Savers have been warned they could face trouble in the future as the regulator found 42 per cent were taking more than 8 per cent from their pensions each year.

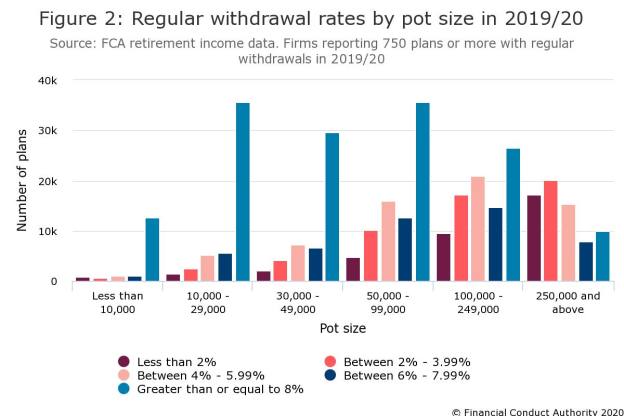

Latest data on the retirement income market from the Financial Conduct Authority, published yesterday (September 29), found savers with smaller pension pots, typically worth between £10,000 and £100,000, were particularly susceptible to high withdrawal rates.

Those with pots worth more than £250,000 tended to be more cautious and take smaller withdrawals.

Steven Cameron, pensions director at Aegon, warned this level of withdrawal from smaller pots was not feasible in the long term.

He said: “While those with tiny pots who are fully encashing them may not need advice, the worryingly high proportion taking large withdrawals of above 8 per cent really do need help in understanding this level of income is not sustainable for life.”

The data showed that of those using an 8 per cent withdrawal rate, more than two thirds (67 per cent) had pots worth between £10,000 and £99,000.

This compared with 24 per cent of those with funds valued at more than £100,000. Typically, savers with larger pensions accessed their pots at a withdrawal rate of between 2 and 3.99 per cent.

Stephen Lowe, group communications director at Just, said: “Of those who are using their pension funds for income, 42 per cent were taking more than 8 per cent a year from the fund which is an increase on the 40 per cent recorded in the previous period.

“Most experts agree that level of withdrawal is highly likely to end up exhausting the fund early in people’s remaining lifetimes.

“These are not people whose funds are so big they don’t need to worry. In fact, the larger the fund, the more cautious the withdrawal rate.”

Andrew Tully, technical director at Canada Life, warned savers would be hit hard in the future.

He said: “The pension freedoms continue to be hugely popular but with this freedom and choice comes huge personal responsibility. Five years in we continue to see a drift away from financial advice as people choose to DIY drawdown.

“While others choose to strip their pensions at what most professionals would argue is an unsustainable rate of income. This may be OK if it is a deliberate strategy to deplete pension pots early, or over a set period, but my concern is we could be storing up trouble for the future if this data continues to tell a similar story in the years to come.”

Other issues

Concerns were also raised by the industry after the FCA’s data revealed the number of people taking regulated advice when entering drawdown had fallen by almost 10 per cent in the half year to March.

Advised drawdown sales had fallen from 66,400 in April to September 2019 to 59,784 in the half year to March 2020.

About 63 per cent of pension pots had entered drawdown with regulated advice being taken by the holder, while 10 per cent of pots entered drawdown by people who received Pension Wise guidance.

This compared with 27 per cent of plans entering drawdown with no advice or guidance.

Meanwhile, the number of pots that were fully withdrawn at first time of access in 2019/20 had increased by 5 per cent to 375,500.

According to the regulator nine out of 10 of these pots were worth less than £30,000.

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.