One of the most time-honoured approaches for income investors is to identify mature companies in well-established sectors as, all things being equal, they should be in a position to deliver the most reliable income streams.

A good example is boring old utilities stocks. Although they might lack glamour, they regularly take pole position in both the UK and US markets as the top yielding sector.

This is thanks to the quasi-monopolies they enjoy and the heavily-regulated industry structures they operate within that enable them to extract high rents for what tends to be very consistent levels of demand.

Consequently, these companies are able to pay out a much higher proportion of their earnings as dividends.

This can be seen from the dividend pay-out ratio for the US utilities sector, which currently stands at close to 75 per cent compared to around 50 per cent for the broader S&P index.

Emerging wisdom

Given that high-yielding stocks will usually have a high dividend pay-out ratio, it is not surprising that income managers tended to steer clear of emerging markets.

This is because emerging market equities were historically labelled as ‘growth assets’ rather than income-generating ones.

And, ongoing growth requires the reinvestment of profits back into a company, which means less cash returned to shareholders.

Times change, however.

These days, there are plenty of well-established emerging market-based companies that pay out appreciable dividends.

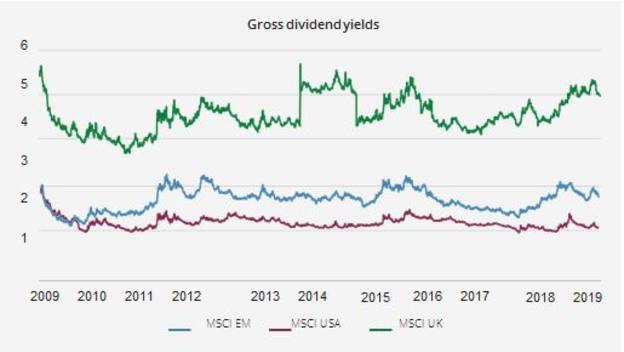

As the chart shows the historic dividend yield on the MSCI Emerging Markets index has been consistently higher than that of the S&P 500 index for nearly a decade.

Of course, dividends alone do not tell the whole story – especially as the US equity market relies on share buy-backs – but they do point to a trend of newer sources of income establishing themselves.

Dividend and conquer

Regardless of where they might come from, investing in higher quality companies that are expected to pay out stable or rising dividends, rather than more growth-oriented companies, has a number of advantages.

In the long-run, theory dictates that a company’s share price should reflect the earnings it is expected to generate.

But market sentiment has a profound effect on equity prices in the short term.

Most fundamental equity analysts would hope to predict a company’s success over, say, one to three years, but trying to tie such predictions to short-term market gyrations can get a little messy.

By contrast, dividends have a much more direct link to corporate earnings than current share prices.

Consequently, the income paid out by a company as dividends should be a more predictable return driver than capital appreciation.

Moreover, because of the stigma that attends a company that is forced to cut its dividend, companies typically do everything they can to maintain their pay-outs, even if earnings start to drop.

Smoothing the ride

Focusing on high dividend paying stocks with stable earnings can also give investors a smoother ride.

This is demonstrated by indices such as the Fidelity Emerging Markets Quality Income Index, which is a ‘smart beta’ product that systematically allocates to higher-quality and higher-yielding stocks.

Over the past 10 years the annualised volatility of returns was 14.9 per cent - compared to 15.5 per cent for the MSCI Emerging Markets index.

The total return was on average 2.6 per cent higher each year too, so you were getting higher returns with slightly less risk.

Another appealing trait of emerging market companies is that, with a comparatively low dividend pay-out ratio of 44 per cent for the MSCI Emerging Markets index – versus the 80 per cent offered by the UK’s FTSE 100 index – they also offer significant scope to ramp up their pay-out ratios.

With any such increase comes added investor interest from income seekers everywhere, which can also drive a pop in share prices.

All this means that a focus on income-producing investments may be a way to lower the risk in your portfolio, while potentially enhancing return.

Even though the yield on emerging market equities might not be earth shattering right now, the risk and return profile that is on offer from holding higher-yielding stocks in a sector with significant potential for capital appreciation should surely be a strong candidate for every income investor’s portfolio.

CJ Cowan is an assistant portfolio manager at Quilter Investors