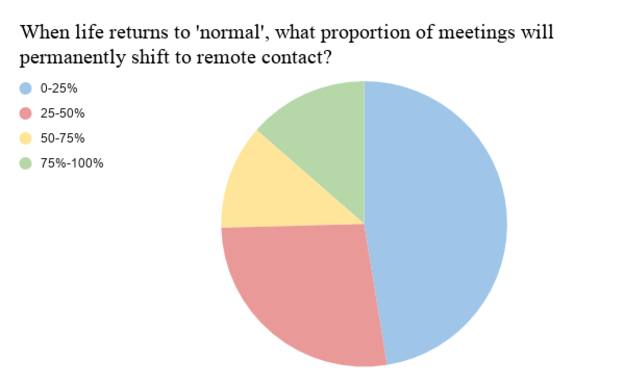

A quarter of advisers believe remote contact with clients will account for a significant number of meetings even when life gets back to normal following the Covid-19 pandemic.

A survey of 179 advisers conducted by FTAdviser has found 27 per cent of respondents predict that up to half of their meetings previously done face-to-face will remain virtual in future.

In total, more than half of the advisers polled (52 per cent) said at least a quarter of their meetings would shift to remote working even after lockdown measures are fully lifted.

But, in a sign that industry practices may soon split down the middle, 47 per cent said they expected no more than 25 per cent of client contact to remain remote in future.

Evolving efficiencies

A majority of advisers agreed they were keen to carry over some of the efficiencies that came with virtual meetings beyond the coronavirus crisis.

Corey Whelan, director at Cambridgeshire Money, said: “In my previous role, I could be out in the car for four hours of the working day.

“Now, when most of my appointments have been done virtually, I’ve got so much more time in the day to get other things done, which would have been wasted had I been out and about in the car.”

Mr Whelan said his productivity had increased throughout lockdown and his business had grown more rapidly than first anticipated.

Mike Jordan, managing director of Jordan Financial Management, agreed. He said: “I can confirm how much more productive an adviser can be when they are not losing up to an hour either side of the meeting in travel time.”

Phil Jeynes, director of corporate sales at Reassured, said advisers using technology to serve clients “has to be a step forward”.

He thought virtual meetings would allow brokers and advisers to manage more clients, and may provide a viable way for IFAs to serve customers with less complex needs at a lower cost.

Earlier this month, a technology specialist predicted that financial services companies that want to win younger customers will need to continue to adopt the sort of new technologies they have been getting used to during the pandemic.

Nick Ford, chief technology evangelist at software platform Mendix, said younger savers needed a joined-up approach from technology and financial services organisations to help provide various platforms and tools that would enable a whole new generation of savers to thrive.

But intermediaries were quick to avoid writing off the value of face-to-face meetings.

Amit Patel, consultant at Trinity Finance, said vulnerable clients would always need face-to-face appointments, while Sean Irwin, IFA at Clarity Wealth Management, said it was more difficult navigating new clients over virtual meetings.

He said: “I had a new business client meeting with a guy who had been sat in cash. We did the usual financial advice process and everything was going well and he was very engaging.

“However, at the end he said he was reluctant to go ahead until we had a face-to-face meeting because he did not know me, hadn’t seen our offices, and he was worried because it was his life savings.”

No mountain high enough

Virtual meetings becoming part of the working norm would also leave advisers less restricted when it came to geographical limits to their business.

Mr Patel said: “The new normal is going to be very different, as advisers can have virtual meetings from the comfort of their own homes.

“It will open up the market as advisers can have appointments without any geographical restrictions, which should open up new opportunities for them.”

Catherine Morgan, financial planner and financial coach at The Money Panel, said a lack of geographical restrictions would also encourage intergenerational wealth conversations as children and other family members were able to “dial in” from their own homes.

She added: “Clients may feel more relaxed being in their own environment and particularly when it comes to talking about money, which is already a highly emotional subject.”

Other advisers were mindful of the potential issues, or changes, which could arise from intermediaries reaching further afield.

Shelley McCarthy, managing director at Informed Choice, said: “A lot of marketing for small firms is based on locality, so now we potentially have the ability to cast the net wide in terms of clients due to technology, will marketing strategies need changing?

“It can definitely mean more efficiencies in the business in terms of travelling to meetings and ‘dead time’, but managing staff remotely can actually take more time in terms of catching up with all team members.”

Although noting the efficiencies could see revenues increase for advisers, Derek Bradley, chief executive of Panacea Adviser, said the result could reduce companies’ need to employ a sizeable group of advisers.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.