The prospect of a Financial Conduct Authority review which compares automated advice with face-to-face advice has been welcomed.

The work and pensions select committee called for such a review (5 April) in its report into pension freedoms.

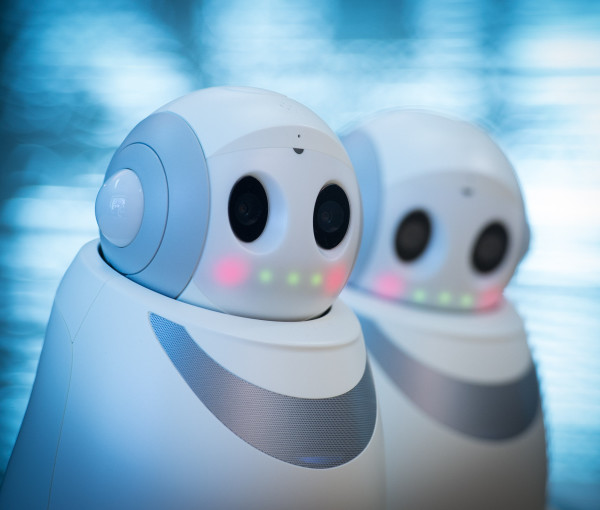

The MPs said there was a clear role for automated services in providing cheaper advice but public scepticism as to whether it is reliable and trustworthy needed to be addressed through empirical evidence.

The committee recommended the FCA conduct and publish a review comparing consumer outcomes from face-to-face and automated advice.

Andrew Firth, chief executive of Wealth Wizards, said: "We would welcome such a review.

"We firmly believe that automated advice is not only going to make advice available to a much larger proportion of the UK, but it will also help to deliver better customer outcomes overall.

"Delivering the best possible outcome to the customer has to be the key metric that robo-advisers judge themselves by, and we believe that open, honest discussion will only help the industry to improve in this regard."

Simon Harrington, senior policy adviser for public policy at the Personal Investment Management and Financial Advice Association, said: "In our view, many of the challenges around take up for advice exist for robo-advice too.

"A review makes sense but we would be wary of assessing the impact of long-term decisions through the lens of a short term impact.

"Robo-advice is a welcome addition to the advice landscape but hold the view that it will always need to be supplemented by an element of human interaction.

"Pensions are as much an issue of the heart as they are the head and as an industry we have to be cognisant of that if we are to achieve the best possible outcomes for consumers."

The committee cited research suggesting 58 per cent of people would not currently want to accept an advice recommendation from a computer.

During the committee's inquiry, the FCA was unable to point to any explicit examples of comparisons it had done between automated and face-to-face advice, although it stressed that quality requirements remained the same, regardless of the advice channel.

An FCA spokesman said: "We welcome the select committee’s report into the pension freedoms. We will consider the recommendations, many of which are measures we are looking at in our Retirement Outcomes Review, including options for default investment pathways."

The committee also recommended measures such as default guidance, a pensions dashboard and a more varied advice market could be vital in ensuring that savers are equipped.

Its report said: "Informed and confident savers are more likely to take up financial advice. More generally, they are more likely to shop around and take sound financial decisions about their retirement."

damian.fantato@ft.com