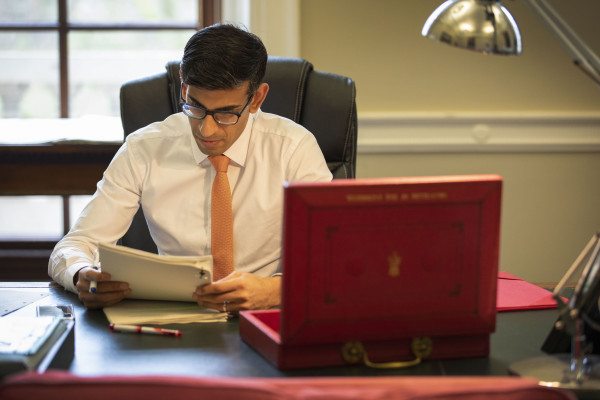

Chancellor Rishi Sunak has announced a £330bn war chest of loans to protect businesses against the financial difficulties caused by the coronavirus.

Mr Sunak, who delivered his debut Budget less than a week ago (March 11), said he would do "whatever it takes" to support the economy through the pandemic.

He said: "The coronavirus pandemic is a public health emergency but also an economic emergency.

"We will support jobs, businesses, incomes and help you protect your loved ones — whatever it takes."

He announced an "unprecedented" package of government-backed loans and guarantees for businesses, worth £330bn or 15 per cent of the UK's GDP.

The loans will be delivered through two schemes: for large firms, a new lending facility with the Bank of England will provide low-cost, easily accessible loans, and for small to medium sized businesses the government will extend its new business interruption loan scheme to provide loans of up to £5m per business with no interest for six months.

The Treasury initially announced the business interruption loans at the Budget last week, but has now increased the loan size from £1.2m to £5m.

Mr Sunak said he was taking a new legal power through the coronavirus bill to "offer whatever further financial support" he decided was necessary.

The chancellor also said the government action was "sufficient" for businesses such as pubs, clubs and theatres to make claims.

For smaller business in that sector who do not have insurance, he said he would provide cash grants of £25,000 per business.

Businesses in the sector will also get a business rates holiday, something previously only available to small leisure and hospitality firms.

Mr Sunak also announced mortgage lenders would be forced to provide up to three months' relief from mortgage payments to consumers who needed it. He did not outline any measures for renters, or any changes to sick pay, but said that in the coming days he would go "much further" to support people's financial security.

Also speaking today, prime minister Boris Johnson said the government needed to "act like wartime government"and "do whatever it takes to support the economy".

The measures announced dwarfed the £30bn of government funds announced at the Budget last week.

Those included a £2bn cash injection for small businesses, promising to refund the cost of providing statutory sick pay to any business with fewer than 250 employees impacted by the virus.

HMRC has also been asked to "scale up" its Time to Pay service, allowing businesses and the self-employed to defer tax payments over an agreed period of time.

Sick leave rules were also relaxed.

The spreading coronavirus crisis has caused global markets to tumble as governments across the world shut down borders, locked down domestic travel and closed sports and leisure facilities.

As at mid-afternoon today (March 17), almost a third (28 per cent) had been wiped from the FTSE 100 since February 24.

The S&P 500 had dropped some 26 per cent over the same time period while the Euro Stoxx 50 was down 32 per cent.

Volatile market conditions have seen indices suffer their biggest daily dives in more than 30 years this month. But reports that the US government is preparing cash transfers to consumers helped lift equities this afternoon, with the FTSE 100 finishing 2.8 per cent higher on the day.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.