Article 1 / 4

How to advise on workplace pensionsHow to make the 75 basis point cap worth your while

Costs and charges can have a significant impact on how much of a pension pot savers actually end up taking home.

The then pensions minister Steve Webb, now policy director at Royal London, was worried some workplace schemes might introduce high charges which would eat into people’s pension pots.

He proposed a 75 basis point, or 0.75 per cent, cap for those who were auto-enrolled onto a default scheme after a report by the former Office of Fair Trading discovered some employees were being charged as much as 2 per cent or more each year by their employers.

As Neil Johnson, senior partner at True Potential explains: “By 2018, 1.8m businesses in the UK will have to put in place an auto-enrolment pension for their employees.

“The majority of these employers will need assistance over the next 12 months to meet their obligations. The opportunity for advisers lies in the scale of auto-enrolment and providing support to businesses.”

That includes ensuring members of workplace schemes know how to make the 75bps cap worth their while.

Explaining the cap

Andy Beswick, managing director, business solutions at Aviva, explains how the cap works.

“The 75bp charge cap is in relation to pension providers. A member using the default fund of a qualifying auto-enrolment pension cannot be charged more than 75bp by their provider.

“Advisers would have their own arrangement for fees with an employer and their employees if offering advice to individuals,” he adds.

A report published by Defaqto in January 2017, called ‘How to analyse auto-enrolment default funds’, confirms the maximum annual management charge (AMC) chargeable for pension schemes is 0.75 per cent.

But it warns additional charges can be incurred through the pricing of trust funds, for example.

The report points out: “While some providers manufacture their schemes to the 0.75 per cent charge, others operate a more complex structure charging a combination of fees, and advisers should be sure to include all of them in their evaluation process.

“Advisers will find that some schemes do not publicly state their fees, requiring employers to apply before they offer specific rates.”

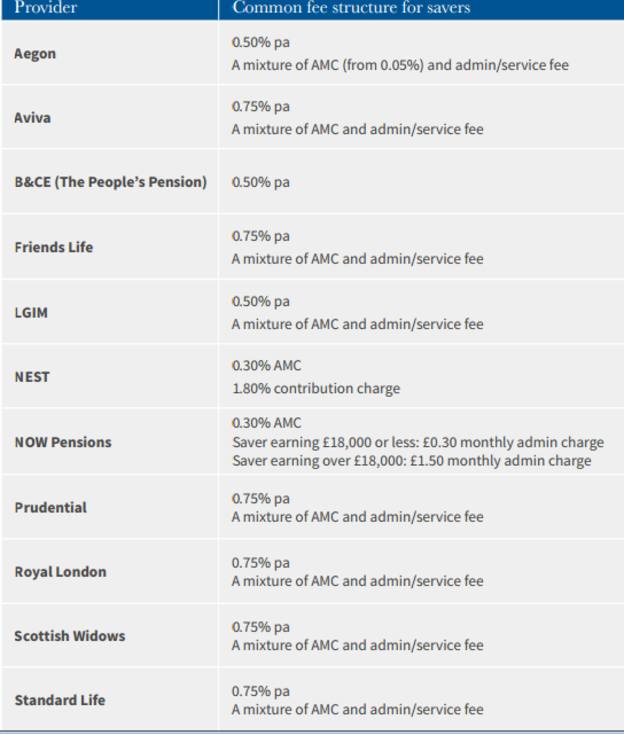

Figure 1: Main default funds - charges

Source: Defaqto, How to analyse auto-enrolment default funds

According to Nick Dixon, investment director at Aegon, there are now more than nine million individuals saving for retirement through DC pensions.

He confirms value for money is very high on the list of employer demands.

“Furthermore the Department for Work and Pensions price cap, Independent Governance Committees, and FCA’s Asset Management Market study reinforce the drive towards lower fees.

“Aligned to these forces, default funds typically embody active asset allocation and passive stock selection costing as little as 0.05 per cent,” Mr Dixon points out.

But he adds: “Advisers typically will not get in trouble for recommending a multi-asset default fund costing 5 bps.”

Defaqto, in its report, lists some of the more common fees to look out for that can be applied to the employer and/or the employees, including:

- Application processing fee

- Middleware costs

- Installation

- Annual management fees

- Annual investment/fund fees

- Change of contribution

- Statutory communications

- Transfer costs (in and out)

- Changes in costs for individuals leaving employer so scheme becomes paid up

- Exit fees for individuals on transfer

- Exit fees for individuals on death

Mixed reviews

The cap has received mixed reviews from many in the industry though.

Secretary of state at the Department for Work and Pensions Richard Harrington indicated in a ministerial statement in January on the forthcoming AE and annual thresholds review, the 0.75 per cent charge cap could undergo a potential revision.

One disadvantage of the charge cap has been the impact on advisers.

Graham Peacock, managing director at Salvus Master Trust, points out: "The cap is a good idea for members but with an outright ban on commission, advisers have been frozen out. Advisers need to charge employers fees or deliver a service to an individual member.

"With written member consent, we will facilitate advice charges for transfer work – this is something very few workplace pension providers will facilitate.

"We developed this to help members get access to advice and (with consent) allow advisers to get remunerated for giving help and advice on pension consolidation and transfers in."

Stephen Coates, benefit consultant at JLT Employee Benefits, says the cap was “inevitable and welcome” but admits setting it at the right level was always going to be a challenge.

“Too high and it offers scope for the unscrupulous, too low and we end up with bland, vanilla propositions.”

He agrees with Mr Dixon, in that that if employer schemes are paying 75bps, they’re probably paying too much.

“The reality is that market rates come in well below the cap,” he notes.

Lydia Fearn, head of defined contribution at Redington, acknowledges: "While there was initial concern the 0.75 per cent charge cap would have hampered innovation and schemes would find it difficult to create a well-diversified and managed default investment strategy, we have seen positive changes to funds.

"It is important that members are not over-charged for the investments they are in, particularly when they are relying on a default arrangement to help grow their pension savings – therefore it is a good idea."

But she would like to see the charge cap widened to include post-retirement arrangements too, so members are not on the receiving end of a sudden jump in charges once they access their pension savings.

Value first, price second?

Mr Coates reiterates the cap should be about value for money but the problem as he sees it is no-one has successfully defined what 75bps should buy you.

“Until we know what good looks like, we just have charges and propositions,” he adds.

He suggests to make the basis point cap worthwhile an employer first needs to define what they want.

“The next step is to find propositions that satisfy their needs and then select based on price. All too often price leads the selection process,” he says.

“Advisers have a duty to lead clients to buy on value first.”

Ms Fearn adds: "Also, clarity on what the charge cap is paying for, whether it is investment or admin charges, will make it easier for advisers to compare value across the product range.

"There is more innovation and work to be done – fund managers should not be complacent. As defined contribution assets grow, there will be a greater ability to utilise scale and I would like to see improved designs and structures to be able to support and help members save better in the future."

eleanor.duncan@ft.com