Firms face £2.5mn ongoing costs with FCA’s financial resilience return

In a consultation paper published today (October 3), the FCA said the new return will be referred to as ‘FIN073 - Baseline Financial Resilience Report’ and will replace the existing one, formerly known as the Covid-19 impact survey.

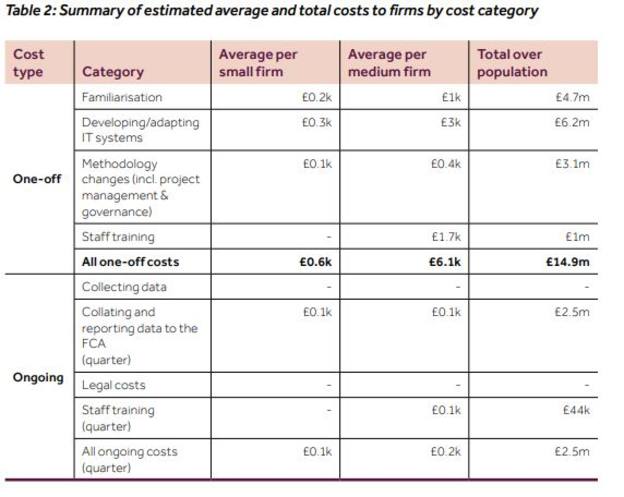

The proposed return will require firms to submit data every quarter, with firms to pay a predicted one-off cost totalling £14.9mn.

Almost all firms that have been reporting on the current survey will be familiar with the data requested.

However, the FCA said it expects that firms will still incur costs to prepare for and report under FIN073, stating that the largest element of both costs associated is with updating IT systems and familiarisation with the new reporting obligations.

One-off costs include the time and resources spent by firms familiarising themselves with the proposals and performing a gap analysis to identify necessary changes as a result. Firms may also incur training and IT costs.

The FCA estimates the total cost of familiarisation will be around £1,014 for medium firms, and around £216 for small firms.

Meanwhile, ongoing costs include collating and reporting the data to the FCA every quarter and related costs such as staff training.

Source: FCA

To familiarise themselves with the proposals, including conducting a gap analysis, the FCA assumed the number of compliance staff who would need to read the consultation will on average be five people at a medium firm and two at a small firm.

“We use an average salary of a compliance function (£56,047), plus 30 per cent non-wage labour costs,” it said.

For the FCA, the main cost will be in relation to IT system changes which it predicted to be a one-off cost of approximately £47,000.

It did not anticipate any significant ongoing IT costs, and considered there will be minor ongoing costs to address any anomalies that arise from the reporting obligation.

Scope of the return

Since June 2020, the FCA has issued a financial resilience survey to collect basic financial data from approximately 23,000 legal entities.

“We have continued to collect this data via additional surveys as this data set has been essential in helping us to understand the risk of firm failure as well as risks across the financial services sector,” it said.

The FCA said having access to “high quality baseline financial resilience data on a regular basis” has improved its ability to act earlier than it may otherwise have done on over 100 firms.

“This data allows us to rapidly assess financial resilience risks at firms, resulting in early intervention where appropriate,” it said.

The FCA said the current approach of collecting the data through ad hoc surveys places significant administrative burden on firms.

It is therefore proposing to rationalise and standardise this data collection in the form of a regulatory return.

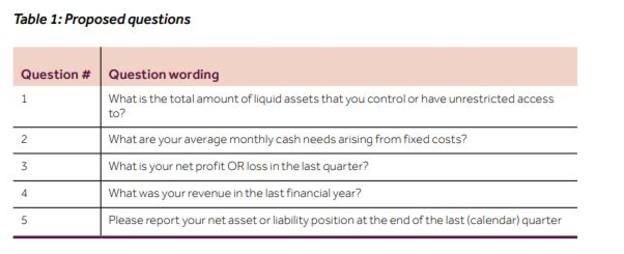

The FCA proposed to include five questions in the new return which is a significant reduction from the nine questions in the existing financial resilience survey.

It said: “While all FRS questions give us valuable data, we have exercised further proportionality in the proposed transition to FIN073 to reduce the questions and manage the burden on firms.”

Source: FCA

The regulator plans to move this data collection onto RegData, the FCA’s data collection platform for gathering regulatory data from firms.

“In doing this we are seeking to reduce both the administrative and financial burden that an ad hoc survey places on firms,” it said. “We also want to increase the quality and consistency of financial resilience data received from our solo-regulated firms.”

In order to measure the success of the new return, the FCA is developing a metric which will enable it to monitor the accuracy with which it identifies firms’ resilience to financial stress.

The FCA said it will also actively gather feedback from industry, including trade associations, to understand if and how the form can be improved, particularly with an aim to reduce the administrative burden placed on firms.

“As well as feedback, we will monitor the volume of calls received by our supervision hub from firms requesting help in completing the return,” it said.

“We will use current volumes in relation to the FRS as our baseline and will seek to see a reduction in calls as a result of both the move from a survey tool to RegData, and the new intuitive form design (subject to a successful pilot).”

The FCA is seeking feedback to its proposals up until December 2.

Following this consultation, the FCA will publish a policy statement and final rules in spring 2023.

This consultation paper comes as last week, the FCA sent its latest financial resilience survey to advisers, asking them to complete it by the beginning of November.

This was the eighth survey the regulator has sent advisers, following one sent to them in mid-June.

However, some advisers have continued to bemoan the survey, arguing that the time it takes to fill it in only makes it harder for smaller businesses to continue trading and offer a consistent service to clients.

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know