The DWP and regulators are expected to publish their response to the consultation and next steps before the July 2023 parliamentary recess.

Eventually all DC pension schemes, both in accumulation and decumulation, will have to produce and publicly publish annual VFM reports.

The government and regulators will be setting out a phased implementation approach possibly over a few years, partly to enable learnings from phase one, but also to avoid overwhelming the pension industry and other stakeholders.

Phase one

The first phase will just include default investment strategies used for workplace schemes, primarily for auto-enrolment.

Schemes in scope include those where 80 per cent or more pension savers were auto-enrolled. DC legacy workplace schemes (non-qualifying schemes for AE) default investment strategies are in scope – some of these will be charging significantly more than modern schemes.

VFM metrics would be a useful guide for pension savers to use prior to consolidating.

It is proposed that micro-schemes will be excluded, along with small self-administered schemes and executive pension plans where members tend to be more engaged with decisions around investments and are typically advised.

In this phase the intended audience will be trustees, IGCs and other industry professionals – not members. However, the government and regulators expect employers to use VFM assessment results to decide which scheme to auto-enrol their members into, or when considering whether their workplace scheme continues to provide VFM.

Phase two

Currently the second phase includes everything else: workplace self-select options; non-workplace pensions, including consolidators and DC pensions in decumulation.

It is possible that this phase may be extended and broken up into additional distinct phases. For example, it might make sense to have an intermediate standalone phase for consolidators where consolidation activity often takes place without advice.

VFM metrics would be a useful guide for pension savers to use prior to consolidating.

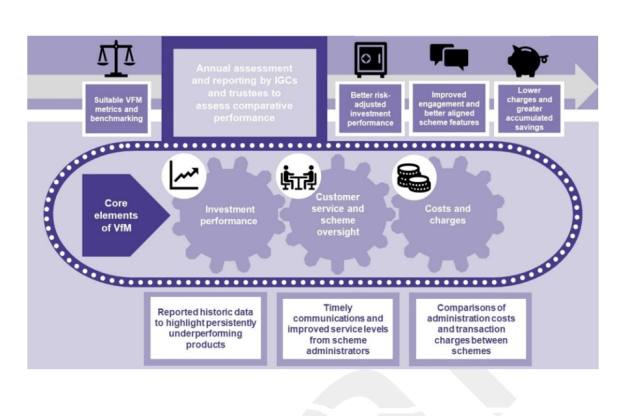

Three mandatory elements of VFM

The proposed VFM framework will be based on three elements of value using a mandatory regulatory framework. These are:

- net investment performance;

- quality of services; and

- cost and charges.

The diagram below shows how the VFM framework will work.

The VFM assessments draw on data already being generated in different parts of the market. This includes data for trust-based schemes; chair’s statement; a development from rules in place for sub £100mn occupational pension scheme VFM assessments; and also comparison data used by IGCs.

But there are a number of new data points for each criteria, especially for measuring and reporting on net investment performance. It will mean that trustees, IGCs and providers will have to generate or collect a great deal more data.

Net investment performance

The consultation makes the following proposals: