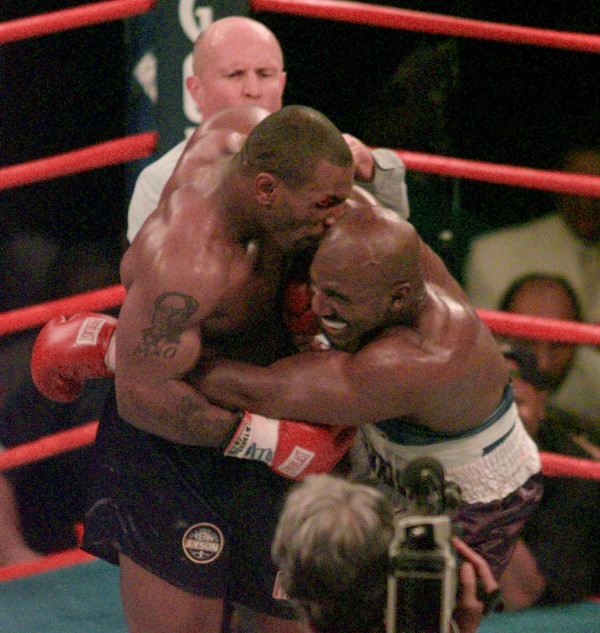

“Everyone has a plan 'till they get punched in the mouth.”

It is not often a quote by former heavyweight boxing champion of the world Mike Tyson is seen as either inspiration or educational - and it is even less common that it can be associated to behavioural finance.

Tyson was one of the hardest hitting heavyweights of all-time; however he was also one of the most controversial and emotional – which often led to his downfall.

This week’s Best in Class looks to target emotion - by using the irrationality attached to emotional decisions - to find pockets of value and invest against the herd.

The M&G Episode Income fund has been managed by Steven Andrew since its launch in 2010.

Mr Andrew joined M&G in 2005, initially as a member of the portfolio strategy and risk team, and his CV includes the likes of F&C Asset Management, Merrill Lynch and the Bank of England.

The fund’s investment process has been designed to prevent the manager falling victim to behavioural biases, and the cornerstone of the process is to establish which income-generating assets currently appear attractively or unattractively priced and why.

Mr Andrew assesses what he would consider to be fair value for a wide range of assets around the world in light of historical expected return, economic theories and investors’ preferences for each asset class.

He calls this ‘neutrality’. He then compares this neutrality with the real yield of these assets to create his valuation framework.

If the valuation stage identifies that certain assets are under- or over-priced, Mr Andrew seeks to identify why.

There may be a valid reason for the price move, or it could be due to human behavioural factors. The team identifies three factors that can help to recognise a behavioural event.

The first is too much focus on a single story, meaning when market participants draw their attention to a specific event and disregard other information.

Secondly, when there are inconsistent responses as the market behaves differently from the manner suggested by economic developments.

Thirdly, any rapid price movement of any asset class, either up or downwards, suggests an ill-considered response.

Over the medium to long term, Mr Andrew would expect such mispricing to correct.

Therefore, these behaviourally driven episodes may create opportunities for investment.

A good example of the fund taking advantage of irrationality in the market in the past 12 months is within Japanese equities, currently the largest allocation in the portfolio (13.4 per cent).

Mr Andrew says Japanese equities have been strongly correlated with European equities and selling off in bouts where the market would appear to worry about growth and the fragility in Europe - without focusing on the positive earnings data in Japan.

“The market is beating us up here but what’s changed in fact rather than emotion? If markets are offering us a heavily discounted asset, like equity, because of the fear of some unknown future, then we should be taking that on,” he says (quoted in FundCalibre in June 2019).

The fund is targeting a sustainable income over a multi-year period.

Mr Andrew achieves this by making asset allocation decisions at the portfolio level which make money, but also builds a portfolio of assets that steadily increases the income.

The fund’s diversification is highlighted in the bond quota - where it holds the likes of US treasuries as a risk-off safety asset, and a diversifying asset for equities.

The less mainstream government bond assets in overseas regions tend to have a shorter-term maturity, but are higher yielding - as well offering currency diversification and income.

In addition to equities (48.2 per cent) and bonds (40 per cent) the fund also has a small allocation to property (2.9 per cent), through the M&G Property fund.

The fund is top quartile over one, three- and five-year periods in the Investment Association Mixed Investment 20 per cent to 60 per cent shares sector.

Over the five-year time frame it has returned 35.5 per cent, compared with a sector average of 25.1 per cent.

It has an historic yield of 2.71 per cent and an ongoing charge of 0.8 per cent.

This is a unique multi-asset, income-orientated fund.

It has demonstrated its process works, while the frequency of income and relatively low volatility makes it a great option for those looking for a low risk income option.