Article 3 / 4

Guide to CryptocurrenciesWhat does the regulator think about cryptocurrency?

The biggest factor that is said to be holding advisers back from venturing into cryptocurrencies is regulation.

Often described as the wild west of investments, cryptocurrencies are not seen as a viable investment channel by many advisers - an attitude that has been strengthened by the FCA’s own attitude towards the sector.

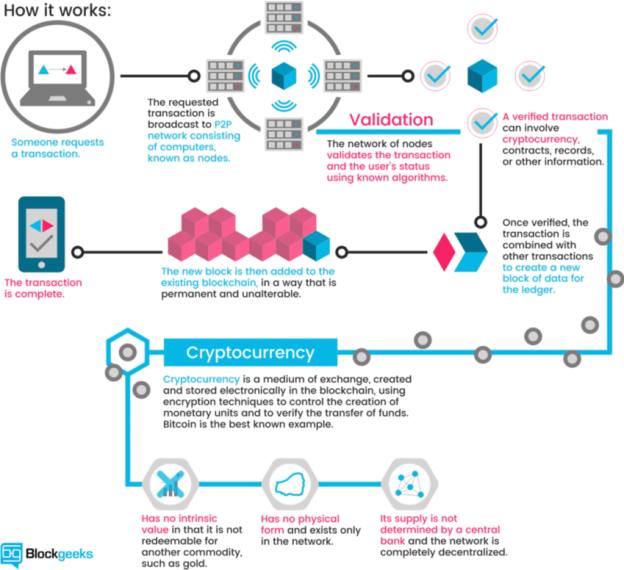

In its recently published guide to cryptoassets the FCA said consumers should be cautious when investing in such cryptoassets and should ensure they understand and can bear the risks involved with assets that have no intrinsic value.

Source: Blockgeeks

In the report the regulator also clarified its regulatory stance on cryptoassets:

- Cryptocurrencies such as Bitcoin and Ethereum, which are defined as ‘exchange tokens’ by the FCA, are not regulated by the FCA but must follow anti-money-laundering regulations.

- Security tokens have specific characteristics, which means they provide rights and obligations akin to specified investments, like a share or a debt instrument will be regulated by the FCA.

- Utility tokens will fall outside of the FCA’s scope, although they might be regulated where they might meet the definition of e-money in some circumstances (as could other tokens).

The Final Guidance will inform further work being carried out in this area, including:

- A Consultation on potentially banning the sale of derivatives linked to certain types of unregulated cryptoassets to retail clients.

- Treasury’s consultation on whether further regulation is required in the cryptoasset market, particularly in relation to unregulated cryptoassets.

- Treasury and FCA work on the transposition of the 5th EU Money Laundering Directive.

When it comes to what the advisory sector thinks about cryptocurrencies and regulation, it should come as no surprise that they feel it is necessary.

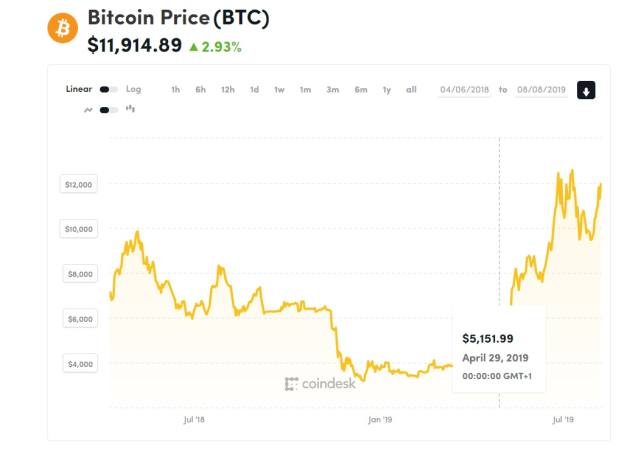

Image source: Coindesk

A study by Etoro has found that over three quarters (76 per cent) of advisers support the regulation of cryptoassets.

Those in favour of regulation see it as a key way to prevent crime or fraud in the sector (80 per cent), increase transparency (73 per cent), and limit investor (66 per cent) losses.

As the regulator has clarified which elements of cryptoassets will begin to fall under its radar, this is just the beginning, according to regulation experts.

Arun Srivastava, partner at law firm Paul Hastings says, currently, there is very little pan-European regulation of cryptoassets.

But regulatory inconsistencies already exist – for example, in Germany, Bitcoin is treated as a financial instrument requiring a banking licence, whereas in the UK it is currently not regulated, at least.

A number of factors are influencing the UK regulator’s approach to policy.

On one hand, the UK wants to be seen as a leading fintech and innovation hub.

On the other, there are concerns around the risks of what are still relatively novel products.

Mr Srivastava says: “Financial crime risks top the agenda, but consumer protection and financial stability are also key concerns.

“The current approach is likely to change as more products get brought into the regulatory net.”

He believes the FCA's regulatory plans for cryptoassets gives the sector some credibility.

He adds, however, that crypto firms who have no regulatory status find it difficult to identify partners, such as banks, who will work with them.

Mr Srivastava says: “The existing regulatory rules already impose regulatory requirements on certain crypto related assets and the FCA has now confirmed this to be the case – where the perimeter lies between the regulated and unregulated sector.

“This is welcome but the more interesting issue is where regulation will move to next, how far will the regulation go? New money laundering regulations which come into force in January will, for example, extend regulatory requirements for anti-money laundering regulation to new product types, such as cryptocurrencies.”

“Cryptocurrencies like Bitcoin have been highly volatile, but not all cryptoassets are the same. Before investing, investigate the substance of the investment, whether there is real money behind it and what the safeguards are around this.”

NextHash, a cryptoexchange founded by Ana Bencic is expanding its digital asset platform where digital assets are traded. These are not only cryptocurrencies, but they also include digital securities or tokenised securities.

Daniele Mensi, managing director at NextHash says: “The FCA is very open in understanding and not rejecting upfront the opportunity of this market. We see [the FCA’s statement] with optimism, which leads us to think that there should be improvements that should come soon.”

Tyler Welmans, UK blockchain lead at Deloitte, says the market has attracted a sizeable amount of scrutiny, with prices fluctuating hugely since its inception.

For some, investment in cryptocurrency has generated outsize returns, whilst others have lost value.

Mr Welmans adds: “Cryptocurrencies that are decentralised, not linked to a central authority, and limited in supply such as Bitcoin and Ether can be vulnerable to huge price fluctuations, driven by changes in market sentiment and amplified by speculators.

“On the other hand, the value of stablecoins, cryptocurrencies backed by assets such as cash and gold, are less likely to fluctuate as their value generally follows the real world assets they are linked to.”

Meanwhile, Adrian Lowcock, head of personal investing at Willis Owen does not believe cryptocurrency is ready for the [investment] market yet because of the gaps in regulation.

Mr Lowcock says: “If you are an adviser telling someone where to invest money and you told them to buy cryptocurrency, I would be interested to see what the FCA would say about that. I think you would struggle to justify it.

“It is probably right for advisers to be skeptical about it at the moment.”