PARTNER CONTENT by INTERNATIONAL BUSINESS OF FEDERATED HERMES

This content was paid for and produced by INTERNATIONAL BUSINESS OF FEDERATED HERMES

How does Unconstrained Credit differ from other flexible credit solutions? Why do you use options? These are just a couple of the most commonly asked questions about our Unconstrained Credit strategy.

We sat down with our Fixed Income team as they tackled the most pressing questions about our Unconstrained Credit capability. Here we show some of the responses from the Q&A.

1. How is our Unconstrained Credit strategy different to other flexible credit solutions?

With a combined experience of over 40 years, the strategy’s portfolio managers Andrew Jackson, Head of Fixed Income, and Fraser Lundie, Head of Credit, have managed a spectrum of funds during downturns and crises. Together, their vast experience alongside the diversity of our fixed income team acts as a key differentiator, enabling us to offer investors a dynamic credit-allocation solution that captures value from credit markets as investment conditions change and targets a gross return of the risk-free rate plus 5-6% per annum1. Although our specialist portfolio managers (such as EM, loans and ABS) and credit analysts provide views and trade ideas, final investment decisions and portfolio implementation are made by Lundie and Jackson.

Other notable differentiators include:

Bottom-up skill: through fundamental credit analysis, we identify issuers that drive returns in each credit market before searching their capital structures for the most attractive instruments.

Top-down oversight: we apply expertise from across the credit spectrum as well as insight from other asset classes. The Multi-Asset Credit Investment Committee (MACIC) drives our appetite for risk, steers the strategic asset allocation across credit classes based on their relative value, and determines what hedges are appropriate for the prevailing market environment.

Full spectrum: unrestricted by security type or geographical silos, we seek to exploit opportunities in developed and emerging markets for investment grade and high-yield corporate bonds, credit default swaps, loans, asset-backed securities and government securities.

Our best ideas: the strategy selects from our team’s best long-only credit ideas, which, combined with a dynamic asset allocation framework, offers the potential to enhance our team’s ability to achieve positive absolute returns through the cycle.

Downside defence: optimal convexity is achieved by a dynamic options overlay that aims to protect against large market and macro risks and acts as a hedge for our high-conviction credit strategy in times of market disruption. There will be instances where this approach is complemented by very material increases or reductions in risk on the long side as dictated by our risk appetite. This combination enables the strategy to manage through periods of stress to capture opportunities and significantly dampen volatility and has been instrumental in driving performance to date.

ESG advantage: we price ESG risks within fundamental credit selection combined with market-leading company engagement alongside our stewardship services team, EOS at Federated Hermes.

Structured with independent risk management: we operate with the flexibility of a boutique, while enjoying the support and resources of a major asset management firm, including independent risk oversight provided by the Federated Hermes Investment Office.

2. Why use options?

We buy out-of-the-money option payers in order to profit if credit spreads widen significantly from a market sell-off. This provides us with an effective hedge, with losses limited to the upfront cost of the option.

Some key benefits of this strategy include:

- Cost effective: when volatility is low options can provide a cost-effective way of hedging the portfolio. Typically, we budget 0.75% per annum for hedging cost.

- Convexity: as the market sells off further, our option hedges become more powerful, making them an effective hedge against significant market shocks such as in Q1 2020.

- Dynamic: flexibility to tailor the exposure to changing market dynamics.

We believe that this process of incorporating options into the Unconstrained Credit strategy is essential to outperforming in both bull and bear markets. Given the strong market rally through 2019, we had been increasing our hedge exposure during late 2019 and into Q1 2020 as we perceived there was a build-up of risk in the market which could result in a pull back.

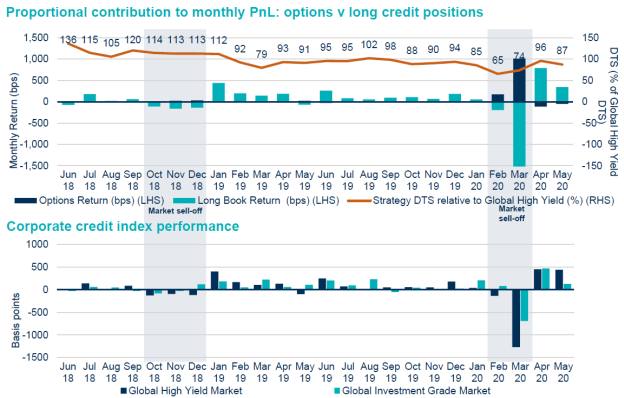

The reality was obviously much worse than anyone could have expected: in March 2020, markets sold off amid fears about the impact of the coronavirus on the global economy and a collapse in oil prices, the power of incorporating an options-based strategy was evident (see figure 1).

Figure 1. Proportional contribution to monthly PnL: options v long credit positions

Past performance is not a reliable indicator of future returns.

Source: Federated Hermes, as at 31 May 2020. High-yield market performance is that of the ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged Index. Investment-grade market performance is that of the ICE BofA Merrill Lynch Global Broad Market Corporate USD Hedged Index.

