PARTNER CONTENT by GRAVIS

This content was paid for and produced by GRAVIS

Despite the consensus earlier this year being that the UK was returning to a “new normal” post Covid, with the conflict in Ukraine causing intense political uncertainty, inflation levels hitting record highs, not one, but two changes at number 10, a disastrous ‘mini-budget’, and a cost-of-living crisis affecting households, this year hasn’t borne any semblance to normality.

Markets have been turbulent, with only 10.6% of funds delivering positive performance in the year, to 31st October (FE fundinfo), and many of those funds and sectors that performed well during the pandemic having suffered since. The property sector has not been an exception, with REITs trading at unprecedented discounts, whilst many of the open-ended funds invested in direct property, are once again facing gating issues as their cash balances have been unable to meet investor redemptions.

Whilst the issues with open-ended direct property funds is one which has been highlighted on many occasions since the Brexit referendum in 2016, it’s the REIT market which we are particularly interested in at Gravis. It’s here that we see an opportunity, a chance to take advantage of current valuations of best-in-class companies in sub-sectors set to benefit from four mega trends: ageing population, generation rent, digitalisation and urbanisation.

The last few months have been noticeably irregular, with REITs trading at a -32.9% discount to Net Asset Value (NAV) as at 18th November1, compared to a -12.4% average discount to NAV over the last 10 years1. Both a bull case and bear case for UK REITs can be identified, however in Gravis’ view there is cause for optimism.

Before examining the bull case, we’re seeing three factors dragging REITs lower. The first of these is high inflation and high base rates, leading to increasing funding costs for real estate companies. The Bank of England is expecting inflation to remain above 10% in Q4 2022 and Q1 20232, whilst investment bank economists are forecasting that the Bank of England base rate is likely to peak at 4.25% in Q2 2023 (with an upper forecast of 5.0%)1. To be bearish on this, there would need to be a belief that rates will be higher than this forecast – without this, they would be in line with market expectations, and therefore already factored into pricing.

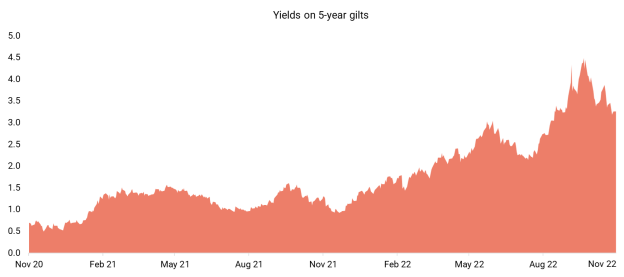

The second element considers yields. Sustained, high levels of inflation leads to high bond yields and rising property valuation yields. Yields on 5-year gilts recently spiked to greater than 4.0% (see fig. 1).

(Fig. 1 - data as at 18th November 2022, source: Gravis Advisory Research, Bloomberg)

To follow the bear case argument, you would need to believe in stagflation, high inflation with no economic growth, and the 5-year forward rates rising back above 4%. Instead, we’ve witnessed yields have come off from their highest levels most recently.

The third bearish argument is that recession is likely to lead to lower rental income. Many have been vocal with their outlook on the UK’s economic state, with the Office for Budget Responsibility highlighting that the economy is “tipping into a recession”, and the Bank of England stating that there is a “very challenging” outlook. Bloomberg provides a UK recession probability index 1-year out, and this is currently running at 90% probability (see fig. 2).

(Fig. 2 – data as at 18th November 2022, source: Gravis Advisory Research, Bloomberg)

The recession we are presently facing however, appears to be a technical recession – a ‘full employment’ recession. The number of vacancies is currently exceeding the number of people searching for work. If the expectation is that we’re heading towards a traditional recession, with mass unemployment, employers unable to rent office space, and people losing their homes, then REITs are not the area for you.

Whilst there are certainly a few arguments for the bear case, as mentioned, we at Gravis are finding that there are many more reasons to be bullish, with five key factors contributing to this view.

Firstly, valuation yields are at attractive levels. As mentioned earlier, if you consider the UK Market as a whole, REITs are trading at a wide discount to the historic average. Historically REITs have traded at an average c.12% discount to NAV, whereas we’re currently seeing them trading at a c.32% discount1 (fig. 3), up from c.40% in September.

