Self reflecting and having difficult conversations is important to achieve inclusion in the workplace, Magenta Financial Planning director Gretchen Betts has stated.

Speaking at the Personal Finance Society’s Festival of Financial Planning, Betts said she was passionate about inclusion and diversity and was thinking about succession, both for her firm success and financial planning.

“Trying to have an impact in financial planning to make it a better career choice for a wider broader diversity of people,” she said.

“I got to thinking more about how I could start to see both Magenta and think about how that could be applied across financial planning as well.”

She told attendees at the Birmingham NEC that it was essential to recognise the dangers that come with biases and focusing on small positive change is the best way to try and achieve better inclusion in the workplace.

“Quite often derogatory remarks that come across in the workplace still hold a large amount of bias and even though some of them are tongue-in-cheek and probably meant as a joke, it is still quite offensive to those on the receiving end,” she said.

“So it's really important that we start to do better with that.”

Betts outlined three things to challenge for financial inclusion:

- Privilege

- Unconscious bias

- Conscious bias.

She explained that in order to make real positive change within individuals, this was important.

“They do take time and effort but it's okay to be uncomfortable when we're talking about some of these things.

"It's okay to acknowledge that it makes us feel a little bit uncomfortable but it's really, really important that we try and think about them.

“They do take time and you've got to put that effort in.”

Unconscious vs conscious bias

Betts explained the difference between the two biases, discussing how unconscious bias can sometimes lead someone to think better of someone because of any similarities we may have with them or worse of them for being different.

“We can all be affected by these beliefs and assumptions and everybody in financial planning knows about bias and how we need to think about that with our clients, with investment biases, risk biases.

“Affinity bias is that similarity bias, the tendency to hire in our own mirror image or the tendency to connect better with people who have a life experience like ours who have the same beliefs and backgrounds.”

Source: Gretchen Bett's presentation

She mentioned other biases such as the confirmation bias which she described as the inclination to draw conclusions about someone based on personal desires, beliefs and prejudices.

Another that she mentioned was the name bias is one where there is a tendency to like people better who have an easy name.

“Naturally, I think we unconsciously exclude people, we do it naturally, we have to think about how we are going to include people,” she said.

“Conscious inclusion can simply be looked at as trying to think differently, to think about how you are making your decisions from everything that you do.

“It's not just in business, even in general life, about your bias, your privilege, and your existing kind of views on things and how that might be affecting your decision.”

Betts said the best case scenario would be to become unconsciously inclusive but stressed that it is so deep rooted within everyone which makes it difficult.

“I do think that we have to consciously think about it, and only then I think we'll be able to realise the full promise that a true diverse and inclusive business can bring us,” she added.

Women in financial planning

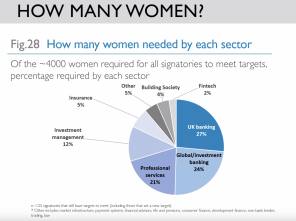

In her presentation, Betts referenced some statistics about women in the workplace.

She said around 25 per cent of female millennials do not feel there are senior female role models that resonate with them at their current employer.

Some 71 per cent feel that while organisations talk about diversity, opportunities are not really equal for all.

Approximatelt 86 per cent of female millennials that are in a relationship are part of a dual career couple.

“We need to make changes to attract more women to our workforce because we know we need diversity and inclusion are needed,” she said.

“There are absolutely loads of female millennials entering the workforce that we should be able to hire. They're going to need us also to give financial advice.

“All these people coming and being career oriented are going to need financial advice from us as well.

Betts added that female millennials matter because they are entering the workforce and "are more highly educated than any female generation before".

She said: “They are more confident and they also consider opportunities for career progression to be one of the highest employer traits.

“They are a completely different kettle of fish than maybe when I entered the workforce is going to be really, really different.”

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know