The Financial Services Compensation Scheme has forecasted a levy of £478mn for 2023/24, as advisers will yet again contribute the maximum.

In an outlook report today (November 24), the lifeboat scheme said this forecast is based on expected compensation payments totalling £592mn in 2023/24.

This includes:

- £497mn for firms that have already failed; and

- £95mn for firms forecast to fail during 2023/24.

Advice firms, which fall under the life distribution and investment intermediation class, will contribute £105.5mn to the levy, a drop of £107.6mn in 2022/23.

This is primarily due to an anticipated surplus of £86mn being carried forward from 2022/23 and offsetting the 2023/24 levy.

The FSCS said it is currently forecasting a lower levy due to an estimated 40 per cent reduction in self-invested personal pension (Sipp) advice claims decisions, with no large advice firm failures expected in 2023/24.

Also the average compensation per claim is decreasing due to macroeconomic inputs.

The lifeboat scheme said this has resulted in a circa £37mn decrease in compensation payments.

The FSCS said the £478mn figure is an early indication and is subject to change.

“Whilst we are expecting to pay more compensation in 2023/24, the indicative levy is lower than in the current financial year due to expected surpluses being carried over,” it said.

“This early estimate does not include compensation costs where there is relative uncertainty about when the claims will come through to us.”

This includes claims against firms that may fail following the proposed British Steel Pension consumer redress scheme.

Caroline Rainbird, chief executive at the FSCS, said: "At this stage in the 2022/23 financial year, no additional levy is expected and we anticipate a reduction of around 20 per cent in the levy required for next year.

"Whilst I am sure a lower levy for 2023/24 is welcome news, I must emphasise that this reduction is due to surplus balances being carried over from 2022/23, and we expect compensation costs in 2023/24 to remain relatively high at £592mn."

She explained that one reason for this is that there is an inherent lag in the system.

"Around 80 per cent of people who need to bring claims to us did not realise they had been given unsuitable advice until at least five years after the event," she said.

"It is also important to note that there are some variables which we have not yet been able to include in our forecasts due to uncertainties around timings. As FSCS operates on a ‘pay as you go’ basis, we will only include costs where we have a high degree of certainty."

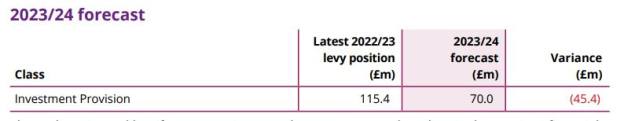

For the investment provision, the early estimated levy for 2023/24 is currently £70mn - £45.4mn less than in the previous financial year.

This takes into account an anticipated surplus (circa £91mn) from 2022/23.

Of the £70mn levy currently forecast, £48mn is for costs in its own class and £22mn is provider contributions paid to the LDII class.

In relation to Sipp operator claims, the FSCS anticipates that there will be a circa £12mn increase in compensation costs related to section 27 claims.

The current levy also includes an approximate amount for its management expenses, which includes FSCS’s day-to-day running costs, as well as costs associated with processing claims.

“We continue to monitor our forecasting closely and will keep levy payers informed of any developments that may impact the levy,” it wrote.

“Further updates will also be provided in the spring 2023 outlook.”

Forecasts vs reality

In the report, the lifeboat scheme said the levy for 2022/23 will remain unchanged at £625mn.

The forecast for 2022/23 was first announced last November when the FSCS said it would be £900mn, however, it reduced this by £275mn in May saying there have been fewer self-invested personal pension provider failures and complex pension claims.

The FSCS said the total levy remains as forecast earlier this year and no additional levy is currently expected.

It includes more than £6mn that it expects to recoup from failed firms, as part of its recoveries work.

Any surpluses remaining in each class, at the end of the financial year, will be carried forward and used to offset the 2023/24 levy as well as future costs.

Currently, this includes:

- £91mn in the investment provision class, mainly due to Sipp operator claims now expected in 2023/24;

- £86mn in the life distribution and investment intermediation class, mainly due to fewer claims processed than anticipated for complex pension claims; and

- £26mn across all other classes.

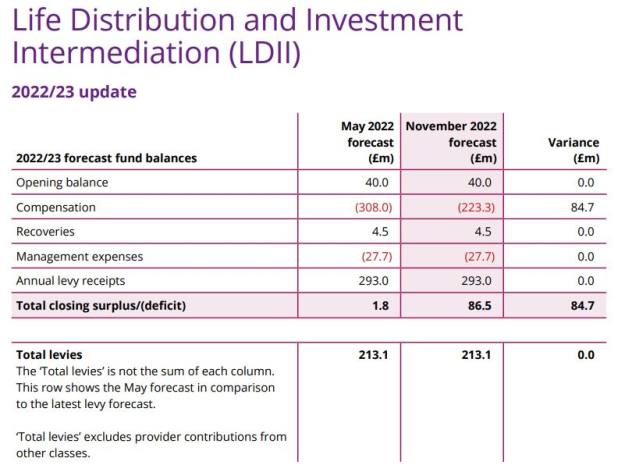

The latest compensation forecast for the LDII class is approximately £223mn – which is approximately £85mn lower than previously forecast.

This is due to:

- Fewer complex pension decisions being issued as the FSCS brought in and trained additional specialist claims handlers

- Macroeconomic impacts including increased interest rates and inflation in the pension redress calculation model which has resulted in lower average compensation payments

- Pension claims put on hold in relation to the FCA consultation regarding calculating redress for non-compliant pension transfer advice

The above factors have resulted in a projected year-end surplus of £86mn which will be carried forward and used to offset the 2023/24 levy.

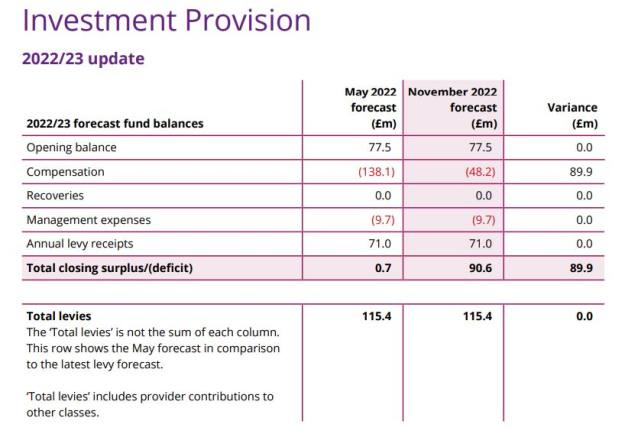

For the investment provision, the FSCS said it paid out approximately £90mn less compensation in this class than anticipated.

This was mainly due to Sipp operator claims expected in 2022/23, now likely coming to the FSCS in 2023/24.

“Given the likelihood of these claims being with FSCS in the next financial year, the anticipated surplus (£91mn) will be taken forward and used to offset the 2023/24 levy.”

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know