PARTNER CONTENT by FIDELITY

This content was paid for and produced by FIDELITY

Collective engagements are more effective in some regions

Our analysts say there are several factors that influence how effective each approach is, the most important of which are local practices and customs.

In Europe, collaborative engagement is viewed as relatively more effective because ESG is now part of mainstream investing, there are many activist organisations, and because ownership concentration can be high. One analyst who covers European stocks says: “Europe is not only tuned into ESG issues, but our team knows the senior management of European companies well and is plugged into the various industry bodies and regulatory systems. This helps us to be heard.”

North America and Japan are the only regions where collective action is not viewed as more effective, but even here it is still on a par with one-to-one interactions, meaning it pays to develop good relationships with management teams to build an understanding of which approach works best.

Our analysts who cover the US and Canada report that engagements often take the form of helping companies understand a different perspective rather than encouraging a specific action, so a personal approach can work better. One US healthcare analyst says: “ESG doesn’t come up in group meetings or collaborative settings because fewer US investors are focused on it. So as one of the largest European investors that these domestic US businesses meet, we tend to have better ESG engagement in our one-to-one calls. That is changing though as US demand for ESG products grows.”

On the other hand, grouping together with other investors can help companies to focus on a particular issue. A US industrials analyst observes: “It can be a more powerful and consistent message to companies when a group of shareholders (or bondholders) all deliver the same message, rather than each talking about their own specific concerns. Many companies I talk to feel somewhat overwhelmed by the wide variety and volume of ESG questions they are fielding, so a collaborative approach may help them focus on the key points that matter.”

Japan, meanwhile, has a different regulatory structure for corporations than elsewhere, and companies still have a lot of crossholdings which can complicate investor discussions. Our fund managers believe Japanese corporate culture is changing fast, and shareholders are being listened to much more, especially during one-to-one engagements on governance.

However, as one fund manager puts it: “Japanese cultural norms mean that aggressive collaborative engagements can be viewed as threatening and could lead to the opposite outcome of what was intended. Domestic asset managers are also often subsidiaries of financial institutions, meaning working together may create conflicts of interest for them.”

Room to grow

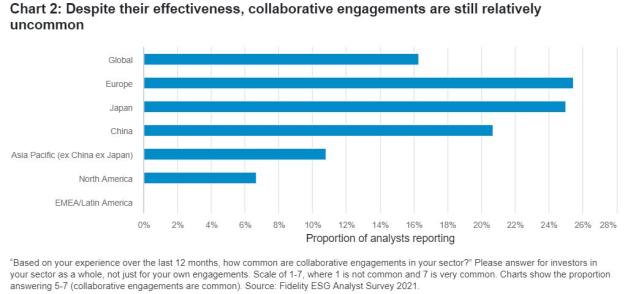

Despite signs that investor collaboration can amplify the impact of engagements, only 16% of our analysts report that it is common in the sectors they cover, giving plenty of room for joint action to increase across all regions.

So why is collaborative engagement not more common? Historically, asset managers have been understandably wary of collaborating with each other for fear of revealing aspects of their investment approach to competitors or breaching compliance rules. Voting at the annual shareholder meetings of investee companies was typically handled by separate teams and was not under the direct oversight of portfolio managers and analysts.

However, the rise of ESG-focused investing has shifted attention towards growing the pie for all rather than simply trying to claim a larger share of a fixed pie. Analysts and managers now typically play a much more active role in voting decisions. Changing culture is hard though, especially as investors might have to work together for extended periods to push through ESG changes.

Recent examples of Fidelity’s collaborative engagements include Climate Action 100+, a five-year investor-led programme to promote clean energy use among key greenhouse gas emitters, and Building Sustainable Protein Supply Chains, a multi-year investor campaign focused on the food production and retail industries.

The best ways to drive change in E, S and G

The survey also found that investor engagement is the most important driver for change in governance practices, while regulation is slightly more effective when it comes to environmental and social practices.

Governance changes are generally quicker to implement and easier to monitor than ‘E’ and ‘S’ factors. Speed is important because the length of time that equity and bondholders are invested in a company might be shorter than the time needed to make environmental and social changes. For example, splitting the roles of chief executive and chairman is easier to enact and measure than, say, changing the technology used in manufacturing.

A consumer discretionary analyst who covers North America sums it up: “It’s not that engagement is ineffective per se for ‘E’ and ‘S’, but it takes longer to implement, is more nuanced and harder to measure, and takes more time to see the end result. Engagement remains important, but so does getting behind more regulated approaches for improvement.”

Nonetheless, investor engagement - whether collaborative or one-to-one - has an important role to play when it comes to propelling environmental and social change. Moreover, regulation and engagement are increasingly intertwined, because a company’s compliance with regulations is often the measuring stick that investors use to evaluate environmental and, to a lesser degree, social factors.

An analyst covering European automakers notes: “Because of the huge cost of developing electric vehicles, carmakers desperately need to convince their investors of their compliance strategies in order to gain access to capital at a lower cost. Similarly, the risk of brand perception of a car company which consistently fails to comply with regulation is another way these sources of influence work in tandem. Thus, whilst regulation may be the dominant driver, in my experience, it works in combination with investor and consumer pressure.”

Fidelity ESG Analyst Survey 2021 - View the full findings

Important information

This is for investment professionals only and should not be relied upon by private investors. The value of investments can go down as well as up and you may not get back the amount invested. The views expressed may no longer be current and may have already been acted upon. Overseas investments will be affected by movements in currency exchange rates. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

Find out more

Related Content