The industry has sounded warning bells over the fact nearly half of all the regulator’s scam alerts feature cloned firms, with impersonation scams branded “most dangerous”.

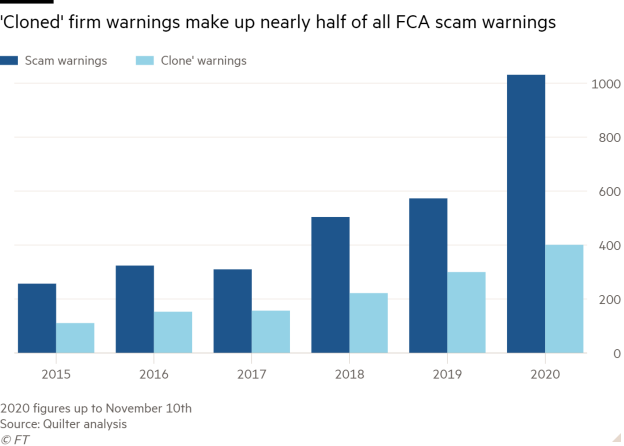

Analysis from Quilter showed that since 2015, an average of 45 per cent of all warnings from the Financial Conduct Authority involved the ‘clone’ of a financial services firm.

In 2019 — the latest year with full data — impersonation scams accounted for 52 per cent of all warnings. The City watchdog has issued 1,031 warnings in 2020 so far, with 401 relating to cloned firms.

Debbie Barton, financial crime prevention expert at Quilter, said: “It used to be relatively easy to spot a scam coming from a mile off. This could have been a suspicious call saying you have won a prize, or a dubious text from HMRC saying you are due a tax rebate.

“But now modern technology has allowed scammers to become much more sophisticated in the methods they use to entice their victims, and we are seeing more and more scammers stealing the brands of well-known financial services firms to trick people into parting with their cash.”

Becky O’Connor, head of pensions and savings at Interactive Investor, warned such scams were riskier for consumers as they were more likely to “switch off their scam radar” if they received what they thought was communication from a trusted brand.

She added: “Brands take time and money to build and trust is very hard won, so for firms and advisers, this type of scam represents a significant threat.”

Tom Selby, financial analyst at AJ Bell, agreed, adding that for companies and advisers, there was risk that trust in financial services and saving more broadly would be “eroded” if an increasing number of people fell victim to scams.

Advisers also raised concerns over fraud that involved impersonations of a firm. Alistair Cunningham, director at Wingate Financial Planning, said: “It’s likely that any potential scammer would find it easier to pass off as an existing firm than to create a new identity.

“Even the FCA have had to put out a warning that their register was cloned for nefarious purposes.”

New laws needed

There is currently no legal system in place to force search engines and social media platforms to remove fake websites and fake adverts which ‘clone’ a financial services firm.

The FCA has called for fraud to be included within online harms legislation, arguing that without changes to the law which provide the regulator with the power to force adverts to be removed, strong results could not be achieved.

Quilter echoed the watchdog’s calls, urging the government to create a “legally enforceable” system to prevent search engines and social media platforms from hosting scam adverts on their sites and to quickly remove suspected scams as soon as they are notified.

The Online Harms bill is set to be introduced to parliament next year.

Aviva, which has struggled with clones of its own, agreed. Peter Hazlewood, group financial crime risk director at Aviva, said: “Once we’re notified of fake websites which dishonestly use Aviva’s brand name, we do everything within our power to have these types of websites taken down.

“Unfortunately, as soon as one is taken down, a new one inevitably pops up. The challenge we face is that these frauds take place outside of our control environment.”

Mr Hazlewood added that the Online Harms Bill presented an opportunity to protect customers at “every stage of their online journey” and that Aviva supported the FCA’s repeated calls for the legislation to include fraud and financial promotions.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.