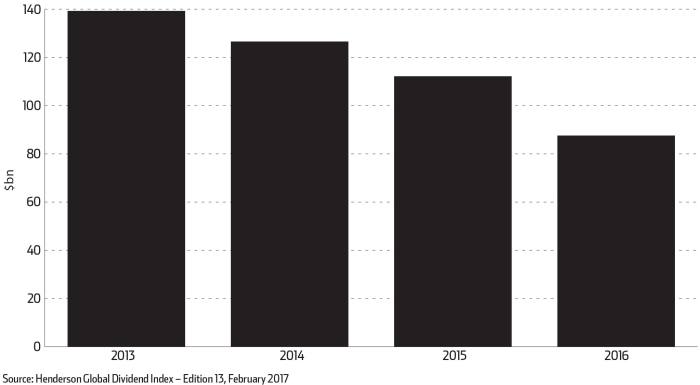

Emerging markets may have experienced a resurgence recently in terms of market performance and sentiment, but 2016 saw a sharp decline in dividend payments.

Figures from the latest Henderson Global Dividend Index show emerging market dividends fell by one-fifth last year, in headline terms, to $87.6bn (£70.7bn), the lowest total since 2009.

The research suggests China may be the main reason for the decline. Payouts in the country declined for the second -consecutive year – by 13.4 per cent, in headline terms – to produce the lowest Chinese total since 2011, $24.8bn.

Russia has also played a part. Its dividend level ended 2016 at less than half its 2013 peak, with payouts affected by the performance of oil and -resources companies. As a -result, India has taken over as the second-largest dividend payer in emerging markets, with 10.8 per cent headline growth in 2016.

However, Paul Hilsley, manager of the Asian Income Trust at Legal & General -Investment Management, points out that India and China lagged behind countries such as Taiwan and Thailand, relatively high yielding countries that performed well in 2016. India, in particular, was hit by a delay in policy reforms and a demonetisation decision.

“From a stock perspective in China, there is major scope to improve corporate governance and returns to shareholders, which could have a positive knock-on effect for the larger financial system,” said Mr Hilsley. “This type of reform could help drive the -ongoing secular improvement of -dividend payouts across the Asia-Pacific region.

“This has been a major theme for over a decade, propelled by improvements in Asian corporate cash flows, balance sheets and management that could well go further.”

Matthew Vaight, manager of the M&G Global -Emerging Markets fund, says one of the main drivers of emerging markets’ recovery was better corporate performance.

He explains: “After years of emerging market firms pursuing growth, we are starting to see evidence of better capital discipline and an increased focus on profitability.

“Firms, particularly in South Korea, are likely to start to implement more shareholder-friendly policies, which could lead to higher shareholder returns over time.”

Ricardo Adrogué, head of emerging market debt at -Barings, agrees that the momentum in emerging markets that built up in 2016 looks set to continue as the global macroeconomic backdrop is supportive, with low but positive economic growth combined with tame inflation by historical standards.

He adds: “Emerging market countries have generally improved their balance sheets in the wake of the financial crisis. Growth has been slower in some regions, but many countries have deleveraged and funding sources look more than sufficient to cover -financing needs.

“Of course, emerging markets are not without risks. Trade agreements and alliances such as the TPP may fall victim to the global trend toward -nationalism. A weaker-than-expected Chinese economy and/or faster-than-expected US Fed rate hikes also pose risks, making country and security selection that much more important.”