(Fig. 3 – data as at 18th November 2022, source: EPRA)

When looking historically at other instances of wider than average discounts, contrarian investors have often been rewarded for investing around points of maximum bearishness. From times when valuations have first reached a 20% discount to NAV in the last 10 years, UK REITs have regularly provided strong future returns (over both 12-month and 24-month periods, see fig. 4). Whilst there is a wide dispersion in returns all outcomes have been positive.

(Fig. 4 – data as at 18th November 2022, source: Gravis Advisory Research, Bloomberg)

Whilst there’s the potential for opportunity in terms of valuations levels looking attractive, stock picking remains key, with a stressed importance on identifying underlying sub-sectors demonstrating strong fundamentals. REITs supported by the ageing population trend (those such as, Assura and Primary Health Properties) are trading at an average c.11% discount to NAV, whilst those falling in the retail space (a sector which Gravis have no exposure to) are trading at a c.43% discount3. Whilst this might suggest that there is the greatest opportunity within retail REITs, we do not hold much conviction that the sector will rebound in the same way as the others.

At a stock level, equity markets are already pricing in significant outward property valuation shifts. The market is pricing in moves in yields beyond those that have already been seen. Warehouse REIT, for example, recently reported a 0.41%4 change in valuers yield from peak value, versus the market implying a likely change in valuers yield of c.1.06%5. The underlying dynamics remain strong for logistics, rent collection and growth are both good. The market looks overly bearish.

The second bull case element is that inflation looks to be peaking. CPI is expected to peak at a 40-year high of 11% this quarter6, the Bank of England is forecasting 2.2% inflation in two years’ time and implied futures rates are forecasting a decline in inflation going forwards.

The third argument is that companies continue to have strong balance sheets. During the Global Financial Crisis, UK REITs had a much higher loan to value (LTV) levels, valuations declined and RETIs were forced into emergency rights issues, destroying value for investors. REITs learnt their lesson, and at present LTVs are lower – portfolios can withstand significant value declines without the REITs having to take any remedial action – and the cost of debt for many REITs is fixed at comparatively low levels for long durations, meaning balance sheets are strong.

The penultimate reason to be bullish is the prospect of rental growth, driven by two factors. The first is contractual rental increases, with many REITs benefitting from indexation and rental escalators built into leases. Impact Healthcare for example has a weighted average leases length (WAULT) of nearly 20 years, with inflation linkage built in. The ability to increase income with inflation, should in turn lead to growth in dividends for investors.

The second factor playing into rental growth can be attributed to rent reversion, market rents are higher than current ‘in place’ rents, and as these expire with time, the leases are renewing at higher rates. This can be seen as embedded growth, helping to offset any outwards shift in valuation yields and rising financing costs.

The fifth and final bull case is signs of capitulation in the market. September and October saw the effects of the ‘mini-budget’, triggering selling and high levels of volatility in the REIT market. What can be seen though is that when an event has had a similar effect on the market in the past, for example the Brexit referendum and the Covid-19 lockdown, we often witness some of the best days in terms of performance in the immediate aftermath.

Whilst at a surface level glance there might appear to be reasons to be bearish with the UK REIT market currently, we believe that these have already been factored into pricing in most cases. Identifying stocks with robust fundamentals combined with the attractiveness of valuation levels, peaking inflation, strong balance sheets, rental growth and signs of capitulation, all indicate that current market conditions could in fact provide an opportunity for REIT investors.

Matthew Norris, Gravis

Capital at risk. Past performance is not a guide to future performance, the value of your investment may go down as well as up.

Sources:

- EPRA and Gravis Advisory Ltd Research

- Monetary Policy Report, November Edition, 3rd November 2022, Monetary Policy Committee, Bank of England

- Gravis Advisory Ltd Research

- Warehouse REIT – latest announcement

- Gravis Advisory Ltd Research

- Overview of the November 2022 Economic and fiscal outlook, 17th November 2022, Office for Budget Responsibility

Find out more