PARTNER CONTENT by JUST

This content was paid for and produced by JUST

The complexities of ensuring that retirement funds last a lifetime has become a central focus for many people.

Having the freedom to access pension funds has led to a seismic shift in purchasing behaviour, with many people remaining in drawdown when they would have previously chosen guaranteed income (GIfL) provided by an annuity.

However, how many truly understand that by remaining invested they also continue to assume all of the risks, particularly longevity. Is it time to reconsider how GIfL can work as part of a retirement portfolio when income is needed?

Chasing a Sustainable Withdrawal Rate

Given the sheer volume of money that has been pouring into drawdown and platforms since pension freedoms, it won’t be too long before the pent-up demand for income starts to manifest itself. Clients will be looking to advisers to provide a decumulation strategy that enables them to withdraw the level of income they choose, allowing for capacity for loss and ensuring the funds will never run out.

This is a tall order when you consider that often there is an expectation that the invested retirement fund will be able to provide all of this. But should it?

Annuities have long been the product of choice if a client had no capacity for loss and that they are only worth buying when the client is ‘old enough’.This is where the thinking needs to be updated.

What we have now is the ability to provide a personalised rate based on the specific circumstances of the individual, so for example, height and weight, postcode, marital status, and the amount someone drinks. An individual doesn’t need to be ill to get an increased rate.

So why is this important? Because it fits into the puzzle of sustainable withdrawal rates.

Every client that switches on income from their drawdown plan will have their own idea on how much they need. But what happens if they really need 5%, but can only sustainably withdraw 3.5%?

Let’s look at three different retirees, using a range of health and lifestyle conditions*.

The rates for a healthy 65 year old (averaged from December 2017 to May 2018) show that they can achieve a lifetime income rate of over 5%.

This tells us it’s time to start looking at GIfL based on the income rate the client can achieve rather than their age.

To blend or not to blend?

Let’s address the obvious objection; the capital used to purchase GIfL means not only disinvesting, but is ‘lost’ if the client dies early.

The capital never has to be ‘lost’, as GIfL can include death benefit options built into annuities. The tax treatment is the same as drawdown. So the argument that the money has to die with the annuitant is no longer valid. The income figure would be slightly lower however, as this reflects the cost of the benefit.

As for disinvesting drawdown funds, there is an argument that if the client requires provision of income for the next 30 years, then a significant portion of capital would have to be earmarked anyway.

Of course, there are many ways to generate income solely from an invested portfolio, for example:

- Natural yield – Retirees match off investment returns against their income needs. But a poor run of investment returns could mean lower income or capital erosion.

- Moving to more cautious funds – Assigning tranches of capital into more cautious assets to provide income over a set number of years. However, many of these funds still fluctuate in value.

Blending is more than just finding a good rate, it’s about shifting risks for the retiree. If GIfL is treated as a ‘pseudo asset’, it’s the only vehicle that can meet both of those requirements.

True blending for a personalised solution

There are two areas for consideration; the impact on the remaining capital, and the effect on the sustainable withdrawal rate.

By securing an underpin of guaranteed income, the retiree (and adviser) are able to rebalance the remaining equities, incorporating the GIFL as part of the portfolio.

The real question though is whether this provides an income rate for the retiree that is sustainable for the rest of their life. To do this, we can look at replacing the bonds element of an example portfolio with a GIfL.

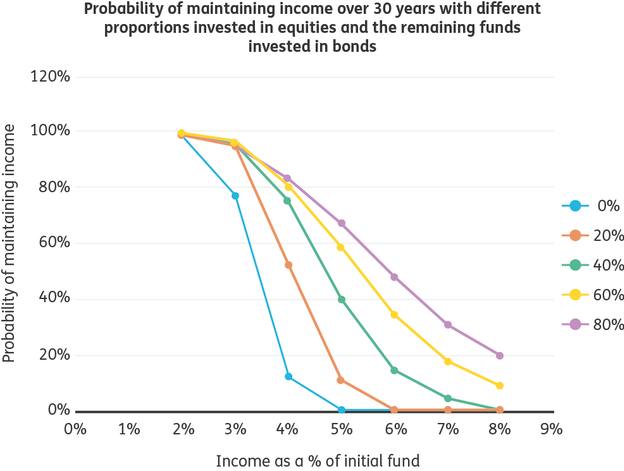

In chart 1, we have stochastically modelled the probability of maintaining income over a 30 year period.

