Data from the Lang Cat’s State of the Adviser Nation report showed 26 per cent of advice firms researched and consolidated information to create their own report on the costs and charges landing on their client’s doorstep.

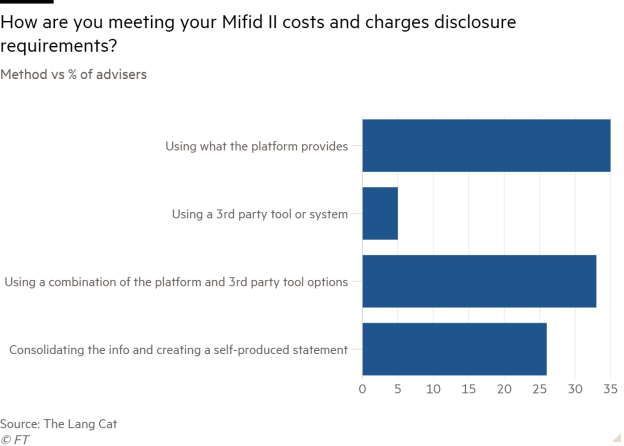

The consultancy polled 404 advice firms at the end of 2019 and found 35 per cent used solely the document provided by the platform, 5 per cent turned to a third-party tool and a third used a combination of the two.

But the remaining 26 per cent of advice firms reported they had taken disclosure and reporting into their own hands.

The Lang Cat stated: “Often this takes the form of a time-consuming, bespoke report for each client, combining platform, back office and investment data.

“This is complex, particularly for those advisers that use multiple platforms, each with different data standards and reporting methodology.”

In the report, the Lang Cat stated it had spoken to one firm, which generated three different figures using the different methodologies and presented all three to the client.

Alistair Cunningham, financial planning director at Wingate Financial Planning, said the process was a “nightmare”. He added: “We do it internally, and manually, and use the platform as a sense check where possible.”

Paul Stocks, director at Dobson & Hodge, agreed. He said: “Reliance on provider cost disclosure in respect of Mifid II often leaves much to be desired — both in terms of accuracy and also an appropriate level of detail.

“We are therefore wary of solely relying on provider disclosure documents in respect of the disclosure.”

Mifid II — the second part of the EU’s Markets in Financial Instruments Directive — was introduced at the beginning of 2018 and made it mandatory for advisers to break down costs for their clients periodically in the interest of greater transparency and value for money.

This had a number of consequences, including a ‘race to the bottom’ price war among and between financial advisers, platforms and fund managers as the cost of investment became clear to the client.

The Lang Cat’s research showed 90 per cent of advisers had reduced the total cost of investing for clients in recent years.

It also saw a large shift in asset flows from active funds into passive portfolios as passive funds come with lower fees.

But the costs and charges disclosure also comes at the expense of additional time costs for advisers, particularly when they feel unable to trust the documents provided by the platforms. Others say the process of providing accurate data is impossible.

Philip Milton, chartered wealth manager and Philip J Milton & Company, described the documents as “inane”. He added: “There can be no such thing as an accurate figure as it is unavailable. It can only be a rough guess and not being of great help to anyone, sadly.

“We try to rely on our platform’s connections and aim to counter the stupid conclusions sometimes drawn.”

Ricky Chan, director at IFS Wealth & Pensions, said: “The process of doing [the costs and charges disclosure] is nonsense and adds red tape and yet more paperwork for the client, which simply confuses them further.

“It’s a struggle for smaller firms and is an absolute waste of time and resources. We rely on platforms to do most of the legwork.”

But other advisers disagreed, noting the Financial Conduct Authority only required advisers to work to a ‘best efforts’ or ‘best endeavours’ level.

Darren Cooke, chartered financial planner at Red Circle Financial Planning, said: “We are all pretty much getting it wrong and actually can’t get it right.

“Thankfully the FCA has provided us with the most wonderful get-out clause; it recognises that we, as advisers, can't control this and we are beholden to the providers so the FCA allows us 'best endeavours'.

“I think some firms are sweating about this way too much, particularly when the clients don't really actually care about the detail.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.