Article 2 / 4

The state of the UK's buy-to-let marketThe impact of Brexit and taxation on the market

The past year has been rather unsettling for the UK’s buy-to-let market.

Firstly there were a number of regulatory and tax changes which unfolded, creating a degree of uncertainty among landlords and tenants.

On top of that the UK took the surprising decision to vote to leave the EU, prompting many in the market to keep a close eye on the Bank of England’s reactions.

Many in the industry have been doubtful about whether the stamp duty changes that came in last year and the adjustments to income tax relief expected in April this year would have any impact on the buy-to-let market, either positive or negative.

Meanwhile, with Article 50 still yet to be triggered there is no clearer picture as to what a so-called ‘Brexit’ will look like.

BTL products

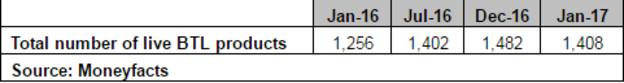

But according to the Moneyfacts UK Mortgage Trends Treasury Report there was a significant drop in the number of buy-to-let mortgage products in December, with 74 deals having been withdrawn from the market in one month – the largest reduction in product numbers since March 2009.

Charlotte Nelson, finance expert at Moneyfacts, observes: "Usually, the month of December is quiet, with providers gearing up for the holidays. This time, however, the BTL market has seen a surge of activity, with the number of BTL products falling back to July 2016’s levels.

"Withdrawals have not been limited to just a few providers, either, with the reductions having been spread across the board."

Is this a direct result of the taxation changes or something else behind the fast-reducing number of mortgage products?

Ms Nelson suggests: “With tougher affordability rules having come into play on 1 January and more changes due in September it is no wonder the BTL market has taken a hit. With the new rules reducing the amounts landlords will be able to borrow, it is little wonder that the 75 per cent loan-to-value sector has seen the largest reduction in product numbers, falling from 606 to 540 in just one month.

“Alongside tougher affordability, major changes to the way in which income from property rentals is taxed will be coming in April. Lenders are perhaps withdrawing products to get back to just their ‘core’ range in an attempt to wait and see what other providers will be doing in the run up to April.”

She has few words of comfort for the buy-to-let market, warning 2017 will be an “uncertain year”, and one which “could be a lethal cocktail for landlords”.

Donna Hopton, a director at Cherry, agrees the tweaks to tax have been somewhat life-changing for the buy-to-let industry.

“Taxation policy and in particular the government’s attitude to landlords, particularly individuals, is thought by many advisers to have had a landmark effect across the whole industry,” she remarks. “There has been an immediate impact on the market but moreover it is believed that this will continue to be very damaging to the market itself, as well as to key stakeholders, tenants in particular, for years to come.”

Rent increases

One of the expected side-effects of the government changes to buy-to-let is an increase in rent as landlords try to meet additional costs. If this were to happen, there is certainly no easy solution.

As John Heron, managing director at Paragon Mortgages, points out: “The major issue with this is that a reduced supply of property to the private rented sector isn’t going to be matched by a drop in tenant demand.

“The UK has a chronic undersupply of housing generally, meaning house prices are high and it is not the case that those who are struggling to find a home to rent will suddenly be able to purchase a house as an alternative.”

He adds: “In fact, by putting financial pressure on landlords, and hence on tenants, recent policy is likely to disrupt many of those saving to own their own home.”

Mr Heron calls for a long-term coordinated housing policy that improves supply across all tenures in place of what he sees as the “piece-meal changes” that have come in.

Despite the more doom laden predictions from some corners of the industry, gross lending of £240bn was predicted in the mortgage market last year and is likely to remain flat rather than fall in 2017, according to Jane Benjamin, head of relationship management at Sesame Bankhall Group.

Robert Sinclair, chief executive at the Association of Mortgage Intermediaries, notes that while the buy-to-let purchase market has cooled, the remortgage market has picked up, “to provide a compensating stream of business”.

He predicts: “Those who went down the let-to-buy route are likely to look to offload over the next 18 months as the tax changes impact on return and rents will not cover costs if they are higher rate tax payers.”

Braced for Brexit

While the tax changes are a direct hit on the buy-to-let market in the UK, the impact of Brexit is a lesser known quantity, in part because no-one is sure of the terms under which Britain will leave the EU.

Ms Benjamin suggests: “Despite 2016 being a politically and economically eventful year most brokers said they experienced a rise in business volumes, with more mortgage completions in 2016 compared to 2015.”

She recalls the outcome of the referendum and the Bank of England’s base rate cut to 0.25 per cent in response to Brexit “jitters” was all expected to have a detrimental impact on the mortgage market and customer confidence. But she points out one industry poll which found the majority of brokers had instead seen an increase in mortgage applications during the year.

There is yet more evidence the UK buy-to-let market has remained in apparently good health in the face of a hugely uncertain economic backdrop.

“The mortgage market has proved to be resilient and we’re still seeing growth in house price inflation, with the recent Halifax House Price Index announcement of a 6.5 per cent increase in house prices in the past 12 months,” Keith Street, vice chairman, group lending at The Northview Group explains.

“Coupled with robust mortgage lending through 2016, the market in general has held up well in a time of continued uncertainty,” he adds.

Regulatory scrutiny

But Paul Shearman, proposition director – mortgages, protection and GI at Openwork, strikes a far more cautious tone when discussing the impact Brexit and the other tax changes will have on what has been up until now a buoyant market.

He points out: “Following [the vote for] Brexit, interest rate movements remain uncertain, and as we await the UK to officially exit the European Union there remains a real possibility that the Bank of England could move rates down to 10 basis points in an effort to stabilise the economy and boost growth.

“More broadly, it feels like the buy-to-let market is now coming under closer scrutiny from the regulator and the government.”

He notes: “Lenders are now increasing their income cover ratios in response to the Prudential Regulation Authority’s tougher underwriting standards, and landlords may find it tougher to find a deal when their current one expires.”

eleanor.duncan@ft.com