So we should not necessarily fear either interest rate or balance sheet normalisation.

However, quantitative tightening is likely to result in higher volatility. And companies, or governments, who have taken on too much leverage in the period of low interest rates, are likely to be left exposed.

In 2008, confronted with the worst financial crisis since the 1930s, the US Federal Reserve decided to deploy an unconventional monetary tool: quantitative easing.

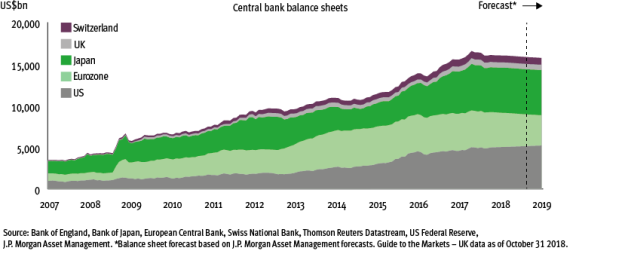

In the years that followed, central banks in the UK, Switzerland and eventually the eurozone all took similar measures, contributing to total monetary stimulus (including purchases by the Bank of Japan) to the global economy and its financial markets that has now reached $16tn (£12.5tn).

QE was designed to encourage investors to search for yield. By increasing demand for riskier assets such as corporate bonds, this lowered borrowing costs when the economy – and tax receipts and profits – were weak.

We estimate QE programmes lowered the US government’s 10-year borrowing costs by approximately 100 basis points. Lower risk-free rates led to lower discount rates, which partially helped equity markets and encouraged investors to look further out on the risk and maturity spectrum to obtain extra yield.

Key Points

- We are entering a period of monetary tightening as the global economy is strengthening

- Other central banks may follow the Fed's move of raising interest rates in December 2015

- Investors may wish to consider focusing on sectors and styles that are positively correlated with higher interest rates

QE calms waters

QE served to compress yields, but most likely also suppressed volatility.

The European sovereign market is a clear example of this. When the European Central Bank was an active buyer in European sovereign bond markets, investors were to a large degree insulated from political noise.

In contrast, the election of a new populist government in Italy coincided with the tapering of the ECB’s QE programme, resulting in considerable volatility in the Italian bond market this year. In short, central banks are no longer actively ‘buying the dips’.

Given that the economy is now normalising, it is perfectly sensible for central banks to begin the process of normalising both interest rates and balance sheets, or quantitative tightening. Furthermore, the process is expected to be very gradual.

Quantitative tightening

The Fed started to raise interest rates in December 2015, and it has not led to meaningfully higher interest rates, nor a significant tightening of financial conditions in the US economy.

The Fed has benefited from a first-mover advantage, but as inflation and growth normalise elsewhere, other central banks may follow suit – also at a very gradual pace.

The ECB has announced it will put an end to net asset purchases at the end of 2018 and that rates are not likely to increase until at least the summer of 2019.

QT will cause debt servicing costs to increase for both governments and companies, but this should coincide with higher earnings. However, the process will not be easy or seamless if too much debt was accumulated in the period of low interest rates.

As Warren Buffett said: “Only when the tide goes out do you discover who has been swimming naked.”

So it is worth investors screening their portfolios to ensure they have not taken on unacceptable risk in the search for yield, and that the assets in their portfolios have sustainable amounts of leverage.

Some emerging economies, in particular, did take on too much leverage in the period of low interest rates and are now vulnerable to rising debt servicing costs.

Turkey and Argentina are prime examples, and their markets have accordingly come under pressure over the course of 2018.

While some nations in the emerging world may still be hurt by higher yields, it is important to remember that not all emerging markets are the same. Some of these nations learned the lessons of the taper tantrum in 2013 and have since reduced their external vulnerabilities.

In fact, many of the Asian economies have seen their current account balances improve and have reduced external debt, which means they should be much better prepared to cope with rising interest rates.

High price of bonds

For fixed income investors, it will be more challenging to find positive returns in the form of increasing bond prices due to falling yields, given that QT should lead to higher yields. It is therefore important to think in terms of total return, rather than just price return.

Within credit markets, investors will need to be particularly vigilant, as some pockets of the market, such as US investment grade, have seen a deterioration in their fundamentals. As it stands, almost 50 per cent of the US IG benchmark index is made up of bonds with the lowest credit rating that permitstheir inclusion.

With more investors now exposed to riskier credit markets as a result of QE and the search for yield, we need to think about whether we have taken on a much higher degree of liquidity risk.

The impact of QT on equity markets will depend on the extent to which corporate earnings increase alongside interest rates. A faltering economy is a more direct threat than the removal of monetary stimulus.

However, investors may wish to consider focusing on sectors and styles that are positively correlated with higher interest rates, such as the banking sector and the value style, and look to avoid those with more extended valuations, such as growth.

QT is not something to fear necessarily, but as central banks begin to take away the punch bowl, there should be an increasing focus on quality assets – those without unsustainable levels of leverage – across the asset class spectrum.

Vincent Juvyns is global market strategist at JPMorgan Asset Management