Since the global financial crisis it has been a challenging time for income investors, having had to navigate a period of lower yields on traditional assets and deal with other structural changes in asset classes, company business models and investment themes.

As investors broaden their search for income, many have started to look towards alternative assets. For many years, property was the asset that dominated most investors’ alternatives allocation.

In recent years, however, the range of alternative investment options available to investors has expanded in size, depth and breadth and now encompasses a wide range of asset classes.

Key Points

- Many investors are looking to alternative assets for income

- Some of them are not very liquid

- Infrastructure holds good prospects

There are a number of real assets investors can gain exposure to, including various forms of real estate, infrastructure, commodities and renewable energy.

On top of that there are specialist credit and alternative fixed income offerings, as well as specialist macro, event-driven or long/short investment strategies that focus on a particular investment style or process.

Tackling new challenges

Once seen as a niche area, figures show the alternative investment industry has grown steadily in the past decade, rising from $3.1tn (£2.5tn) of global assets under management in 2008 to $10.3tn by June 2019, according to alternative asset specialists Preqin, and has been predicted to grow to around $14tn by 2023.

For many years, alternatives were the preserve of institutional or high-net-worth investors, but they are now moving into the retail mainstream, as individuals, confronted with volatile financial markets and retirement savings gaps, seek different sources of income and returns.

Investment managers have enabled this trend by making products more accessible, packaging alternative investment strategies into regulated mutual funds.

For the more illiquid and niche investment areas, accessibility has been improved through the use of investment trusts as a fund structure.

These closed-ended investment vehicles allow a broad range of investors to access otherwise unreachable investments, such as renewables, infrastructure or private equity, which are generally quite illiquid asset classes.

From an income point of view, the structure of an investment trust allows it the flexibility to build up income reserves that can help smooth income distributions. Open-ended funds do not have this capacity, which is why investment trusts have more impressive dividend track records.

Indeed, there are 21 investment trusts that have increased their dividends for 20 or more consecutive years, of which 12 have an equity income focus.

In periods where companies’ payouts come under pressure, these income reserves can be particularly valuable.

This was the case during the global financial crisis, and this feature should once again help support many trusts in the current environment given the swathe of dividend suspensions from so many businesses.

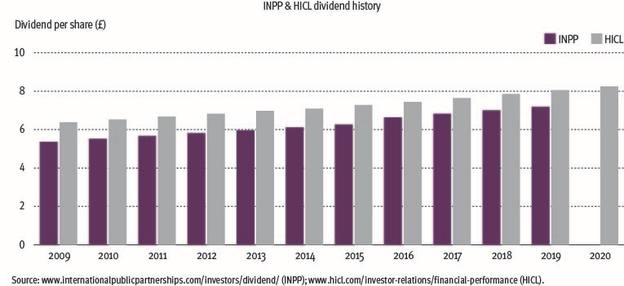

Two infrastructure investment trusts — HICL Infrastructure and International Public Partnerships — have also benefited from this structural advantage, and have increased their dividend payout every year for more than a decade.

Infrastructure is a growing area of interest for income investors, mainly because of the long-term sustainable income streams from projects that are often backed by governments.

This can include hospitals, schools or transport networks, all of which can be considered quite defensive, ‘real assets’, with revenues that are often inflation-linked in some way.

In the current environment as countries gradually ease lockdown restrictions, the ‘new normal’ we emerge into could see governments look to spend more on transport infrastructure to help with social distancing requirements, as well as placing an increased focus on hospitals and health services, and improved telecom and digital infrastructure to meet the increased demands of more people working remotely.

All of this could lead to an increase in the potential investment opportunities for this asset class.

Solar powered returns

In a similar vein, renewables could also be a strong candidate for those seeking sustainable income streams.

Most often associated with wind power or solar energy, these investments can share a number of characteristics with traditional utility investments, such as predictable revenue streams, and defensive and non-cyclical traits where they are less sensitive to changes in the economic cycle.

In addition, the global move towards tackling climate change — boosted by the consequences of the coronavirus shutdown that resulted in significant improvements in air quality — and the fall in prices as technology becomes cheaper and more sophisticated, may see governments expedite their decarbonisation strategies, providing further opportunities for investors.

Creating the right balance

However, while alternative investments offer many advantages to the income investor, there are also risks. Many of these assets, particularly infrastructure, renewables and property, are also relatively illiquid.

While investment trust wrappers provide more access to larger numbers of investors, they come with their own complexities, with share prices able to diverge from underlying asset valuations. It is therefore important to understand the drivers of this.

As we navigate the new post-coronavirus environment, there will inevitably be challenges to all asset classes in one form or another, but markets will continue to evolve to meet the income needs of investors and potential opportunities remain for those willing to seek them out.

Helen Bradshaw is an income portfolio manager at Quilter Investors TBC