PARTNER CONTENT by GRAVIS

This content was paid for and produced by GRAVIS

For companies that own renewable energy assets with long-term fixed/known price Power Purchase Agreements (PPAs) for the electricity they generate, there is very little/no sensitivity to fluctuations in power price expectations, as cash flows are linked to a pre-determined price. Such arrangements appear frequently in North American renewables projects where contracts can be >15 years in length.

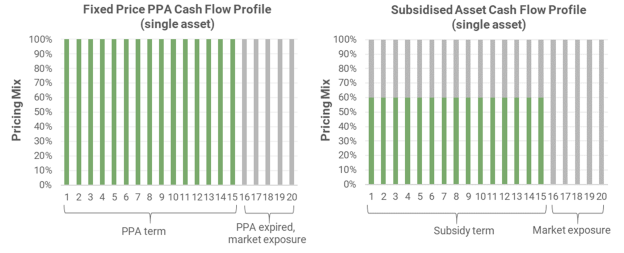

Where PPA markets are less developed, such as the UK, the build-out of renewable energy capacity has been aided by subsidies that provide some certainty for the cash flows which incentivises developers to commit to a project. For example, the Renewables Energy Certificate, Feed-In Tariff and Contract for Difference schemes, used in the UK, Europe and Australia, assisted by facilitating a payment to the generator per unit of electricity produced, or by providing pricing certainty for the expected output from an asset over a 15-year time horizon (or longer). Although, there remains uncertainty as long-range forecasting is difficult and can lead to inaccuracies.

Example of simplified cash flow profiles for single renewable energy asset (fictional) under long-term fixed PPA and subsidy basis

The ‘value’ of assets developed without any form of certainty to the cash flows are highly sensitive to movements in near-term electricity prices and long-term price projections. Now renewable energy technologies are geographically widespread and cost-competitive with conventional forms of electricity generation, the construction of new, unsubsidised assets is increasing. The asset owner must be prepared to take on material uncertainty for future cash flows. However, that risk may be considered acceptable: it is widely anticipated that society will become increasingly reliant on electricity, e.g. through the electrification of transport and heat, and increasing digitalisation – the International Energy Agency forecasts annual demand growth of c.2% per annum between now and 2040, price increases in real terms over coming decades.

Renewable energy assets located in different geographies, where subsidies differ, or assets that are of varying ‘vintage’, since subsidy schemes have adjusted over time, will typically have different cash flow profiles due to the underlying mix of fixed and merchant price exposure. Companies that own diversified portfolios of renewable energy assets (by geography, technology and vintage) will have a unique blend of cash flows and varying degrees of sensitivity to assumptions relating to power prices.

Near term cash flow mix (1 year view):

Since asset valuations are calculated by discounting future cash flow expectations, a higher exposure to merchant power prices results in valuations having greater sensitivity to movements in price projections – both near-term and long-term. We see this in the net asset valuations reported by UK-listed renewables companies on a quarterly basis, which incorporate the latest long-term pricing projections from energy consultancies. The table above provides three company examples which demonstrate varying exposures to fixed pricing and resulting merchant power price sensitivity.

Over the last year or so, electricity price forecasts have been under pressure. On the supply side, a general oversupply of oil and natural gas has weakened pricing (electricity prices are still somewhat linked to the trajectory of gas prices) while on the demand side, the Coronavirus pandemic and resultant cessation of economic activity meant that demand fell sharply during March and through Q2 2020, compounding the price weakness.

Nevertheless, we have observed a sharp improvement in pricing in Europe and the UK since the April/May lows, with spot prices moving beyond pre-pandemic levels in many areas. Moreover, futures prices have firmed significantly and while futures markets may only ‘go out’ a few years in key markets, this improvement is of importance. If renewable energy companies value future cash flows based on energy consultancies’ price forecasts and those forecasts are at odds with the reality of what may be presently achieved, as we see now, then the challenges and inaccuracies resulting from using long-term price forecasts to drive asset valuations becomes apparent. For example, if a renewable energy generator removes its price risk for anticipated output in two years’ time by locking in prices via a short-term PPA or through futures markets, then any subsequent change in pricing forecasts for that period becomes irrelevant.

The owners of portfolios of renewable energy will typically have energy trading teams seeking to lock in attractive prices at opportune moments. The chart below illustrates the movements in UK electricity price futures (December contracts) over one year. Extracting the December 2021 contract, we can see a significant improvement in the price from the nadir in March 2020 to the end of September 2020. Current valuations will still be factoring in prices for 2021 that incorporate futures prices from earlier this year, whereas trading teams could be locking in prices for power output in late 2021 at rates some 20% higher. This demonstrates the potential for significant divergence between prices that are factored into valuations from period to period and what is ultimately achieved.

It appears reasonable to anticipate that recent improvements in electricity pricing across the UK and Europe will have a positive impact on asset valuations once incorporated into future cash flow expectations. While very long-term expectations may be relatively unchanged, if not softer, the disproportionate impact of near-term cash flows on the discounted cash flow model is likely to dominate.

One region where pricing has not rebounded strongly as economies have begun to ‘open up’ is Scandinavia. A wet, mild winter meant hydro balances were high going into 2020, while lower demand caused by lockdown meant supply has been easy and price recovery has been slower. Regional factors will ordinarily drive different electricity price dynamics at any given time in different markets, contrasting recent months, where the pandemic has had a homogenous, overarching impact on demand and pricing. In addition, the level of interconnection between two geographic energy markets will impact how correlated electricity prices are in those markets. For example, the correlation between electricity pricing in Scandinavia and Iberia is close to zero with very limited interconnection between the two markets. Therefore, geographic diversification will typically be beneficial in reducing price risk for a mixed portfolio of renewable energy assets.

The VT Gravis Clean Energy Income Fund is well positioned to withstand volatility in long-term electricity price forecasts as a result of its diversified portfolio, which is exposed to companies that own renewable energy assets across a range of geographies, technologies, and contractual counterparties, in addition to a significant bias towards fixed/known revenue streams as opposed to merchant price exposure.

William Argent, Director

Fund Adviser, VT Gravis Clean Energy Income Fund

Past performance is not necessarily a guide to future performance. The value of your investment may go down as well as up

Find out more