PARTNER CONTENT by GRAVIS

This content was paid for and produced by GRAVIS

The early entrant renewable energy companies are already very substantial. They have relatively simple business models and throughout this troubled year they have remained largely unaffected by the market turmoil brought on by the ravages of Covid-19. But to invest globally takes great skill and knowledge of the underlying issues that drive prices and valuations. So, over the next five weeks, Will Argent, Fund Adviser to the VT Gravis Clean Energy Income Fund, will explore five aspects underpinning the renewable energy sector and broader decarbonisation theme.

The areas to be covered are as follows:

- Power Purchase Agreements (PPAs)

- Power Prices

- Energy Efficiency

- Storage Market

- Macro view and expectations for the future

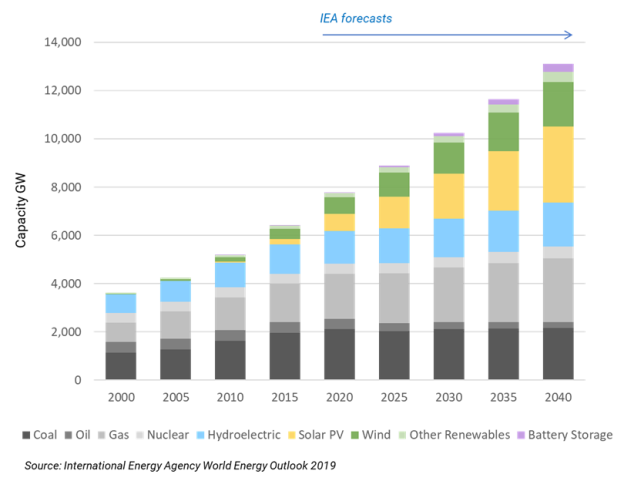

Forecasters at the International Energy Agency (IEA) anticipate that over the next 20 years $10 trillion will be invested in renewable assets. In the shorter term, by 2024, the IEA expects new capacity installations to bring renewable power to 200m homes around the world.

To encourage institutional investors with these vast sums at their disposal, long term and detailed financial planning is required. The sector has developed a simple pricing model which provides renewable energy companies with an element of predictability for the value of the electricity they generate. In North America in particular, renewable energy companies negotiate long term contracts with utility companies (and increasingly, large corporates) through which a pre-determined price is agreed. Both parties are able to determine with some accuracy their long term revenues and costs. These contracts are known as Power Purchase Agreements (PPA’s), which, as the name suggests, are agreements between two parties for the sale of electricity at an agreed price for an agreed and often lengthy period of time.

For other parts of the world, considerable time and effort has been expended predicting power pricing and the trends to which the sector is exposed. Electricity prices are usually linked to the prevailing and forecast price of gas, which fluctuate depending upon economic activity. Over the last year, electricity price expectations have been under pressure particularly in the early stages of the pandemic, although more recently demand and prices have started to firm up.

Whilst we know that there will always be a market for clean electricity, it isn’t always possible to forecast how much is likely to be generated and when, dependent as it is on the weather. A sunny, but breezy day in mid-summer can lead to a huge oversupply when we least need it. In order to harness the increase in intermittent renewable energy production, a new and logical market in industrial batteries has developed in recent years. These batteries enable generators to store excess electricity, before releasing it back into the Grid when generation is below requirements.

Sadly, and like the rest of the world, the UK wastes over 50% of the electricity it generates. The wastage occurs as a result of inefficient transmission, from generator to consumer, as well as during consumption. In the case of fossil fuels, a significant amount of the energy generated is used to aid the burning of yet more fuel. Energy efficiency has recently come into focus, and with numerous areas of the economy required to improve credentials in this regard – as well as the commercial incentive to reduce costs and wastage – we expect to see an increase in capital flowing to the energy efficiency sub-sector.

There are many opportunities for investors to participate in the rapidly growing renewable energy sector. The foundations are in place for the wall of money being pumped into the sector to increase significantly, and investors are now able to access this theme in its early stages whilst there are still attractive returns to be had.

To conclude, the subsequent five articles by Will Argent will cover some of the aspects and themes we consider to be key, and which lie behind the strategy of the VT Gravis Clean Energy Income Fund. We hope you find them of value and interest.

For more information on the VT Gravis Clean Energy Income Fund please visit our website.

William MacLeod,

Managing Director, Gravis Advisory Limited

Past performance is not necessarily a guide to future performance. The value of your investment may go down as well as up.

Find out more