People using pension freedoms to dip into their retirement pot at 55 could end up losing their benefits, Sir Steve Webb, partner at LCP and former pensions minister, has warned.

According to Webb, as furlough schemes finish and the additional £20 on universal credit payments comes to an end, people who are over 55 and still working might become concerned about their jobs or might find themselves made redundant.

This could put a strain on people's finances, and lead to them dipping into their pension pots under the pensions freedom regime, to help tide themselves over.

Approximately 1.6m people aged 55 to 65 are on benefits, such as universal credit or the employment and support allowance, and this number could rise.

But in a new paper, called 'How getting pension freedoms wrong could cost you your benefit', LCP and fintech company Engage Smarter have warned tapping into the pensions pot could mean tapping out of valuable benefits.

The 26-page paper looked at how the means-tested benefit system for those under pension age and for those over pension age interacts with different pensions freedom choices, such as taking an income through drawdown or taking a lump sum.

The paper said: "The problem facing individuals who have to make these choices is that benefit rules are complex and different pension choices – such as leaving the money where it is, cashing it out in full, going into drawdown or buying an annuity – can have different implications for benefits.

"Some choices may be better than others, but the saver is unlikely to be familiar with the rules and neither is their pension provider. There is a risk that growing numbers of people could make poor choices around accessing their pensions and suffer financial detriment as a result unless something changes."

Of the various options, one of the most dangerous is the temptation to use the pension pot like a bank account.

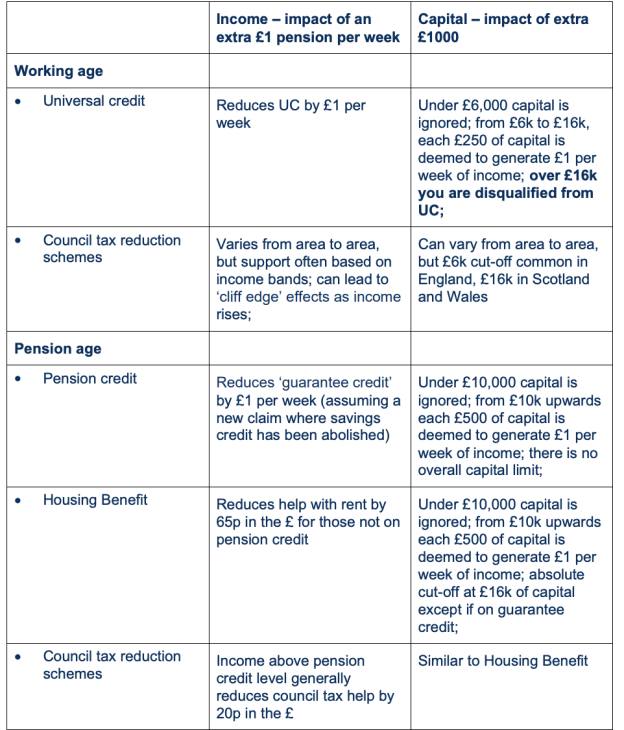

According to the paper, where people under state pension age take money out of a pension pot, this can affect their benefit entitlement in two main ways.

The first is that, if they end up with more savings, this increases their ‘capital’ when they are assessed for benefit. Therefore, those with more than £16,000 in capital are disqualified from universal credit, while even having £6,000 in capital means help from English local authorities with council tax bills can be stopped.

The second potential problem is that, if people use their pension to buy a regular income through an annuity, each pound of annuity income could be deducted from their benefit income.

Similar issues can apply to those over pension age who are on pension credit or housing benefit, though the rules apply in a different way (see table).

Source: LCP/EngageSmarter paper

Co-author Matt Gosden, founder of EngageSmarter, together with strategy consultant Peter Robertson, pressed the point home in the paper.

The paper said: "Individuals currently getting help with their Council Tax and considering taking money out of their pension will need to find out from their local authority how this might affect the amount of help that they get.

"Pension schemes, pension providers and official guidance bodies such as Pension Wise or the Money and Pension Service are very unlikely to be able to supply up-to-date information that is accurate at the local authority level."

Webb said while this would not be an issue for people who’ve never worked or saved much, as they won’t have pension pots to worry about, it would be a worry for people who have "worked and saved but now find themselves out of work in later life, and might reasonably think that using pension freedoms to tap into their pension is a sensible way of keeping their finances together".

He warned: "The research might be particularly topical if a combination of £20 coming off universal credit rates, and the end of furlough, means a lot more people turning to their pensions for cash.

"It would be pretty grim if no-one told them that by dipping into their pension they could actually wipe out the help they get with the council tax or even their entire universal credit."

As part of the government's financial response to the Covid-19 pandemic, a temporary £20 increase to universal credit payments was introduced.

Although this top-up scheme ends on October 6, some people could feel the pinch in their pockets at the end of September, depending on the day they usually receive universal credit.

But people cannot keep their pension untouched while claiming benefits. The paper also warned: "Pensioners cannot sit on large sums of untouched pension whilst claiming large amount in mean-tested benefits.

"Even if a pension pot remains untouched, those who claim benefits are treated *as if* they had used the pension to purchase an annuity or income for life.

"This ‘imputed’ income is then treated in the same way as any other private pension income."

Coinciding with the launch of the paper, LCP and EngageSmarter have launched a website called www.pensions-and-benefits.uk. This is a free benefit checking calculator that will help raise awareness of the possible knock-on effects on benefit entitlement of taking money from your pension.

simoney.kyriakou@ft.com