It’s time to ditch Olivia Newton-John’s advice to ‘get physical’, and start getting digital instead.

That's a not uncommon view among advisers nowadays: the need for the industry to embrace a ‘tech-savvy’ culture is clear. But the issue of how to use this approach to attract new clients - an area of increasing interest, or perhaps concern, as the pandemic makes it harder to form new business relationships - is up for debate.

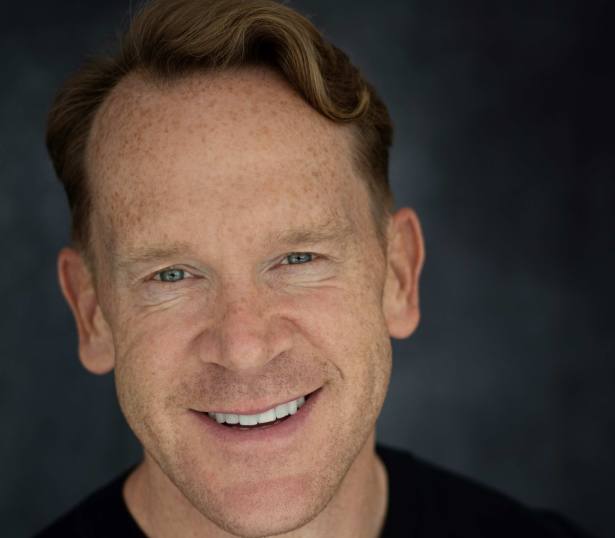

Mark Ireland says he has managed to successfully engage and build relationships with new clients by using technology to communicate and gather client data remotely, as more people work from home and require services to be delivered ‘at an arm’s length’.

He believes there are still lots of opportunities in attracting new clients who are looking for financial help to manage their finances as they navigate through the uncertainty that Covid-19 has thrown up, with ever-changing rules around lockdown as well as concerns surrounding job security.

The chartered financial adviser at Hitchin-based Lyndhurst Financial Management says: “Initial enquiries are dealt with a little differently these days, with Teams or Zoom-type meetings being much more common, as well as using technology to gather client data at arm’s length.

“This is working really well, and as, over time, we engage with more and more people who are ‘computer-savvy’ we will as an industry engage much more digitally with our clients, providing a personal service but tailored to online delivery.”

Since the start of the pandemic, paper-based communication and documentation has become increasingly obsolete in a society-wide effort to reduce contact and streamline services.

Key Points

- Advisers need to make use of technology to attract new clients

- New clients tend to come through recommendations from other professionals

- Clients are rethinking their finances

This shift to providing more digital services was echoed by research from Encompass Corporation, which found that 73 per cent of businesses are more likely to select a bank that could perform all relevant regulatory checks digitally.

The analysis, which quizzed 200 senior business decision-makers in large and medium-sized UK companies, found that 56 per cent believe their bank has noticeably improved aspects of its digital services since the start of the outbreak.

New enquiries

But being tech-savvy is just one way to attract clients. Mr Ireland argues that advisers can also capitalise on a post-lockdown era by tapping into the new and unexpected needs of their clients as a result of coronavirus.

Sadly, the rise in Covid-19 deaths has also seen a rise in clients asking about wills and trusts.

Mr Ireland said: “New client enquiries have mostly continued to come through trusted relationships with other professionals, so business owners looking for guidance on pension funding and other ways of extracting funds from their company, for example.

“Others have, sadly, been as a result of unexpected deaths, due to coronavirus, leading to new will trusts being established.

“Long-term care funding enquiries have fallen a little, which we understand is similar to a dip in the level of new enquiries in good quality care homes, probably for obvious reasons given the terrible way that the sector was treated and the resulting deaths.