This is based on a balanced set of equities, and investment grade bonds.

Chart 1

his shows that the higher the level of income taken, the probability of sustaining it changes in accordance with the mix of equities and bonds held. If the portfolio has 40% equities and 60% bonds, there is a 40% chance of maintaining income at 5% over 30 years. This also reflects the results shown by Morningstar in their recent paper, so shows consistency in results.

If 60% equities and 40% bonds is used, then the probability moves to 60% chance of success of delivering 5% income sustainably.

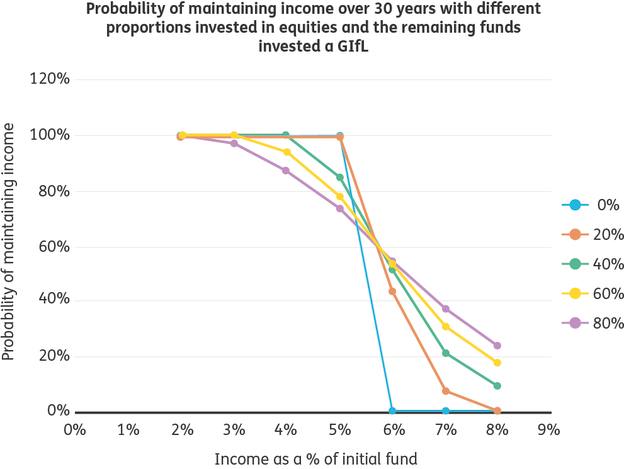

Now taking it a step further, what happens when we strip out the bonds element, and replace it with a GIfL. This example assumes 65 year old in ‘reasonable’ health, which generates an income rate of 5.8%, and uses the same stochastic simulations.

Chart 2

Now we can see that the curves have shifted to the right. If we examine the 40% equity holding again, then the probability of sustaining 5% income has increased from 40% in the previous chart to 84.9%. (To clarify, the 0% equity holding will fall away from 100% probability to 0% after the 5.8% income level, as this is would be the rate of income paid under the GIfL).

Looking at a higher equity content of 60%, the probability of sustaining 5% income is pushed up from 60% to just under 80%. Using GIfL even at higher withdrawal rates, still increases the probability of maintaining income, as the volatility found in bond funds, as well as the chance of a negative return has been removed.

Summary

When it comes to providing a sustainable withdrawal rate, treating GIfL as a guaranteed asset class shows that blending works.

The risk dynamic is shifted, allowing the retiree to chase after growth with the remaining equity. Not only does it meet the sustainable withdrawal rate conundrum, but it also provides a measure of capacity for loss protection.

It is inevitable that there will be a market correction at some point, and blending in this way will help to mitigate some of the downside, while providing longevity hedging.

Tony Clark, Proposition Marketing Manager.

*Based on an individual with a fund value of £100,000. An annuity being payable monthly in advance, no dependant’s pension, no escalation, 10 year guarantee period, no value protection. Rates cover December 2017 to May 2018

Healthy Life - post code only. Respiratory - COPD diagnosed 13 years ago, lung function minimally impaired, hospitalised two years ago, takes one medication. Diabetes Type 2 - diagnosed nine years ago, one medication taken daily, HbA1c readings provided, monitors blood glucose levels once a day.

For more information visit our website

‘This is a Just Paid Post. The news and editorial staff of the Financial Times had no role in its preparation’

Find out more