PARTNER CONTENT by FIDELITY

This content was paid for and produced by FIDELITY

Sustainable investing has come in for a great deal of criticism since the turn of the year. The fall from grace has been spectacular with several factors contributing such as the revelation that some ESG-labelled funds invested in companies with significant exposure to Russia1, the challenge of balancing the need for energy security and affordable prices with the green energy transition and the debate over the role of defence companies in sustainability focussed portfolios.

As a relatively new field, sustainable investing suffers from a lack of commonly agreed standards and metrics as to what represents best practice, meaning that to some extent, the ESG profile of a company is at least partly in the eye of the beholder.

This has some important consequences. For example, it makes it difficult to group ESG funds together when analysing performance - as a group they have quite different holdings from one fund to the next, which brings with it different risk profiles and sensitivities. To talk about the performance of ESG funds as a single group is a large over-simplification.

It also risks undermining confidence in the integrity of sustainability analysis, which I believe is an unfounded concern. For example, much has been made of the lack of correlation between the ESG ratings of a given stock from the major 3rd party rating agencies2 (such as MSCI and Morningstar) when compared to the very tight correlation of bond ratings for a given issuer. However, much of the difference is explained by different methodologies used and a fundamental difference in what the agencies are trying to measure (for example measuring the risk to a company’s valuation from ESG factors versus the impact a company has on environmental and social factors). This is why detailed stock-level analysis is vitally important, a key reason why we rely heavily on the Fidelity proprietary ESG score in our stock research and selection process.

I think this debate risks missing the wood for the trees. No - we do not have perfect universally agreed upon framework to score companies on sustainability. However, neither is there universal agreement by the market on whether a certain stock is a buy or a sell. Aspects of sustainability will mean different things to different people, and that is ok; I believe we need to accept there is a level of subjectivity involved.

Perhaps most importantly, we mustn’t let this plurality of approaches impede the pursuit of further progress. Just because there is no standardised sustainable investing framework does not mean that we should abandon the approach all together, as some critics would argue3. To say that investors should stop pressuring companies to introduce or improve important goals such as emissions reductions targets, supply chain auditing or access to employee training and talent development programs until a common framework emerges seems misplaced. Investors, alongside governments and regulators, should be encouraging constant improvement at the companies we engage with whilst the sustainable investing industry continues to develop and mature, as there is little time to lose in tackling many of the biggest challenges facing society.

Navigating a changing investing landscape

One challenge the industry has been navigating in 2022 is the ongoing shifts in the broader investment landscape. Global interest rates have been falling steadily for the past 4 decades, driving lower discount rates and higher valuations for stocks, and in particular, quality growth stocks. This has undoubtedly favoured the sustainable investing trend, given an ESG lens naturally tends to bias toward quality companies with strong long-term growth potential. Therefore, the shift to higher interest rates, inflation and energy prices have all presented challenges this year.

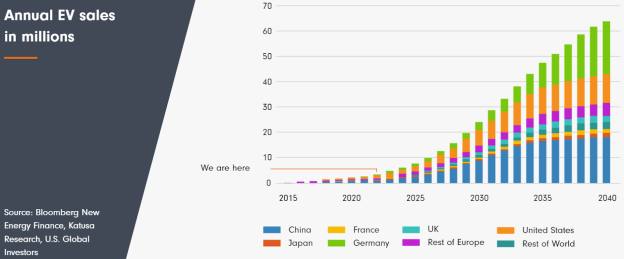

Amidst the volatility, uncertainty and fear that has driven stock markets in the last few months, it is easy to lose sight of the fact that most of the long-term global sustainability trends remain unchanged, and in many cases, strengthened or accelerated. Below are just three examples of long-term themes that we invest in for the fund, showing that we remain very early in the adoption of vital technologies like electric vehicles, offshore wind installations and innovative drug manufacturing methods.

These trends will continue regardless of short-term changes in interest rates or inflation, and in fact in some cases, are accelerated by recent moves: for example, the rise in energy prices is pushing governments to accelerate renewables investment4 and building efficiency measures5, and higher inflation is driving greater investment in automation and productivity tools - all key investment areas for the fund.

Jamie Harvey, portfolio manager, Fidelity Sustainable Global Equity Fund

Learn more about the Fidelity Sustainable Global Equity Fund

Sources & Footnotes:

- The Wall Street Journal Article, Russia War in Ukraine Exposes Weakness in ESG Fund. 1 April 2022.

- MIT Sloan Sustainability Initiative, The Aggregate Confusion Project.

- Financial Times Article, The fallacy of ESG investing. 23 October 2020.

- IEA, Oil Market Report - March 2022.

- Euractiv Article, EU urges building insulation push in bid to end reliance on Russian gas. 19 May 2022.

Important information

This information is for investment professionals only and should not be relied upon by private investors. The value of investments can go down as well as up and you may not get back the amount invested. Investors should note that the views expressed may no longer be current and may have already been acted upon. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. The Fidelity Sustainable Global Equity Fund has the potential of having high volatility either due to its composition or portfolio management techniques. It can also use financial derivatives for investment purposes, which may focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM1022/371106/SSO/NA

Find out more

Related Content