Article 1 / 4

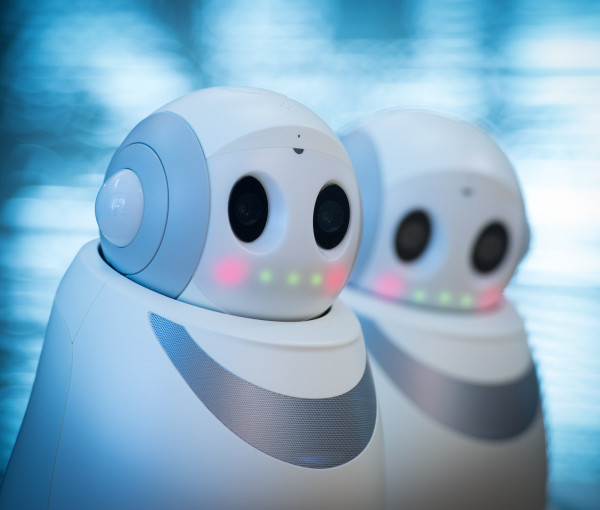

Platforms and back-office systems have evolvedRobo cop or Robo flop?

The 'robo' term is too generic to have real meaning and is more likely to confuse your customers than help them. Not all digital advice services will be fully automated. Some are, but others streamline parts of the process and still involve human interaction. It is not a matter of one or the other is right, rather, what do you want to offer your clients? Equally, decide if you want to offer an advised service, non-advised or both.

It is important to identify your objective to be able to identify the right solution. Are you trying to open up a new channel to enable you to reach customers who cannot afford your traditional service? Do you wish to allow some of your existing clients to access some of your services in a streamlined manner? Are you looking to create a service the children of your clients can use to start investing, before they reach the stage where traditional advice is affordable? Or are you trying to put in place low-cost ways to deal with clients who are no longer economic in a post-RDR world?

To test this, it can be worthwhile creating a number of client personas and thinking about how your service would support the needs of each. Imagine a typical client for the service you want to offer and identify the type of solution you would expect to present them with. This will help you to identify the features you need your service supplier to offer.

Automated advice services are in their relative infancy. At this time, most focus on the accumulation phase of saving. We are now seeing a handful of decumulation services emerge and several more are in the pipeline: currently, if you are looking at the latter, you will significantly limit your options.

When planning any new service, it is crucial to have a clear understanding of how you will take it to market. Build it and they will come simply does not work as a digital strategy. The high cost of customer acquisition is the biggest single challenge to the emerging direct-to-consumer digital advice services.

Established advice firms should be in a far better position than start-ups to offer low-cost services, but they still need to be able to reach customers cheaply. Have a clear view of how you aim to achieve this in order to identify any special requirements. For example if you are planning to target the service to members of auto-enrolment schemes your firm has set up for employers, do you have the ability to co-brand the service with the employer?

Every time two software systems need to talk to each other, there is a potential point of failure. The fewer different systems you can have running in your business, the more likely it is that you will be able to effectively streamline your operation. If you are looking to launch a low-cost advice solution, it is important to minimise the level of any manual interaction that may be necessary. For this reason, I would always encourage people to talk to their existing software suppliers about what they have on offer or what they are planning in the near future.

As well as considering your client management system provider, look at the software supplier who provide your risk-profiling tools and even your portfolio modelling and rebalancing software.

If your current suppliers are not yet offering automated advice solutions, it is worth talking to them about whether they plan to introduce them and if so what the likely timescales are. If you have extensive experience in using a system, it may be better to wait a short while to use their version of automated advice rather than having to make significant changes to the way you work by moving to a new system.

It is still worth considering alternative suppliers; there are a range of highly innovative systems being developed. However, if you are going to work with the new supplier, make sure you clearly understand the extent of integration they will be providing to your current software and when.

Will the alternatives work with your current risk profiling tools?

Using a mixture of risk-profiling tools within a practice will inevitably lead to inconsistencies in the advice given. If at some stage you have to move a client from one risk-profiling tool to another, this can require major changes to the underlying assets. It is advisable to use a single risk-profiling system across both your traditional and automated/semi-automated business.

What is the profile of the sort of cases you want to automate?

To make sure the tools you select are suitable for the target audience, it is important to consider the type of cases and scenarios you are looking to support with your digital service.

What mechanisms can you implement to identify cases not suitable for automated advice?

In the current state of development, few if any automated solutions are able to accommodate all advice scenarios. In choosing an automated advice supplier, it is essential to have a clear understanding of the sort of cases you will want the automated service to refer for human intervention, and which situations you wish to trigger such action.

How will you validate that the system you choose produces the outcomes you expect?

From a regulatory perspective, it is important to be able to demonstrate that you have a clear understanding of the likely outcomes that will emerge from the use of your automated service. Professional indemnity insurers may ask to see evidence of the work done to understand outcomes and we expect the FCA to start asking for this sort of evidence as the automated advice market grows. It is as important to understand which cases will be rejected or diverted to human advice as those that will be accepted. Your firm will be responsible for any advice given, so it is crucial for the advice firm to understand the mechanics of the automated solution.

While not an exhaustive list, the above are all factors that firms should consider as part of their partner selection, but don't be tempted to rush this process as the partner you select now should have a key role in the success of your firm for several years.

Ian McKenna is director of the Finance & Technology Research Centre and founder of DigitalWealthInsights.com

Key Points

To identify the right solution, it is best to identify your audience.

Established advice firms should be in a far better position than start-ups to offer low-cost services.

Few automated solutions are able to accommodate all advice scenarios.