Europe has had a long road to recovery since the financial crisis of 2007-08.

It has spent years being spurned by UK investors who found better investment opportunities elsewhere, whether that was in the UK, US, Japan or even in the emerging markets.

But recently the tide has turned and investor sentiment towards Europe has been improving.

Net retail sales of the Europe ex UK sector gathered by the Investment Association show this changing investor sentiment in quite stark terms.

There were significant outflows from this sector between September 2016 to January this year, with retail sales down -£341m in the first month of 2017.

Then from February until September this year net retail sales of the same sector have been positive, reaching £507m in August and dropping only slightly to £489m the following month.

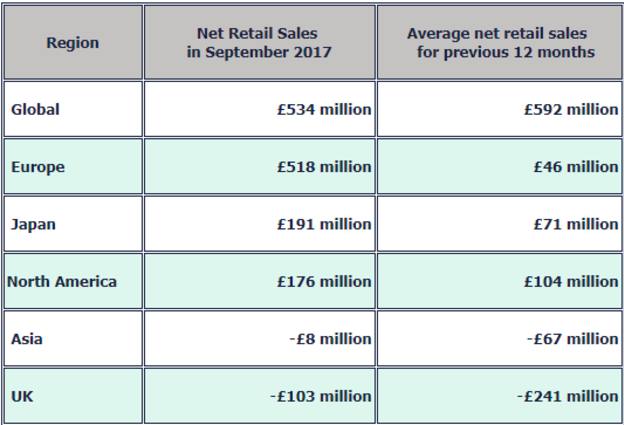

European equity funds were the second bestselling equity funds by region in September, with net retail sales of £518m, the same data set shows.

Figure 1: Net retail sales of equity funds by region

Source: Investment Association

Held back

Chris Hiorns, manager of the Amity European fund at EdenTree Investment Management, acknowledges the recovery in the region is long since due.

“Clearly, it’s the last of the major economies to recover after the credit crisis,” he observes. “We had a recovery fairly early on in the US which was meant to be the centre of the credit crisis, I think the UK followed more recently.

“Even Japan has managed to manufacture some growth there by very active policies.”

But he admits: “Europe really didn’t pursue those policies. It pursued policies not only of austerity from a fiscal point of view, but also it failed to carry out the same sort of monetary stimulus that occurred in the US, UK and Japan at a later stage.”

In fact, Europe was being held back by multiple recessions, according to Graham Bishop, an investment director at Heartwood Investment Management, who recalls the eurozone fell back into recession as recently as 2012.

Mr Hiorns says: “We had an abortive attempt to tighten monetary policy back, I think, in about 2011-12 and it was only more recently the ECB [European Central Bank] has had very active monetary stimulus, with quantitative easing – certainly a lot later than the other major economies, so this meant the recovery was deferred.

“Now I think it’s quite clearly underway.”

Europe has always been the last remaining recovery market, points out James Rutherford, co-head of investments for European equities at Hermes Investment Management.

He explains: “Europe, from a fundamental viewpoint and earnings viewpoint, has disappointed in its delivery for 10 years.

“I think if you look back over those 10 years, we always start the year, and the analysts all look for, about 10-15 per cent earnings growth and we don’t make it much past Easter before those expectations start falling again. For a number of years the expectations have gone from 10-15 per cent, and by the end of the year, they’re zero or slightly negative.”