By the time you read this, there will be less than four months to go until the Financial Conduct Authority’s investment pathways will need to be offered to the roughly 30 per cent of consumers moving their defined contribution pensions into drawdown without consulting a regulated financial adviser.

This may catch quite a few clients with advisers, who are either starting drawdown or, more likely, moving more funds into drawdown without recently speaking with their adviser.

From August, drawdown product providers will need to implement the FCA-prescribed investment pathways to help consumers make the most of their retirement savings by lining up their savings access needs with the right decumulation choice as follows:

• Option one: I have no plans to touch my money in the next five years.

• Option two: I plan to use my money to set up a guaranteed income (annuity) within the next five years.

• Option three: I plan to start taking my money as a long-term income within the next five years.

• Option four: I plan to take out all my money within the next five years.

The FCA should be commended for trying to create a ‘robo-guidance’ solution to the problem of unengaged retirees – a third of who default into their existing pension provider’s drawdown policy, and a third of these defaulters have their savings plonked into cash or cash-like assets today.

As advisers will know well, leaving money festering in cash funds for long periods seriously erodes its purchasing power.

Pathways force the saver to decide what they want to do with their money once they can access it at age 55.

Key Points

- From August, drawdown providers will need to implement investment pathways

- Many people with small pots are unengaged

- An adviser will need to be involved in the process

Broadly, in option one, they may decide that they are going to retire much later and will not need to access the money for five years or more.

Option two steers them to purchase an annuity based on the consumer’s desire to secure a guaranteed income in retirement.

Option three suggests that they want to use the money for drawdown, but an investment solution still needs to be found that optimises income long-term; while option four is the active choice to move all the pensions savings out within the next few years ready to spend.

Even the unengaged will make a decision because they will not get their tax-free cash out until they do.

Their drawdown provider must then offer one ready-made investment solution for the option chosen by the saver.

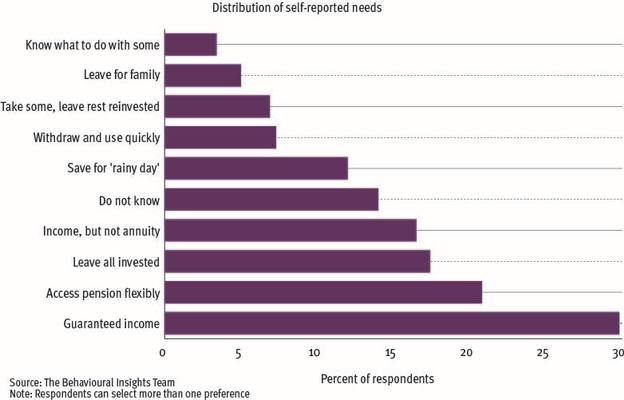

However, investment pathways fails to allow for splitting of the pot so that a portion might be earmarked to meet a particular short-term goal (pay for a new car or expensive holiday), while the rest is retained to provide a long-term income at the point of actual retirement in, say, 10 years’ time, even though consumer research tells us that is precisely what many people want to do.

To properly understand the varied circumstances that consumers find themselves in as they go into decumulation, it is worth reading the Behavioural Insights Team’s research document entitled ‘Increasing comprehension of investment pathways for retirement’.

As part of this report, the BIT conducted a study of 1,468 UK consumers aged 54-70. It found that 33.7 per cent of the sample had DC pots worth under £30,000 in total.

We can only speculate how many of these people with relatively small pots are ‘unengaged’, precisely because they are looking elsewhere for most of their retirement income.

As the chart shows, the study found a fifth (20.8 per cent) wanted flexible access to their savings, 6.9 per cent wanted to take some as soon as possible and leave the rest invested, and 5 per cent wanted to leave all their pension invested with a view of handing it over family.

The investment pathways are a crude attempt to replicate what an IFA would look at together with a client taking their tax-free cash out and moving the other 75 per cent into drawdown.

While the client is naturally focussed on getting their hands on the cash to meet a pressing short-term need, the adviser can lift their eyes to the longer horizon and make sensible plans for the portion left invested.

The implementation of investment pathways is in some ways therefore an interesting test case into what can be achieved in ‘robo-guidance’ through FCA-rubber stamped customer journeys.

However, it also highlights that you can only go so far in robo-land before you need to turn to the services of a adviser to make a fully researched and personalised recommendation that recognises all the personal circumstances of each would-be retiree.

An adviser will be able to ask the questions that might uncover the reality of what that DC pot needs to achieve. Is it the only long-term personal savings pot available to the customer? Or are they looking to downsize their home, tap into their small buy-to-let portfolio, or are they waiting for an anticipated inheritance, or plan to sell a business before contemplating retirement? What attitude to risk can they adopt?

It is that thorough fact find that uncovers the best options for their DC pot(s).

Only an IFA can uncover the real financial needs of a person, based on a thorough understanding of their circumstances.

That same IFA is likely to be best placed to help DC pension pot holders make the right choices in decumulation and the right investment selections in line with those decumulation choices.

Adrian Boulding is director of retirement strategy at Dunstan Thomas