Since the start of 2018, the European economy has disappointed investors.

A multitude of factors, both external and domestic, have contributed to a backdrop of slowing economic growth.

Certainly, there was a lot of promise and expectation for European growth at the start of 2018. Fuelled by easy financial conditions and falling unemployment, the European recovery looked to be finally finding its feet.

Since then, economic data for the region has deteriorated significantly. As this weakness has persisted, investors have become tired of the seemingly perpetual excuses for weak data, and sentiment towards European assets has worsened.

With few domestic catalysts for a turnaround, it may take a rebound in demand from the emerging world to improve prospects for the region.

What has gone wrong for the European recovery?

Export growth at a standstill

Much of the weakness can be attributed to net exports, which contributed 1.4 percentage points to the annual real GDP growth rate in the fourth quarter of 2017, but in the third quarter of 2018 its contribution was negative.

Both imports and exports contributed to the deterioration, as the rising oil price in the first three-quarters of 2018 led to a sharp increase in imports, while at the same time export growth stalled.

Given that exports make up approximately half of GDP in the eurozone, a slowdown in global growth was always going to prove a strong headwind. In particular, demand from emerging markets has softened.

In November, exports to Turkey contracted by one third year-on-year due to the confidence crisis that led to a slowdown in growth and the devaluation in the currency, while export growth to Asia slowed because of a slowing Chinese economy.

But domestic factors have played their part too.

In Italy, the new coalition government’s dispute with the European Commission over its proposed budget sent borrowing costs to multi-year highs and tightened credit conditions.

In France, the protests of the ‘gilets jaunes’ have caused significant disruption, sending the French composite purchasing managers’ index into contractionary territory at the end of 2018.

Populism remains a risk across Europe, with the European parliament elections in May likely to show that Eurosceptic parties still garner significant support.

In Germany, the car industry has struggled to get to grips with the new emissions testing regulations, hampering production and dragging significantly on growth.

What could be the catalysts for a turnaround?

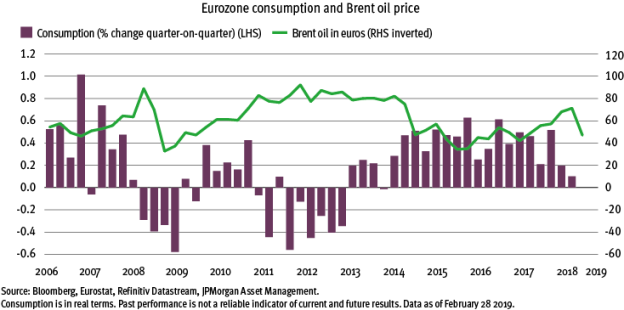

With the unemployment rate continuing to fall and wages picking up, the European consumer is still supported. In addition, the oil price has fallen significantly since October last year, serving as a significant tax cut for European households.

Historically, there has been a close inverse relationship between the oil price and consumption in the region, as the chart above shows, suggesting that the recent move in oil can help to boost consumption, and may also help European businesses by easing cost pressures.

Monetary policy looks set to remain accommodative in 2019, which will keep lending rates at a very supportive level.

ECB initiatives limited

While the European Central Bank has acknowledged the risks to the outlook have moved to the downside, attention is quickly turning to what the ECB could do to provide further stimulus.

This may involve further liquidity assistance through its Targeted Long-Term Refinancing Operation II initiative – a €700bn (£605bn) programme to incentivise eurozone banks to lend to non-financial corporations and households, by lowering the banks’ marginal borrowing costs. Italian and Spanish banks currently hold the largest chunk of the loans (60 per cent).

This policy measure is starting to come into focus again as these loans will begin to mature in June 2020.

As a minimum, we would expect the ECB to announce an extension of the initiative to continue to provide support to the banking sector and economy.

Beyond this liquidity provision, the ECB’s ability to stimulate the economy further is limited. Key interest rates are already in negative territory, and the ECB will struggle to expand quantitative easing as it is nearing the upper limit of the amount of German Bunds it is permitted to buy.

On the fiscal side, governments are moving to incrementally looser policies, notably in Italy and France. But these countries will ultimately be constrained by their already high public debt-to-GDP ratios.

With limited help available to the eurozone economy from within, an improvement in external factors might prove the key for a turnaround in sentiment among both manufacturers and consumers alongside the avoidance of a hard Brexit, and a de-escalation in trade tensions or a soft landing in China.

Eurozone stocks may perform better than the economy.

The multitude of elements that have contributed to a slowdown in Europe, coupled with the absence of a clear catalyst for a turnaround, has left investors cautious of investing in the region.

But it is worth remembering approximately 50 per cent of European corporate revenues come from outside the region.

Key points

- There is slowing economic growth in Europe

- The fall in the oil price could be have a positive effect

- Eurozone stocks may perform better than the economy

In 2018 the European macroeconomic environment continued to deteriorate, but companies were still able to achieve a respectable 5 per cent earnings growth.

An uncertain economic outlook for the region suggests investors should remain cautious in the near term.

But the international nature of European companies and the broader eurozone economy means the direction of the global growth environment will have a large bearing on future performance.

Investors will likely stay on the sidelines in Europe until we get the promise of a lasting recovery in growth.

Tilmann Galler is a global market strategist at JPMorgan Asset Management