Has Christmas come too early now that Santa Sunak has delivered his Summer Statement?

As markets opened on Monday 6, the consensus was there was plenty to look forward to, as chancellor Rishi Sunak was set to deliver his economic statement to the Commons and the markets anticipated some good gifts.

City analysts were weighing up what Mr Sunak would say, and debating how much fiscal policy would be “unleashed” – in the words of Matthew Cady, investment strategist at Brooks Macdonald – to combat the monetary effects of the Covid-19 pandemic.

As a result, the Blue-Chip index started strongly at the opening of the week, rising from 6,144.82 at close on Friday 3 to 6,291.15 at 8:30am on Monday 6, before tailing slightly during the day.

But while Wednesday’s Summer Statement – dubbed by many as the ‘mini-Budget’ – was big on promises, the market didn’t seem to bounce higher as a result.

Instead, the FTSE 100 closed further down on Wednesday 8, at 6,156.16 and even lower the next day, at 6,052.46.

So what disappointed the markets?

Of the raft of measures launched by the chancellor, let us see how well the big-ticket items have cut it with financial services professionals.

Stamp duty and green bonus

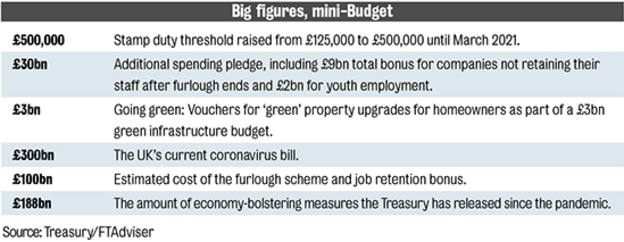

Commentators had expected stamp duty would be axed for six months for many homeowners. Instead of cutting it completely, Mr Sunak raised the residential stamp duty land tax threshold from £125,000 to £500,000.

He said the higher threshold would apply immediately to all residential property purchases and run until March 31 2021, and would result in the average stamp duty bill falling by £4,500.

This measure has gone down well with financial services professionals, with Florence Codjoe, personal finance expert at Bankrate, saying this move would be “especially significant for first-time buyers who are struggling to save for their own home”.

The raised SDLT threshold to £500,000 means more properties will be lifted temporarily out of the taxman’s reach, and could go a long way to helping first-time buyers especially with costs.

Additionally, homeowners will receive vouchers of up to £5,000 (£10,000 for poorer households) to pay for “green” property upgrades, as part of a £3bn green infrastructure budget. The Treasury said the measure is expected to support more than 100,000 green jobs.

But earlier this month, data from the Bank of England showed UK household deposits grew in May by more than £25bn, which was the biggest monthly increase since records began in 1997.

Is this a sign the consumer is ready to spend – or a red flag indicating dangerous consumer indebtedness? More than 30,000 job cuts have already been announced from big businesses and, on July 16, the Office for National Statistics will reveal its latest redundancy statistics. This will be an interesting read.

Maybe Mr Sunak’s ‘Eat Out to Help Out’ scheme of 50 per cent off restaurant meals will help cut household bills; or increase the likelihood of more diabetes-related claims on insurers. Time will tell.

Jobs for youth

The chancellor’s £2bn ‘Kickstart’ job creation scheme will pay the wages of 16-24-year-olds at risk of unemployment for six months, essentially creating a free pool of labour for companies.

While there is no cap on the number of jobs available through Kickstart, businesses must show the jobs are additional roles, at least minimum wage and 25 hours per week. The company must also provide training and support to help the worker find a permanent job.

As reported in FTAdviser, some financial services company bosses believe such a scheme could make a “big difference” to recruitment in financial advice, with Alan Chan, director at IFS Wealth and Pensions, commenting: “The financial services industry will welcome [the scheme] with open arms during these challenging times.”

In a statement, Keith Richards, managing director of engagement for the Chartered Insurance Institute, said: “A six-month spell of employment could be an excellent way for young people to discover how insurance is a vital profession where they could have a rewarding career.

“The job creation scheme must be properly integrated with other initiatives such as apprenticeships, to ensure there is a pathway for young people from their initial experience to achieving the skills and knowledge required to be a fully competent insurance professional.”

In addition, the chancellor confirmed a bonus package for employers taking on new apprentices in the aftermath of the coronavirus crisis, while encouraging bosses not to ditch staff returning from furlough, by offering £1,000 bonus for employers for each member of staff they retain.

Understandable concerns

So how well will all this positive news pan out in reality? Market indicators and financial services commentators alike point to the scale of the economic slump the UK is heading into, if not already in.

Brooks Macdonald’s Mr Cady points out this big-ticket spending plan cannot mask the fact the UK is in a big debt hole.

He states: “With UK public debt bigger than the economy in May for the first time in more than 50 years – since 1963 – there are ultimately limits to the support that the government can offer long term.”

Even the announcement by Prime Minister Boris Johnson earlier in July of an acceleration of £5bn of previously announced government spending is only worth around a quarter of 1 per cent of GDP.

Nimesh Shah, spokesman for Blick Rothenberg, says: “You can’t help but think the chancellor will deliver some bad news at the Autumn Budget.

“The significant government support throughout the pandemic and the latest measures all come at a cost.”

What does this mean for advisers?

On the one hand, it could be good news for mortgage brokers over the next six months; but banks will still be keen on affordability issues and, as advisers have pointed out in the pages of Financial Adviser and beyond, many lenders have pulled their higher loan-to-value products.

A stamp duty break is not going to help people priced out of the mortgage market.

Insurance advisers have seen business coming their way from concerned citizens keen on protecting their families; the importance of communication in the months ahead is paramount, however, to ensure policies remain in place and are not cancelled by clients concerned about monthly expenditure.

Also, as Alan Knowles, managing director of Cura Financial, comments, brokers with clients that have accident, sickness and unemployment cover may well find their clients have the ‘unemployment’ cover pulled from their policies as insurers consider the financial implications of having to pay out in a period of high unemployment. Again, communication will be vital.

Regarding pensions and investments, advisers have already been contacting clients and checking that portfolios are robustly diversified. Few worries there, but some rebalancing of allocations might need to be done before the year end, with Brexit on the horizon.

While the rumour of a ‘wealth tax’ did not become reality, many believe this may be deferred until later in the year, so advisers would be well-placed to do some expert tax planning for their wealthy clients.

As Nigel Green, chief executive and founder of deVere Group, says: “Santa Sunak has, rightly, been praised for his handling of the economy.

“But what happens when, in the Budget in November, he is forced into becoming Scrooge Sunak to pay for his support measures?

“Many higher earners and investors will now be thinking the result of his largesse, inevitably, means higher taxes to help plug the enormous £300bn black hole in government coffers.”

And where will that tax money come from? Britain’s wealthier investors would do well to watch this space.

Simoney Kyriakou is editor of Financial Adviser