3. How has the strategy performed during the coronavirus pandemic – and what role did options/hedges play?

In advance of the crisis our view had been that markets offered little value and, as a result, we entered the crisis with less risk than at any time since the launch of the strategy. From 24 February and into March 2020, credit markets sold off heavily as a dispute over oil production between Russia and Saudi Arabia rattled investors fearing a coronavirus-driven global recession. During this time, we actively adjusted the options overlay as the market moved downwards. This enabled us to take profit on positions and ensure that our Unconstrained Credit Strategy remained protected as much as possible should the market continue to sell off.

Having increased options positions going into the crisis, our portfolio management team actively adjusted the options overlay as the market moved downwards, taking profit on positions and ensuring the strategy remained protected as much as possible should the market continue to sell off. As risk increased at the end of February, our team quickly scaled up options exposure – reaching a peak of 147% of NAV in notional terms on 3 March.

As spreads widened and options moved into the money, we took profit and rolled positions into longer dated, bigger notional, further out of the money contracts. Figure 2 shows the increase in the average strike as the Crossover moved wider, demonstrating how a rapid widening of options positions has the potential to add considerable value. For further granularity, we also added smaller positions with the same maturity but different strikes.

Figure 2. Options overlay: seeking downside protection through the sell off

Past performance is not a reliance indicator of future returns. Source: Federated Hermes, Bloomberg, as at 31 March 2020. Performance shown of Hermes Unconstrained Credit Strategy in USD, gross of fees. Xover level represents the level of the IHS Markit iTraxx Crossover CDS index. Hedge PnL represents the aggregate performance of the options book and index hedges within the strategy, including but not limited to contracts on the iTraxx Crossover index. Please refer to Figure 1 for the rolling performance of the Unconstrained Credit Strategy. Please refer to the footnote for the rolling performance of the Unconstrained Credit Strategy2.

By actively managing the options book during this period of tumult, this enabled us to crystallise option profit and loss, while at the same time maintaining convexity and a measure of protection. The total contribution of options to the performance of our Unconstrained Credit Strategy from 24 February to 31 March was 9.35% – this compares to the Global High Yield index which fell by 14.38%3 (Note: the Unconstrained Credit Strategy does not have a benchmark; the comparison demonstrates the return that would have been achieved by investing into a Global High Yield benchmark during this time).

To find out more from questions such as what to expect in terms of performance and how Unconstrained Credit expresses its ESG credentials, read the full Q&A here.

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. Any investments overseas may be affected by currency exchange rates. Past performance is not a reliable indicator of future results and targets are not guaranteed.

Disclaimer:

For professional investors only. This is a marketing communication. It does not constitute a solicitation or offer to any person to buy or sell any related securities, financial instruments or financial products. No action should be taken or omitted to be taken based on this document. Tax treatment depends on personal circumstances and may change. This document is not advice on legal, taxation or investment matters so investors must rely on their own examination of such matters or seek advice. Before making any investment (new or continuous), please consult a professional and/or investment adviser as to its suitability. Any opinions expressed may change. All figures, unless otherwise indicated, are sourced from Federated Hermes. All performance includes reinvestment of dividends and other earnings.

Federated Hermes refers to the international business of Federated Hermes (“Federated Hermes”). The main entities operating under Federated Hermes are: Hermes Investment Management Limited (“HIML”); Hermes Fund Managers Ireland Limited (“HFMIL”); Hermes Alternative Investment Management Limited (“HAIML”); Hermes Real Estate Investment Management Limited (“HREIML”); Hermes Equity Ownership Limited (“EOS”); Hermes Stewardship North America Inc. (“HSNA”); Hermes GPE LLP (“Hermes GPE”); Hermes GPE (USA) Inc. (“Hermes GPE USA”) and Hermes GPE (Singapore) Pte. Limited (“HGPE Singapore”). HIML, and HAIML are each authorised and regulated by the Financial Conduct Authority. HAIML and HIML carry out regulated activities associated with HREIML. HIML, Hermes GPE and Hermes GPE USA are each a registered investment adviser with the United States Securities and Exchange Commission (“SEC”). HGPE Singapore is regulated by the Monetary Authority of Singapore. HFMIL is authorised and regulated by the Central Bank of Ireland. HREIML, EOS and HSNA are unregulated and do not engage in regulated activity.

Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET. Telephone calls will be recorded for training and monitoring purposes. Potential investors in the United Kingdom are advised that compensation may not be available under the United Kingdom Financial Services Compensation Scheme.

1 Hermes Unconstrained Credit Strategy does not have a benchmark for performance purposes. The risk-free rate – currently Libor – is given for illustrative purposes only.

2 Unconstrained Credit Strategy: Rolling performance (%) Past performance is not a reliable indicator of future returns.

3 Performance of HW00 Index in USD.

Performance shown is the strategy in USD gross of fees. Subscription and redemption fees are not included in the performance figures. Data is supplementary to GIPS® compliant information at the end of the document.

Source: Federated Hermes, as at 30 May 2020.

Find out more

Related Content