PARTNER CONTENT by ARTEMIS

This content was paid for and produced by ARTEMIS

With inflationary pressures persisting and interest rates heading higher, investors in some bond funds may be feeling nervous. Here, Juan Valenzuela explains why the Artemis Target Return Bond Fund has the tools and the flexibility to reduce inflation’s impact.

Inflation has repeatedly been cited as among the biggest risks facing economies and financial markets. The reason why will be painfully clear to anyone who has bought a used car, or a house – or even a steak this year.

If expectations of higher inflation do become engrained, however, the design of the Artemis Target Return Bond Fund gives us the tools to reduce its impact.

Inflation readings are persistently coming in ahead of forecast

Inflation is a broad-based dynamic, affecting developed and emerging market economies alike. Elevated absolute inflation numbers guarantee that headline (and core) inflation will, in most economies, be well above the targets of central banks for a considerable period of time to come.

Inflation is surprising on the upside in the G10 economies

These developments are causing investors and (more importantly) central banks to question if the current period of inflation will prove 'transitory'. Projections made in December indicate that 14 of the Federal Reserve’s rate-setting committee now expect core PCE for 2022 to be above 2.3 per cent.

Can inflation still be defined as transitory?

Clearly, the risk that elevated inflation begins to filter through to a rise in medium and long-term inflation expectations has increased. In fact, the Fed recently admitted inflation cannot now be defined as transitory. This could damage the credibility of central banks and have a lasting impact on the economy.

‘Transitory for longer’. Between June and December, the views of Federal Open Market Committee members on where inflation will be next year have changed significantly.

Estimated core 2022 PCE

To say that a long period of elevated inflation would not represent a benign environment for fixed income as an asset class would be an understatement. It will require a greater inflation premium and therefore higher bond yields.

How do we try to protect capital – and still earn a return – in a time of inflation?

The design of the Artemis Target Return Bond Fund gives us the tools to reduce the impact of inflation, through both directional and relative-value trades...

1. Our duration is limited by design.

Our allowed duration ranges between minus two to plus four years. By limiting the overall sensitivity to moves in yields, the portfolio will be structurally less exposed to a disorderly sell-off in bond markets.

Carry module | Credit module | Rates module | Overall | |

|---|---|---|---|---|

Modified duration | 0.43 | 2.05 | -0.36 | 2.21 |

Equally, we fully acknowledge that we would benefit less than traditional fixed income funds if yields were to fall...

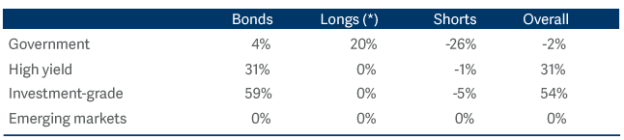

2. We can focus on those areas of the fixed income market that are less negatively impacted by expectations of higher inflation.

High-yield bonds have a shorter duration than the wider fixed income universe. They also tend to perform strongly in periods traditionally associated with higher inflationary pressure.

The same applies to the bonds of certain emerging market economies, especially commodity exporters. Our current preference, however, is for high-yield bonds, which accounted for 31 per cent of our portfolio at the end of November.

3. Flexibility to allocate capital to those sectors that are potential beneficiaries of inflation.

Rather than attempting to track bond indices, our goal is to outperform the Bank of England’s base rate by at least 2.5 per cent a year. That allows us to disregard sector weightings in bond indices, giving us the freedom to avoid sectors for whom inflation would be harmful.

Equally, we can allocate capital to bonds issued by companies in a handful of sectors, most notably financials, which could potentially benefit from an environment associated with strong economic growth, higher bond yields and steeper yield curves.

In contrast to most conventional bond funds, we also take relative-value trades in the government bond market...

1. We can use inflation positions to express our views on the magnitude and evolution of inflation over time.

This can be either in a particular economy in isolation, or on a relative basis between countries. We can observe the market’s expectations for inflation stretching for decades to come using inflation breakevens (the difference between ‘nominal’ and ‘real’ yields for a given tenor). In the UK, for example, we can observe the market’s expectations for average RPI for the next 50 years.

We can then judge whether we think the market is overstating or understating the risk of inflation – and take positions accordingly.

For instance, we might take the view that the risk of inflation in the US over a particular time horizon (such as the next 10 years) is not being fully priced in. In that scenario, we could profit as the market’s inflation expectations begin to converge with ours. Or, if we were to hold the position to maturity, to profit from the difference between realised inflation and implied inflation.

We currently believe inflation valuations in a number of economies are compelling – but not in the UK.

We therefore maintain a short inflation position in the UK (concentrated in long-dated, 10 to 20-year tenors) set against long exposure in Europe (towards the front end of the curve).

2. We use ‘curve trades’ to express our views on term premiums.

Yield curves can be conceived of showing two things in the same line: firstly, interest-rate expectations and, secondly, a term premium. This term premium is, in effect, the additional yield that bond investors demand in compensation for uncertainty about the future. Inflation risks constitute a large part of that term premium.

Clearly, the higher inflation expectations are, the greater the risk that inflation will erode the value of the nominal cash payments that a bond’s owner will receive in the future – and, naturally, the higher the premium investors will demand. Because there is more time for risks to materialise as time passes, longer-maturity bonds normally carry a higher inflation premium.

We can position the portfolio to benefit from the steepening of yield curves that would result if central banks are seen not to be responding sufficiently to elevated inflation readings. If the market starts to demand a bigger premium for owning long-dated bonds, we would expect the yield ‘spread’ between long-maturity bonds to widen relative to short tenors – for the yield curve to steepen.

The spread between 50-year and 10-year gilt yields is negligible. We think mounting short-term liabilities and the end of QE will likely see the yield curve steepening in the UK.

A ‘steepening’ bias is currently evident in our positions, particularly in the UK. As we move towards the end of QE in the UK, the long end of the curve is particularly exposed to the higher yields that would result.

3. Diverging outcomes on inflation give us opportunities to implement cross-market positions.

Third in our relative-value toolkit are our cross-market positions. As the world recovers from the pandemic over the coming years, we expect to see a significant divergence in the trajectories being taken by individual economies. Differences in the size and the composition of fiscal support offered by different governments, and the varied sector exposure of their economies, will result in economies recovering at different paces – and so produce different outcomes for inflation.

In simple terms, we want long exposure to bonds of those economies where inflation and interest rates will remain subdued relative to those in which inflationary pressures are likely to lead to higher bond yields.

Today, we are long Germany versus the US. If there is one economy that could be exposed to elevated inflationary pressures that might demand a more forceful response by central banks, it would seem to be the US. While inflation in Germany could well run above the European Central Bank's target for some time, the same is not likely to be the case for many other Eurozone economies – so the ECB will not need to be quite as hawkish as the Fed.

Performance of the Artemis Target Return Bond Fund, from launch to November 30 2021

All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Juan Valenzuela co-manages the Artemis Target Return Bond Fund alongside Stephen Snowden

For professional and/or qualified investors only. Not for use with or by private investors. This is a marketing communication. Refer to the fund prospectus and KIID/KID before making any final investment decisions. Capital at risk. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Investment in a fund concerns the acquisition of units/shares in the fund and not in the underlying assets of the fund. Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them.

For information on sustainability-related aspects of a fund, visit www.artemisfunds.com. The fund is a sub-fund of Artemis Investment Funds ICVC. For further information, visit www.artemisfunds.com/oeic.

Third parties (including FTSE and Morningstar) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit www.artemisfunds.com/third-party-data.

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

Issued by Artemis Fund Managers Ltd which is authorised and regulated by the Financial Conduct Authority.

Find out more