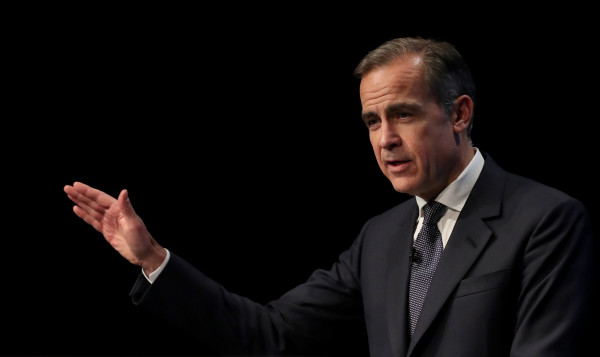

The governor of the Bank of England made these comments while addressing the Scottish Economics Conference at Edinburgh University this morning (2 March).

Mr Carney said the economist Adam Smith said money was defined as a store of value, a medium of exchange and a unit of account.

He said: "The long, charitable answer is that cryptocurrencies act as money, at best, only for some people and to a limited extent, and even then only in parallel with the traditional currencies of the users. The short answer is they are failing."

He said regulators would now need to decide whether to "isolate, regulate or integrate" cryptocurrencies and their associated activities.

Cryptocurrencies are currently banned in Bangladesh, Bolivia, Ecuador and Morocco while China has recently banned exchanges, financial institutions and payment processors from handling them.

But Mr Carney said: "If widely adopted, however, isolation risks foregoing potentially major opportunities from the development of the underlying payments technologies.

"A better path would be to regulate elements of the crypto-asset ecosystem to combat illicit activities, promote market integrity, and protect the safety and soundness of the financial system.

"The time has come to hold the crypto-asset ecosystem to the same standards as the rest of the financial system. Being part of the financial system brings enormous privileges, but with them great responsibilities."

In September the Financial Conduct Authority raised concerns about virtual currencies such as Bitcoin, saying investors should be prepared to lose all their money.

One bitcoin is currently worth £7,883 but it's price has proved to be volatile in recent months, reaching nearly £15,000 late last year.

At the start of 2017 one bitcoin was worth £745.

Mr Carney said: "Over the past five years, the daily standard deviation of bitcoin was ten times that of sterling. Consider that if you had taken out a £1,000 student loan in bitcoin in last December to pay your sterling living costs for next year, you’d be short about £500 right now.

"If you’d done the same last September, you’d be ahead by £2,000. That’s quite a lottery. And bitcoin is one of the more stable cryptocurrencies.

"Indeed, the average volatility of the top 10 cryptocurrencies by market capitalisation was more than 25 times that of the US equities market in 2017.

"This extreme volatility reflects in part that cryptocurrencies have neither intrinsic value nor any external backing. Their worth rests on beliefs regarding their future supply and demand - ultimately whether they will be successful as money.

"Thus far, however, rather than such a sober assessment of future prospects, the prices of many cryptocurrencies have exhibited the classic hallmarks of bubbles including new paradigm justifications, broadening retail enthusiasm and extrapolative price expectations reliant in part on finding the greater fool."

Mr Carney said it was not clear the extent to which cryptocurrencies would ever become effective media of exchange.

He said: "Currently, no major high street or online retailer accepts Bitcoin as payment in the UK, and only a handful of the top 500 US online retailers do. For those who can find someone willing to accept payment for goods and services in cryptocurrencies, the speed and cost of the transaction varies but it is generally slower and more expensive than payments in sterling.

"That’s because the more heavily used cryptocurrencies face severe capacity constraints.

"For example, Visa can process up to 65,000 transactions per second globally against just 7 per second for Bitcoin. And if you use a debit or credit card in the UK, the transaction is completed in seconds and without exchange rate risk. In contrast, Bitcoin users can face queues of hours."

In September the rapid rise in bitcoin's value led the vice-president of the European Central Bank Vitor Constancio to compare it to the "tulipmania" of the 17th century, generally considered the first speculative bubble.

Meanwhile Jamie Dimon, chief executive of JP Morgan has called the virtual currency a fraud and said those who invest in it were "stupid".

Richard Turnill, global chief investment strategist at BlackRock said bitcoin could become mainstream in future years, but it is a long way from that point right now.

David Scott, an adviser at Andrews Gwynne in Leeds, said if equity markets are viewed as being in a bubble because the valuations bare no relation to the cash flow generated by the companies, then bitcoin must be an extreme case because it has no cashflow to back it up.

david.thorpe@ft.com