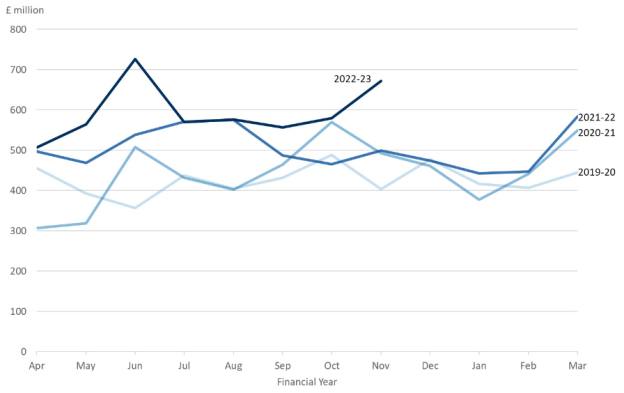

The government has raked in another £4.8bn in inheritance tax receipts in the months between April and November 2022.

Figures from HM Revenue and Customs, published this morning (December 22), showed IHT receipts were up £600mn compared to the same period a year earlier, continuing an upward trend.

Andrew Tully, technical director at Canada Life, said: “The latest IHT receipts shows we are on for a record breaking year.

“With thresholds frozen until at least April 2028, more estates will be coming in from the cold and will likely be caught in this widening tax net, and this is despite predicted house price falls in 2023.”

Source: HMRC

Tully said financial advisers will be helping by discussing estate planning solutions with clients and their wider families.

“Engaging early with good planning can help to reduce or mitigate IHT so it’s essential anyone who considers IHT to be an issue should be seeking expert advice now,” he said.

HMRC confirmed the spike in receipts in November 2022 was due to a small number of higher-value payments than usual.

In the months between April and October 2022, the government saw £4.1bn.

Rachael Griffin, tax and financial planning expert at Quilter, said: “This morning’s HMRC figures show the government’s decision to extend the freeze on tax thresholds to fill the gap in public finances will likely prove to be a lucrative one.

“Receipts from income tax and national insurance payments from April to November 2022 reached £251.4bn – an increase of £31.8bn compared to the same period a year earlier.

“This rise will no doubt be music to the chancellor’s ears as just last month he announced income tax thresholds would be frozen until 2027/28, and this growing source of government income will only rise as the years progress.”

The chancellor also opted to freeze IHT thresholds to 2027/28 – a move which is expected to net more than an additional £1bn for government coffers according to Office for Budget Responsibility forecasts.

“IHT and the increasing number of people it impacts is often a source of contention, and this morning’s data will no doubt add to this,” Griffin said.

“Inheritance tax is fast becoming a profitable area for the government, largely due to the rapid rise in house prices seen in recent years causing more people to tip over the threshold.”

This comes as last week, the Institute for Fiscal Studies, called for reform to the tax treatment of pensions on death on the grounds of fairness as it deemed pensions to be ‘a highly effective way of avoiding inheritance tax’.

However, Griffin said such reform would likely only make things fairer for the exchequer and not for bereaved families.

In a report called “Death and Taxes and Pensions”, the IFS said basic-rate income tax could be levied on all funds that remain in pensions when people die, and pension pots should be included in the value of the owner’s estate for inheritance tax purposes.

Under current legislation, if an individual dies before the age of 75, any funds in their pensions are not subject to income or inheritance tax.

“Making pensions subject to IHT would be counter-intuitive to encouraging people to save for their retirement, and with the lack of certainty on the direction of social care it is crucial that people continue to put their own financial plans in place,” Griffin said.

“Given IHT thresholds have already been frozen, more and more people will already be dragged into paying what is often regarded as one of the nation’s most hated taxes, let alone if pensions were to be brought into the mix.”

She added: “IHT has traditionally been viewed as a tax on wealthier individuals, but the number of people caught in the IHT net has been rising steadily for some time now and this number will only continue to rise as we move further into the freeze."

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know