PARTNER CONTENT by ONEFAMILY

This content was paid for and produced by ONEFAMILY

Equity Release

by Nici Audhlam-Gardiner, Managing Director of OneFamily Lifetime Mortgages

It might surprise you to learn that one in eight people who retired in 2018[1] did so without any pension savings. What may surprise you even more, though, is that the average size of a pension pot at retirement is only £28,000[2].

It’s no wonder that, with so little being saved towards retirement, many potential retirees face the prospect of having to work for longer than they had expected or accept that their ‘golden years’ may not be quite so golden after all.

Bridging the income gap in retirement

There is, however, a potential solution at hand. And it may be closer to home than many of your customers realise.

Given that over 65s hold in excess of £1.6 trillion in property wealth[3], releasing some of this tied-up wealth, using a lifetime mortgage, could well be the answer to their retirement funding problems.

Indeed, with almost £4 billion of equity released in 2018 (up from just over £3 billion in 2017)[4], using a lifetime mortgage is becoming an increasingly popular way for those approaching later life. The money released from their property can be used to help loved ones with a house deposit, pay for a special treat, such as a holiday, or simply supplement their income in retirement.

As this market has been growing, so has the number of product options available to customers. Recent Moneyfacts research indicates that the number of equity release products increased five-fold from 2014 to cover an ever-increasing range of customer needs[5]. The vast majority of these products operate within the Lite and Standard loan-to-value (LTV) ranges.

Whilst these have served the market and consumer demand well, the fact that LTV’s generally reach a maximum of c. 50% mean that there are still some consumers whose demands cannot be met within the lifetime mortgage market. The introduction of Retirement Interest Only (RIO) mortgages last year provided another option for those approaching retirement to obtain lending at levels comparable to traditional mortgage LTVs.

With the new OneFamily Super LTV Lifetime Mortgage, the product bridges some of the gap between standard lifetime mortgage LTVs and RIO and mainstream mortgages. The product has been launched for a segment of customers who may have higher borrowing requirements – whether it be to unlock the equity to pass onto family members, or to supplement their day-to-day living.

Giving borrowers greater flexibility and choice

Boasting the highest LTV ratios in the lifetime mortgage market[6], OneFamily’s Super LTV Lifetime Mortgage product is designed to offer borrowers over the age of 65, in England and Wales, even greater flexibility and choice by allowing them to unlock up to 58% of the equity in their home.

This product also retains some of the most popular features associated with OneFamily’s other lifetime mortgage products, such as giving borrowers the ability to borrow up to £1 million and allowing them to make voluntary repayments of up to 10% of the initial loan amount each year, should they want to.

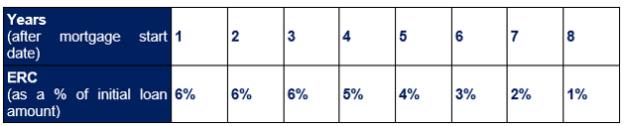

Customers taking out a Super LTV product will also benefit from OneFamily’s simple and transparent early repayment charges (ERCs), as shown in the table below.

And, because they are fixed and easy to understand, your customers have the added comfort of knowing, exactly what they will be charged if they choose to redeem the loan within the first eight years. After that, they can redeem their loan at any time with no ERCs.

We’re here to help

OneFamily is committed to working with advisers to help them to secure the best outcome for their customers, and to be able to find a solution when potentially no one else can.

If you would like to find out more about OneFamily or how the new Super LTV Lifetime Mortgage might be suitable for your customers, go to www.onefamilyadviser.com/super-ltv

‘This is a OneFamily Paid Post. The news and editorial staff of the Financial Times had no role in its preparation’

[1] Prudential Class of 2018 report, https://www.pru.co.uk/pdf/CO2018-No-pension.pdf

[2] Opinium Research - A review of the pensions landscape in 2017 https://www.opinium.co.uk/wp-content/uploads/2017/08/A-review-of-the-pensions-landscape-in-2017.pdf

[3] Savills property wealth report https://www.savills.co.uk/insight-and-opinion/savills-news/239639-0/over-50s-hold-75--of-housing-wealth--a-total-of-%C2%A32.8-trillion-(%C2%A32-800-000-000)

[4] Equity Release Council figures December 2018

[5] Moneyfacts Research, https://www.mortgagestrategy.co.uk/five-fold-jump-in-equity-release-products-moneyfacts/

[6] For customers aged 65-100 with a Lump Sum Lifetime Mortgage in England and Wales. Based on iPipeline’s Equity Release service as at 26/02/2019. Excludes enhanced/impaired lives.

Find out more