Best in Class: Baillie Gifford Japanese Income Growth

While the eight year tenure of Shinzo Abe has ended, it seems many of his policies are set to continue under his successor Yoshihide Suga.

Mr Abe made many forward strides in his time as prime minister – not least his “three arrows” of Abenomics – namely aggressive monetary policy, fiscal consolidation and a growth strategy for the country.

A big impact of this strategy has been on the corporate governance side, such as improving cross-shareholding rules – in fact, shareholders are being treated better in general, with another important factor being the greater ability to pay dividends.

Japan, like most of Asia, has seldom been seen as an income opportunity – but it is very much a growing area.

For example, there was roughly 250 trillion yen on the corporate balance sheets of Japanese companies in 2018, with half of those companies in a net cash position. This allowed companies to pay dividends from the earnings and their cash pile, the result being a 10 per cent rise in payments that year.

The obvious question is: how has the pandemic impacted dividends? The answer is that while shareholder-pay-outs have seen their multi-year upward trajectory stop – dividends have actually been more resilient in Japan than other parts of the world.

Companies in Japan have long been criticised for hoarding too much cash – that might well be a shrewd decision in hindsight given the strength of their balance sheets.

Japanese pay-outs fell only 4.2 per cent to $37.7bn in the second quarter of 2020, down 3.1 per cent on an underlying basis. Contrast that with heavy falls in the UK (-54 per cent) and Europe (-44.5 per cent).

This resilience supports the argument that the environment is ideal for growth of dividend payments in Japan – and this week’s Best in Class is ideal for those looking to get in early.

The Baillie Gifford Japanese Income Growth fund is run by Matthew Brett and Karen See. Mr Brett joined the firm in 2003 and also manages the Baillie Gifford Japanese fund, while Ms See has been part of the broader Japanese equities team since 2012.

This fund has a bottom-up, growth focus with a long-term investment horizon. The fund looks for companies that have a sustainable competitive advantage, improving returns on capital and efficient balance sheets, to create a portfolio of growth companies but with a yield orientation.

Stocks will fall into one of four growth buckets: secular growth, growth stalwarts, special situations and cyclical growth.

Idea generation is organic, with inspiration coming from company meetings, regular investment trips to the region, trade fairs and a sharing of ideas across the wider global equities team.

The managers also have an independent researcher in Tokyo to investigate any specific rules and regulations around investment ideas.

These ideas then go through an analytical framework. Factors covered include industry background and the company's competitive advantage within it.

Considerations here include the industry growth rate, pricing structure, barriers to entry and the uniqueness of the product or service. Once these companies have been identified, the managers will look at their financial characteristics and the attitude of the management team.

The final consideration will be valuation. Broadly, the team believe it is better to find growth first rather than cheap companies. They will consider valuations relative to peers - looking at earnings, cashflow and returns.

The 45-65 stock portfolio has a mid-cap bias to accommodate the growth aspect of the strategy. Sectors where companies have no control over their pricing - such as oil & gas and mining – will be avoided.

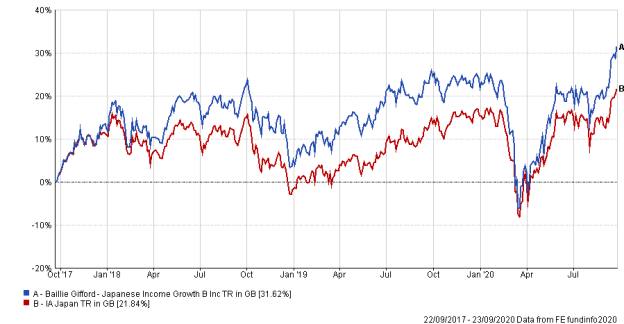

The fund has returned 57.4 per cent to investors since its launch in July 2016, compared with 45.6 per cent for the IA Japan sector average. It currently yields 2.4 per cent and has ongoing charges of 0.63 per cent.

This relatively new fund is ideally positioned to tap into the exciting change in dividend attitudes in Japan. The Baillie Gifford Japan team are widely regarded as one of the best around and this fund not only offers income diversification, but also access to a growing dividend story.

Darius McDermott is managing director of FundCalibre