A few weeks ago we had a look at whether Jupiter's acquisition of Merian had led to their funds becoming more popular among DFMs.

We thought it would be interesting to conduct a similar exercise with Liontrust, a fund house whose growth has been driven - at least in part - by M&A activity in recent years.

To recap: since 2017, Liontrust has bought Alliance Trust Investments, Neptune, Architas and Majedie (plus it hired the heads of fixed income from Kames Capital).

It would have bought Gam last year but that didn't go to plan, as has been well covered.

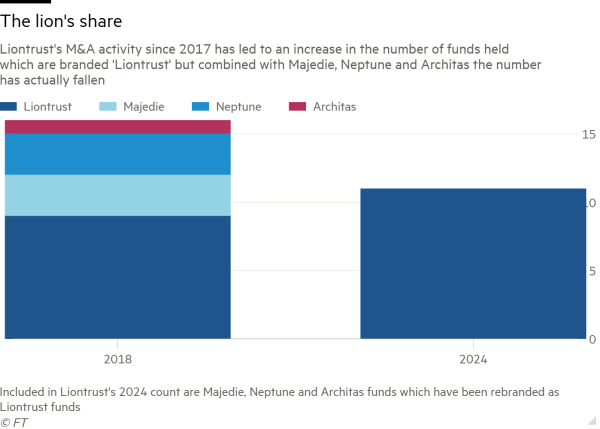

So has this led to an increase in the number of Liontrust funds which are held by DFMs? Well, yes if you only take branding into account.

The number of Liontrust branded funds has gone up from nine to 11 since 2018 but when you take into account the funds which Liontrust has acquired the number has gone down from 16 to 11.

At the broadest level, the number of Liontrust, Neptune, Architas and Majedie holdings in our database was 43 in 2018.

This has almost halved to 24 Liontrust holdings now (this includes those funds which have been rebranded from their previous fund houses).

We should briefly mention here that one of the funds which is no longer held by any DFMs we cover is Liontrust Russia which is, shall we say, facing problems outside Liontrust's control. But Neptune Russia was only ever held by one DFM anyway.

Special Situations

The biggest sell-off was seen in Liontrust Special Situations, which saw a net six allocators head for the exit door. We covered its recent wane in popularity here, alongside the shift away from UK growth equities across the board.

Having said that, it remains one of the more popular UK growth funds and a DFM we spoke to still holds it in high regard, and believes the reason for its underperformance is down to a bias in small and mid-cap stocks, which have been largely out of favour.

The story is less positive elsewhere. Majedie UK Equity had been held by seven DFMs in 2018 but Liontrust UK Equity is only held by one.

Majedie UK Income was once held by five DFMs but it has since been merged into Liontrust Income, which is held by none.

The Majedie Tortoise fund (which became Liontrust Tortoise in 2022) saw its only DFM in our database exit through the gift shop, presumably part of the crowd that pulled out of the fund following the departure of its two managers Matthew Smith and Tom Morris.

Its AUM now stands at just £5.5mn, down from around £30mn at the time of the acquisition.

Architas Diversified Real Assets was once held by three allocators and is now held by just one.

Liontrust declined to comment.

On a positive note, one fund which has held up relatively well is Neptune European Opportunities, which is now Liontrust European Dynamic. In 2018 this fund was held by four allocators and is now held by three.

Liontrust UK Growth (a fund the company did not acquire) has also picked up two owners recently and is now held by three allocators.

Both funds are around £1bn pounds in size, and while their UK growth fund has delivered middle-of-the-road Q3 returns over one year and Q2 over three, its European Dynamic fund is faring very well.

It has consistently achieved first-quartile returns over one, three, and five years, proving a shrewd pick for investors seeking exposure to European financials and pharmaceuticals, with Novo Nordisk, Publicis Groupe, and Pandora its largest three holdings.

So it’s not all bad news for the company.