Giant fund house Baillie Gifford saw its highest ever monthly inflows last month as investors piled nearly £1bn into its funds.

Morningstar data, published yesterday (August 18), showed £991m was funnelled into Baillie Gifford throughout July in a sign its growth oriented house-style remained in favour with investors.

Within their respective categories, many Baillie Gifford funds were among the very top sellers in the month too, as the asset manager’s popularity continued to grow.

Why so popular?

Philip Milton, chartered wealth manager at Philip J Milton & Company, said the firm’s popularity stemmed from the fact it had called the performance of US tech investments “so right”.

He said: “It’s quite easy really. They are to be congratulated, though they are riding the ever extending index and it becomes more dangerous with every point.”

Baillie Gifford was an early investor in US technology companies, backing the likes of Tesla, Amazon, Netflix and Alphabet (Google’s parent company) through a number of its funds.

Such companies have boomed in the past few years and, more recently, thrived during the coronavirus-induced lockdown while other companies took a beating.

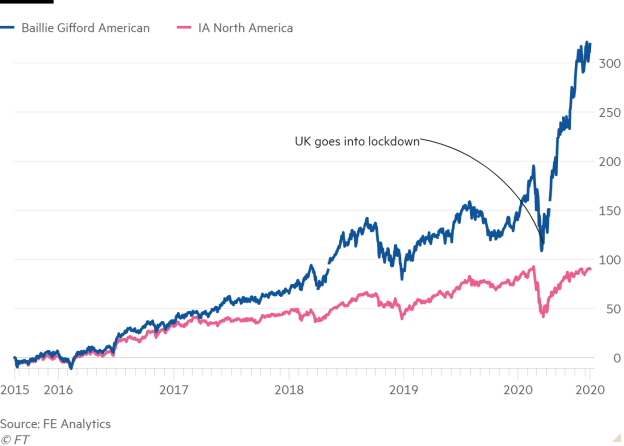

Baillie Gifford’s £4.8bn American fund, of which 43 per cent is invested in technology, is the absolute top performer in the 150-strong IA North America sector over a three-month, six-month, one-year, three-year and five-year period.

Over five years it has returned 320 per cent compared with the sector’s 90 per cent and the outperformance has widened since the coronavirus crisis began.

But it’s not just Baillie Gifford’s US-focused funds that have outperformed their peers.

Its Japanese fund is the absolute best performer in the IA Japan sector over five years — returning 80 per cent compared with the sector’s 52 per cent — while its UK Equity Alpha fund is the best performing fund in the IA UK All Companies sector across all time periods.

Ian Porter, director at Roberts Clifford Wealth Management, said: “This has happened because they are investors, not speculators.

“They have conviction in their approach and unapologetically stick to it. They are also forward-looking as opposed to being overly anchored to a belief that history repeats.”

Alex Harvey, portfolio manager and co-head of research at Momentum Global Investment Management, agreed but added that portfolios "heavily exposed to just one style" could easily be "caught offside" when conditions turn and instead advocated for a more balanced approach.

Wider trends

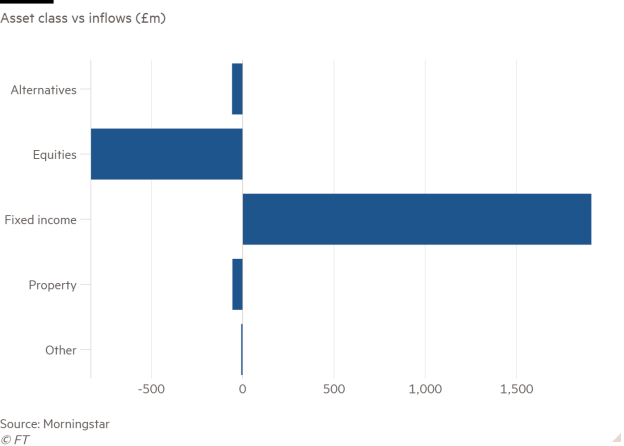

Overall, the Morningstar data shows investors doubled down on their move to fixed income, pumping £1.9bn into bond funds in July as fears of a second wave and increased US-China tension prompted them to be more cautious.

This followed £1.2bn of inflows into fixed income products in June and a further £1.9bn into the asset class in May.

Equity funds were the least popular in July, suffering from £830m of outflows in a sign investors were continuing to cash in the profits made off the back of the stock market rally.

Alternative funds saw £58m outflows while investors pulled a similar amount (£56m) from property portfolios.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know