Comparison site Moneyfacts has published its list of what it believes are the best self-invested personal pensions (Sipp) and small-self-administered schemes (Ssas) available to investors.

Moneyfacts awarded four and five stars to schemes it deemed best in rank after carrying out "unbiased" and “extensive analysis” on the providers in the market.

This included analysis of the features each product offered investors, and particularly the levels of fees they charge.

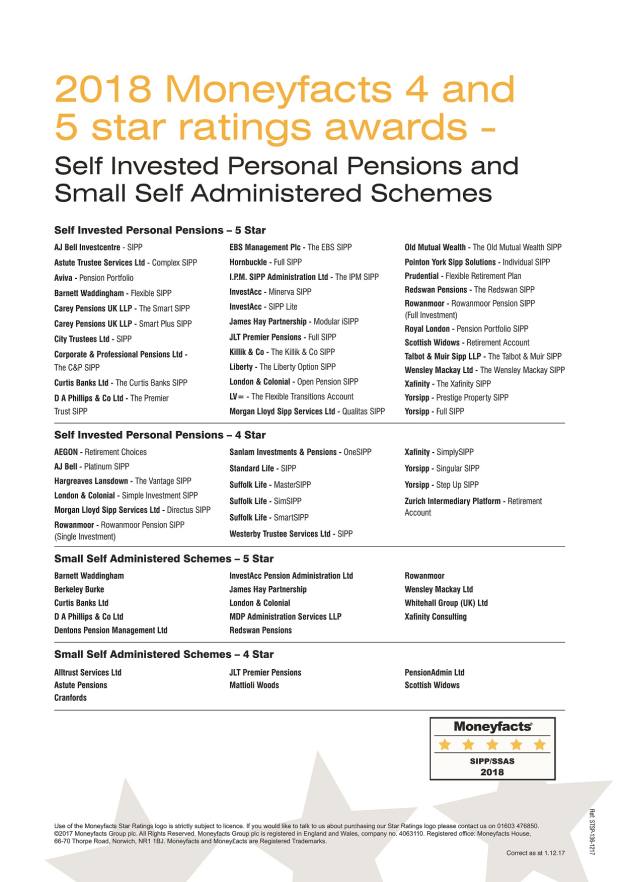

Of the Sipps evaluated, 12 were awarded the full five star rating, while 16 took home four stars.

Among the top Sipps were well known names such as AJ Bell, Prudential, Hornbuckle, Royal London, Scottish Widows, Talbot & Muir and Royal London as well as lesser known ones.

In addition, 14 Ssas were deemed best in class, alongside seven which received four stars.

Among the best Ssas providers were Barnett Waddingham, Berkeley Burke, Curtis Banks, Dentons Pension Management, Xafinity and James Hay.

Richard Eagling, editor of Moneyfacts’ Investment Life & Pensions magazine, said: "When it comes to retirement planning, self-invested pensions such as Sipps and Ssas have become a favourite among individuals looking for the most flexible pension products, but the enormous choice means that selecting the most appropriate provider can be difficult.

“The Moneyfacts Sipp & Ssas Star Ratings highlight the companies that offer the schemes with the most extensive range of features and competitive charges, helping consumers direct their focus when considering a scheme.”

Mr Eagling said the annual star ratings focused on the features Moneyfacts deemed most relevant from a consumer perspective.

It used a scoring system to calculate the ratings, with values allocated to several features of the product.

Each of the scores was weighted according to the benefit to the consumer or company and the relative cost, it said.

For Sipps these included minimum and maximum ages; minimum contributions and transfers in; number of segments allowed; fees such as set-up fees, annual admin fees, dealing fees, cash transfer fees, and things like lifetime annuity availability and charges, capped drawdown charges, and flexi access charges.

For Sass the researchers looked at types of service offered; minimum contributions and transfers in; funds under administration; and various fees.

Moneyfacts said it uses direct information from providers and feedback from the industry to determine what features are deemed to be most desirable in the current market.

It holds about 50 fields of information per individual product, which are continually updated.

Features are also reviewed in line with market changes, giving distinction between individual products, the firm said.

Here are the schemes that fared best:

carmen.reichman@ft.com