PARTNER CONTENT by JUST

This content was paid for and produced by JUST

Since pension freedoms, we have seen increased numbers of retirees opt to remain invested using drawdown products, rather than choose a guaranteed income for life, provided by an annuity.

This means that many retirees are electing to carry the burden of ongoing investment, sequencing, and longevity risks.

It could be argued that when a retiree enters into decumulation, the biggest challenge is quantifying the client’s capacity for loss. How is this effectively recorded, and managed?

Centralised Investment Propositions

Many advisers start by building their client’s wealth, typically through a systematic approach to managing investments, commonly known as a Centralised Investment Proposition (CIP). This delivers consistent outcomes across all their investment clients irrespective of wealth.

A typical CIP provides a framework for advisers to ensure each area of need is measured and recorded:

- Consistent use of attitude to risk tools – these have evolved into sophisticated modelling tools.

- Consistent risk profile output – reflects the client’s risk appetite.

- Asset allocation – aligned to the client’s risk profile

- Risk mapping – assets are risk rated to ensure consistency with the client’s financial objectives.

- Rebalancing – regular reviews to meet the client’s needs

This consistency of approach also helps advisers to develop their business value, building a portfolio of retirement assets that are managed in an effective way.

However, when clients move from accumulation to decumulation, the risk list gets turned on its head.

This means the client’s investments are now facing different challenges:

- Potential for capital value to fall, as income is drawn down.

- The time available is unknown; the money now has to last for as long as the client lives.

- Sequencing risk and pound cost ravaging. These can potentially force a client into drastic measures to preserve capital and future income provision.

- The shift from risk appetite to risk capacity – measuring capacity to absorb capital loss, and more importantly income loss.

A change in advice principles

A post pension freedoms view of capacity for loss in decumulation is derived from the move away from the ‘solutions’ led approach to ‘principles’ based’.

Pre-pension freedoms, the amount of funds that a client had drove the product choice:

Generally, there were arbitrary fund limits in place before a client would entertain a drawdown product. Anything below this, and they were considered a good fit for annuity.

This simplified approach doesn’t really cut it anymore, and the advice principles led approach now reflects the changes in retirees’ behaviour.

Now we see a ‘principles’ led advice approach, split between ‘safety first’ and ‘probability driven’.

This allows an adviser to differentiate between retirement goals, requirements for longevity risk management, and crucially evidencing capacity for loss.

Within the ‘safety first’ approach, the client’s essential spending is covered, and given the need to remove longevity risk then the product to match this would be a guaranteed income for life.

The ‘probability-driven’ approach is where the discretionary spending sits. Longevity risk is assumed by the individual, and sustainable withdrawal rates are calculated to meet income needs.

This ‘principles led’ advice approach signposts the adviser to the appropriate principle to guide their advice; ‘safety-first’ for those who have capacity for loss challenges, and probability-driven’ for those who don’t.

Evidencing Capacity for Loss

To demonstrate how capacity for loss is measured for each element, we can work through a case study[1] based on income needs for a 65 year old couple, with a 50/50 balanced portfolio (including charges of 1.5% pa) and balanced attitude to risk.

The clients have a requirement for £20,000 of annual income; £8,000 to provide essential expenditure, and £12,000 for discretionary spending.

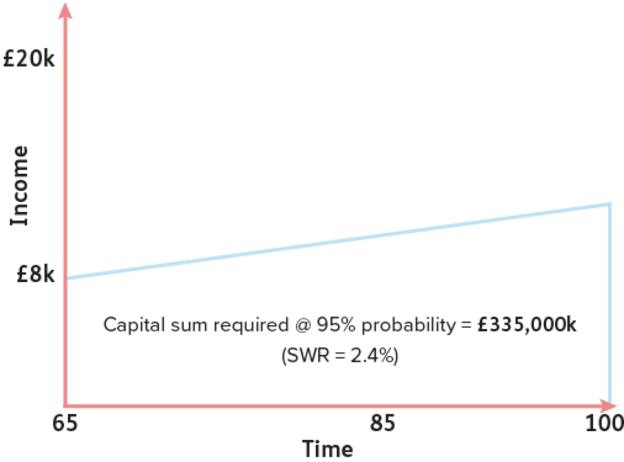

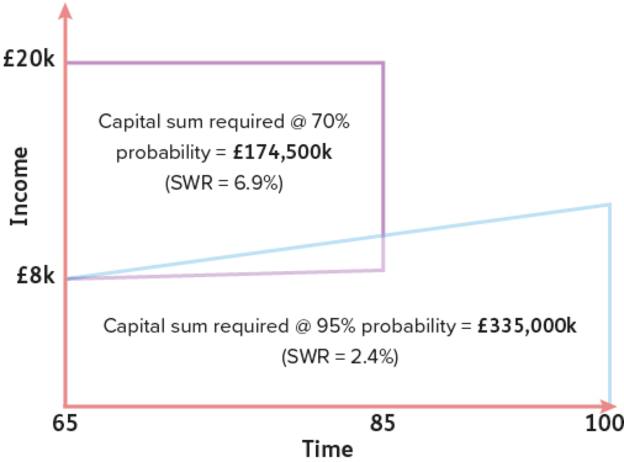

Starting with essential income, this is plotted out to age 100 for joint life survival probability. The income is increased in line with CPI, and a probability of success of 95% to reflect a high level of certainty of outcome.

This scenario dictates that capital of £335k is required which equates to an initial sustainable withdrawal rate of 2.4% (£8k divided by £335k x 100).

Next, the discretionary spending:

This discretionary spending is plotted to age 85, with the view that 65 to 85 will be the clients’ most active years. A lower probability of success (70%) can be assumed to reflect the nature of this tranche of income. This identifies that capital of £174,500 is required, which equates to a sustainable withdrawal rate of 6.9%.

Of course, this example brings forth further questions;

- What if they have less than £335,000? Can other assets such as property be used to cover any shortfall?

- What if they have £400,000 in funds? Are the clients prepared to take a higher risk with the discretionary element, by using a lower probability of success?

This also addresses the need for ‘flexibility and access’. These are often cited as over-riding reasons for remaining invested, despite the risks. Measuring capacity for loss in this way in decumulation pins down what the money is really there for.

Summary

Splitting income provision this way demonstrates the shift we have seen in the retirement decumulation area recently.

Aligning these measures against suitable products allows the opportunity to grow remaining capital. This is important, as a reducing portfolio for the client also means reducing income for the adviser business.

Something that sounds simple, taking income from drawdown, can be very complex, and demonstrates the vital part that advisers play in managing client expectations.

Read our new Think report ‘Evidencing capacity for loss in decumulation’.

Tony Clark, Proposition Marketing Manager.

'This is a Just Paid Post. The news and editorial staff of the Financial Times had no role in its preparation’

[1] Sourced with figures from FinalytiQ

Find out more