PARTNER CONTENT by ROYAL LONDON ASSET MANAGEMENT

This content was paid for and produced by ROYAL LONDON ASSET MANAGEMENT

After years on the sidelines, sustainable investing has finally moved into the mainstream. At Royal London Asset Management (RLAM), we’ve been integrating ESG factors into our investment processes since 2003 and two of the funds in our sustainable range celebrate their 10th anniversaries this year. While we’re naturally delighted about this new-found popularity, we’re a little frustrated by some of the more questionable marketing it has generated.

Growing pains

Admittedly, the terminology can be confusing – what is the difference between sustainable and responsible investing, for example? And what difference does it make to apply ESG screening or consider ESG factors?

Also, the sector’s newly-fashionable status has led to some blurring of the terminology in the scramble to launch new products. Distinct and clearly-defined investment approaches have been stretched and morphed to appeal to an even wider investor base. Much of this comes from inexperience, although some feels more cynical.

What can you do to avoid being sucked in by marketing hype? My advice is to get a clear understanding of the differences between the core approaches; consider your client’s specific requirements, and then find a fund manager with a record of delivering good long-term investment returns across different market conditions.

What is sustainable investing?

Ethical investing, which began meaningfully in the 1990s with ‘green funds’, was based on negative screening i.e. screening out ‘bad’ stocks on criteria such as environmental impact (e.g. oil and mining companies) and social harm (tobacco companies, arms manufacturers). ‘Dark green’ investors often accepted that returns could be below market. They would trade off financial returns against social or moral returns.

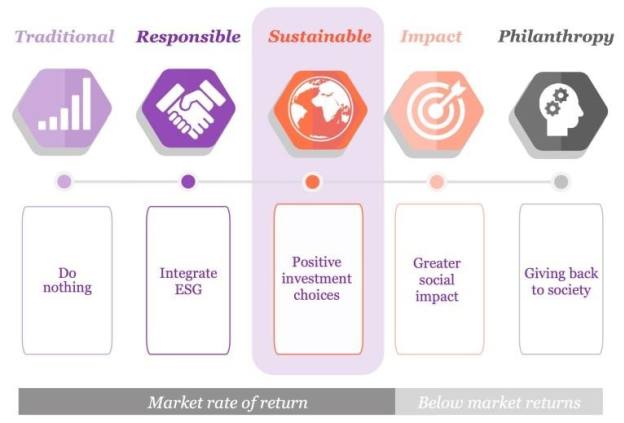

Over time, this has evolved into responsible investing (see figure 1), which is more sophisticated and can deliver market rates of return, but is still based on the concept of screening out against certain ESG factors. For example, a fund may screen out mining or fossil fuel companies on their environmental impact or a bank on its corporate governance standards. This will be set out in the fund’s mandate and essentially be fixed over time.

Sustainable investing is different from responsible investing. While having common origins in old-school ethical, it is a more modern and inclusive manifestation of embedding values in investing. The conceptual difference compared to responsible investing is that the screening is positive – rather than ‘screening out’, we ‘screen in’. It is about doing good, rather than avoiding bad.

We consider similar ESG factors, but seek to make pragmatic investments that will make a positive impact on society. As an example, we don’t invest in fossil fuel companies not because of screening, but because we believe that their business models face obsolescence and contain embedded risks. However, were an oil company to invest hugely in renewable energy and battery technology, thereby de-risking its business, over time we might consider an investment.

First and foremost, however, we aim for market rates of return or above. My aim as a fund manager is to generate positive returns for investors. Our sustainable investment process highlights market inefficiencies that can be exploited to generate positive investment returns. By considering both the positive and negative sides of ESG factors, I believe we have an edge over traditional fund managers.

Figure 1: While similar, sustainable investing is conceptually different from other approaches – it should generate competitive investment returns, while making a positive impact on the world

Source: RLAM

What it isn’t…

At the end of the spectrum is philanthropy, which is usually focused on very wealthy people or institutions that want to ‘give back to society’. The key is that while the social or moral returns may be high, the investment returns are zero (beyond tax breaks). Philanthropy can have an amazing social impact, but it isn’t investing.

The link is impact investing, which previously had a niche, but important role between philanthropy and sustainable investing. It described investment that offered sub-market returns, but enabled projects or products that had significant social benefits – sub-market investment returns were compensated by philanthropic ‘impact’. The key was additionality, which described the benefit to society that happened only because someone was prepared to give up investment returns.

Then marketing got hold of the term. It has now been hijacked as funds lay claim to the aggregate ESG impact of all of their holdings. There’s so much hyperbole and double-counting that, in my opinion, ‘impact investing’ has become meaningless. These effects would often accrue without the fund’s investment: there’s no additionality!

Our approach

For us, sustainable investing has three core principles:

Financial returns – this is the point of investing and we believe it’s entirely complementary to the other two factors. Well-managed companies by ESG metrics are likely to be financially well run – in basic terms, sustainable investing improves returns.

Social and environmental improvement – we believe companies that address social issues or environmental challenges through innovation are more likely to succeed over time.

Engagement – no company is perfect and after investing we will engage with them to make the case for higher standards or a different approach. Not only does this help to make society better, it can improve financial returns by highlighting problems in advance.

The significant head start we have over many of our competitors means that we’ve had time to develop a differentiated investment process based not just on data-driven models as ESG data standards are poor.

Overall, we aim to invest in companies demonstrating a net benefit to society, through either the products and services they offer or ESG leadership. As a result, we invest in a range of innovative, responsible, well-managed companies with strong long-term growth potential.

Two funds, a decade of delivery

Two of the funds in the suite of sustainable funds available at Royal London Asset Management celebrate their 10 year anniversary this year. You can find out more about the Royal London Sustainable Diversified Trust and Royal London Sustainable World Trust as well as our full range of sustainable funds at rlam.co.uk/sustainable.

Mike Fox, head of sustainable investing at RLAM, describes the sustainable investing landscape.

For professional clients only, not suitable for retail investors. The views expressed are the author’s own and do not constitute investment advice. The value of investments and the income from them is not guaranteed and may go down as well as up and investors may not get back the amount originally invested. For more information on the fund or the risks of investing, please refer to the fund factsheet, Prospectus or Key Investor Information Document (KIID), available via the relevant Fund Price page on www.rlam.co.uk

All information is correct at September 2019 unless otherwise stated.

Issued by Royal London Asset Management Limited, Firm Registration Number: 141665, registered in England and Wales number 2244297; Royal London Unit Trust Managers Limited, Firm Registration Number: 144037, registered in England and Wales number 2372439; RLUM Limited, Firm Registration Number: 144032, registered in England and Wales number 2369965. All of these companies are authorised and regulated by the Financial Conduct Authority. Royal London Asset Management Bond Funds Plc, an umbrella company with segregated liability between sub-funds, authorised and regulated by the Central Bank of Ireland, registered in Ireland number 364259. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland.

All of these companies are subsidiaries of The Royal London Mutual Insurance Society Limited, registered in England and Wales number 99064. Registered Office: 55 Gracechurch Street, London EC3V 0RL. The Royal London Mutual Insurance Society Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. The Royal London Mutual Insurance Society Limited is on the Financial Services Register, registration number 117672. Registered in England and Wales number 99064.

This is a Royal London Asset Management Paid Post. The news and editorial staff of the Financial Times had no role in its preparation

Find out more