David Cameron, in his first comment since leaving politics, bemoaned to a US audience how populism had lost him his job. A year ago populism was an esoteric term. Now it is being used more and more, even though there isn’t much consensus on its definition.

An academic paper written by Ionescu and Gellner in 1964 suggests that “populism worships the people”, and questions whether it has an underlying unity or is the name covering a multitude of unconnected tendencies. In some respects it isn’t an ideology, but a mode of political expression that is employed selectively and strategically, targeting issues of mass appeal.

The term populism in today’s context reflects a varied demographic, being an eclectic group of voters from both the left and the right. The issues are often viewed as the ordinary man oppressed by a remote elite, or regarding immigration or national sovereignty. The EU referendum in the UK highlighted how seemingly arcane issues can rapidly become a mainstream school of thought.

This rise of populist politics in the UK is being mirrored across the developed world. Seventy per cent of Europe by GDP has elections in 2017, just when populists are rising rapidly in the polls. Political tail risks remain high. Typically, the agendas of these parties have focused on a break from the incumbent political establishment, and tend to overpromise: developing simple policies with mass appeal, irrespective of their ability to be delivered.

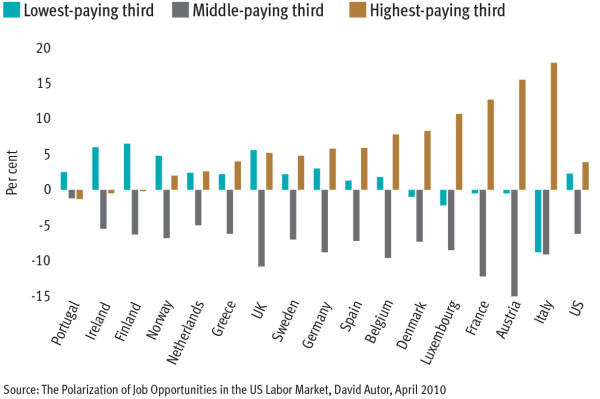

Why has this phenomenon begun now? There appear to be several key drivers of the rise in populism, primarily high inequality, generated by stagnant economic and wage growth, alongside increasing cultural diversity.

A metric for inequality such as the Palma ratio is appropriate as it measures the ratio between the top 10 per cent of earners versus the bottom 40 per cent.

The ratio was developed by Gabriel Palma, of the University of Cambridge, who implied in his work that globalisation was creating a distributional scenario in which what really matters is the income divide between the rich and lower-income workers, with ever more precarious jobs in ever more “flexible” labour markets. The Palma ratio highlights that some of the greatest inequalities in Organisation for Economic Co-operation and Development countries are places where we have witnessed some of the most significant populist uprisings.

One of the more immediate effects of populism has been the rise in uncertainty, prompting investors to flock to quality and defensive equities. Historically there has been a close correlation between rising uncertainty and an appetite for defensive equities. Although not as strongly correlated, demand for gold – often seen as a safe haven – increases in times of rising uncertainty.

Where populists have won in emerging market countries there is often a rise in infrastructure spending, which temporarily raises growth in output, real wages and employment, but quickly gives way to inflation which erodes the initial gains. However, in the developed world populists in opposition tend to be more successful than populists in office.

Regardless of its success at elections, populist momentum can be a very powerful catalyst for reform, with incumbent parties scrambling to counter the wave. As mentioned, the end result is typically a rise in infrastructure spend to stimulate economic growth and social initiatives to combat inequality, which are likely to lead to an increase in consumer spending, with the end result being a rise in inflation.

There are more elections scheduled this year where populist parties are gaining traction. As inequality issues cannot be reversed overnight, uncertainty is likely to remain elevated in 2017, favouring safer, lower-volatility assets. While rising populism doesn’t always end up with the political incumbent losing, some populist policies are typically implemented to assuage the disenfranchised.

Investors can protect their portfolios by gaining exposure to assets that perform well in inflationary environments, such as equities, inflation-linked bonds, precious metals and infrastructure. Populism may have come to the fore in 2016, but its impact will be felt for years to come.

James Butterfill is executive director and head of research and investment strategy at ETF Securities