughout the investment chain.

“However, climate-related disclosures do not yet meet investors’ and market participants' needs. The new rules will help markets, investors and ultimately consumers better understand the impact of climate change and make more informed decisions.”

Levels of disclosure

In the 99-page document looking at rules for asset managers, life insurers and pension providers, the FCA said it is looking for disclosure to be made at two levels.

The first is entity-level disclosures whereby firms would be required to report annually on how they take climate-related risks and opportunities into account in managing or administering investments on behalf of clients. These must be published on the firm’s main website.

The second is product or portfolio-level disclosures whereby firms would be required to report annually on the individual products or portfolio management services they offer. These include a core set of metrics on carbon emissions.

According to the FCA, most asset management firms will fall into its remit for these new rules.

Life insurers which provide insurance-based investment products and defined contribution pension products are also in scope, along with platform providers and self-invested personal pension operators.

The regulator’s proposals do not apply to defined benefit schemes as these fall within the scope of DWP regulations.

In addition, the rules will not apply to asset managers and providers that have less than £5bn in assets under management.

The FCA has proposed a phased approach, with the rules for the largest firms coming into force from January 2022 , with a publication deadline of June 30, 2023.

These firms include assets managers with more than £50bn in assets under management and providers that have more than £25bn.

The rest of the firms will see the rules come into force from January 2023, with a publication deadline of June 30, 2024.

The regulator said many larger firms are already making voluntary disclosures and have therefore already invested in the resources to do so. However, the initial costs for smaller firms are likely to be higher and so the phased approach gives them time to prepare.

The FCA stated: “Overall, the proposed timing is consistent with the government’s commitment to achieve a net-zero economy by 2050. A longer timeframe for implementation would be incompatible with the urgency and scale of the changes needed to support the transition to a low-carbon economy.”

Listed companies

In a separate 87-page consultation, the FCA discussed extending its climate reporting rules to companies that issue standard listed equity shares.

The FCA stated: “We are proposing to implement the new rule and associated guidance in a way that mirrors the existing rule and guidance for premium listed commercial companies.”

These companies would have to set out in their annual report whether they have made disclosures which are consistent with the TCFD’s recommendations.

The FCA stated: “Better disclosure about companies’ exposure to climate-related risks and opportunities will lead to more informed market pricing and help drive investment towards green projects and activities. Improving climate-related disclosures along the investment chain has therefore been central to our sustainable finance strategy.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know