The coronavirus crisis will push advisers to focus on more specialist areas as new ways of working remove geographical barriers and regulation furthers client segmentation, experts have predicted.

Barry Neilson, chief customer officer at Nucleus, told FTAdviser the combination of advice firms searching for profitability, the crisis prompting new ‘distanced’ ways of working and product development requirements forcing advisers to adjust their client segmentation would result in advisers specialising into increasingly niche areas of advice.

He said: “We are definitely in a world now in which advisers are in a position where they are empowered to know their client characteristics, and it is inevitable more advisers will specialise in various aspects.

“If we are living in a world with Zoom, it does not matter if the client is five miles or 500 miles away. Geography will reduce as a selection criteria and advisers’ ability to demonstrate experience or expertise in an area will be more important.”

Nucleus’ 2020 Census, published today (June 29), showed advisers were already actively considering reducing the number of face-to-face meetings with clients even before the pandemic struck.

The wrap-platform polled 180 of its users at the end of last year and found 30 per cent were exploring alternatives to traditional advice, up from 25 per cent the year before.

Mr Neilson said: “Like a baby bird being pushed out its nest, Covid-19 has forced everyone to quickly adopt, and become comfortable with, video conferencing and this is likely to play a substantial role in the client communication mix.

“This opens up exciting opportunities for financial planners to move beyond the clients that are easily geographically accessible and seek out clients that have a requirement for their specialisms, irrespective of their location.”

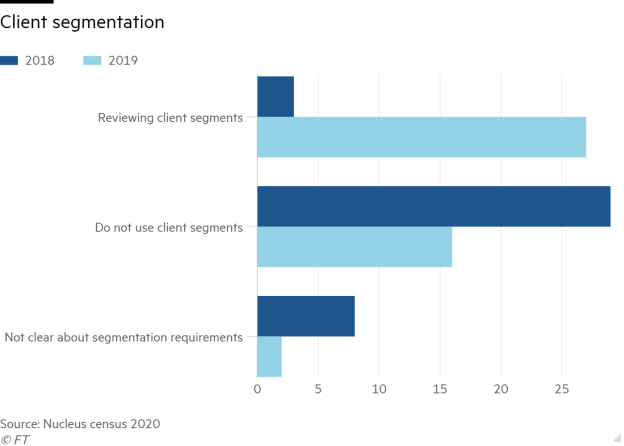

The Nucleus census also showed advisers were becoming more aware of their clients' different needs.

Some 27 per cent of advisers polled were in the process of reviewing their client segments, compared to 3 per cent the year before, while the proportion of advisers not using client segmentation dropped from 29 per cent to 16 per cent.

The percentage of advisers unclear about client segmentation requirements fell from 8 per cent in 2018 to just 2 per cent in 2019.

Mr Neilson said: “Clients need sustainable, profitable businesses. If increased client segmentation leads to them finding they have elements of client segments that are no longer a good fit for their proposition, it is entirely appropriate for advisers to focus on the clients that are good for the firm.”

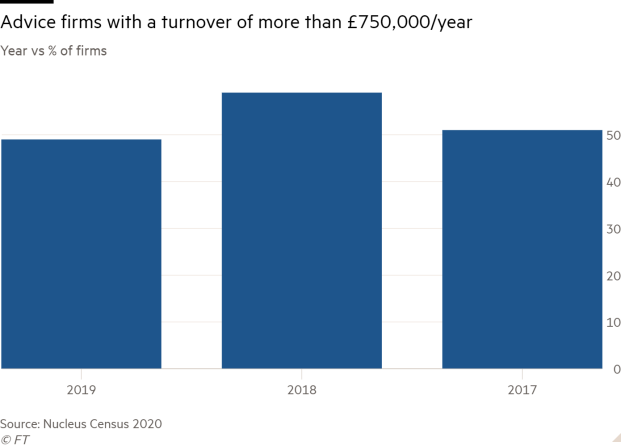

The research showed the number of adviser firms with a gross turnover of more than £750,000 had dropped to 49 per cent in 2019, compared to 59 per cent in 2018 and 51 per cent in 2017.

Clare Farrell, managing director at advice firm Northfield Wealth, said: “At the moment, we’re a well-known local firm, but the current environment suggests there’s nothing stopping us from appealing to more of a national audience. That’s really exciting.

“This crisis has shown you can literally work from anywhere in the world. So I think a bit of both remote working and office working is going to work for us as a business.”

Nick Platt, managing director at Henwood Court Financial Planning, agreed: “It removes any geographical barriers for clients and potential clients. We could have clients in the Shetland Islands now that we could quite easily service.”

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.