These can lead to excessive weightings of certain strategies or a portfolio that expresses too many similar ideas, over-exposing it to particular risks.

In a crisis, when traditional correlations break down, it can come as a nasty surprise. This is where good portfolio construction shows its worth.

Effective portfolio construction aims to optimise risk-adjusted returns for a given set of constraints and to embed diversification and resilience into the investment process.

The quality of investment ideas and strategies remains paramount, but portfolio construction identifies the best way to put them into practice.

A robust, repeatable portfolio construction process can also help uncover and remove biases and correlations, allowing investors to add return without taking additional risk.

Key Points

- Diversified portfolios can have biases

- Volatility has an impact on portfolios

- It is useful to assess volatility in different situations

In particular, this is as true for funds that invest in publicly traded assets such as bonds and equities as it is for real assets such as infrastructure and real estate.

Instead of blindly following an inefficient benchmark index, investors can construct portfolios of well-understood assets that allow their expertise to add value – identifying and optimising return drivers, ensuring diversification and taking a forward-looking view to managing risk.

Active managers often follow a bottom-up and simplistic approach to portfolio construction; purchasing the securities they like, avoiding those they dislike and determining whether they are happy with the resulting overall risk and tracking error.

But while tracking error helps investors see how they are deviating from their preferred benchmark, it is not necessarily a great tool for measuring risk. These deviations need to be value-creating and risk-reducing.

Changes to the way markets function can cause distortions and this has been evident in recent years in the stock market. The rise of passive investing has led to many investors now getting exposure to big-picture trends through exchange-traded funds, rather than rigorous research of company fundamentals.

For example, when something dramatic happens, such as a sudden change in the macroeconomic environment, ETFs reallocate at a large scale, which affects a lot of companies, sectors and investors.

For investors who do not want to be at the mercy of volatility, the next step is to understand how to make their portfolio construction process more robust and capable of delivering resilient outcomes.

In credit, there are multiple return drivers such as carry – how much yield investors are getting – and forward-looking views on how spreads in different sectors might change depending on the market backdrop.

Managers should look to isolate the most efficient places to generate yield and carry relative to the benchmark, while simultaneously identifying idiosyncratic ideas, which are more focused on spread compression.

Underrated qualities

Humility is an underrated quality in the construction process. This is because investment managers tend to be optimistic about their ability to forecast performance, which creates a bias toward riskier allocations.

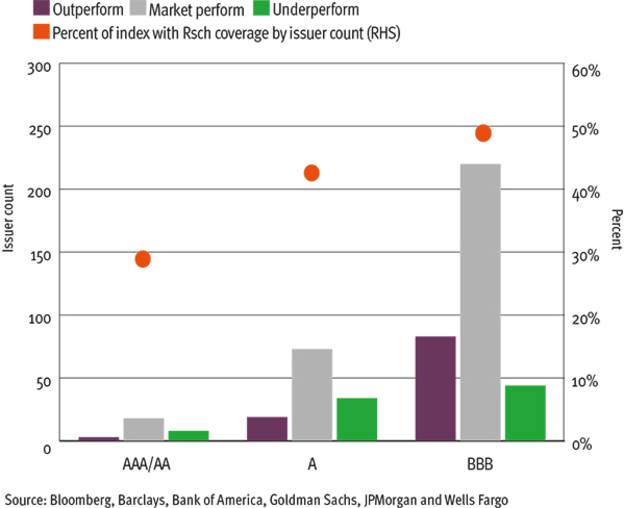

To illustrate this, back in 2017 Aviva Investors conducted a study evaluating every US investment-grade corporate bond recommendation from five sell-side research departments, capturing ‘outperform’, ‘market perform’ and ‘underperform’ recommendations across each rating category.

The data showed there isa clear low-quality bias to the outperform recommendations: the number of outperform recommendations for triple-B bonds is six times higher than for single-A bonds.

If portfolio managers are looking to research analysts for investment ideas, they will naturally be biased toward riskier securities.

Not only is this important before implementing a new idea, it is also essential to monitor invested ideas on an ongoing basis, to track whether they are behaving in line with expectations and, if not, to understand why not.

Resilience targeting, meanwhile, is about choosing the ‘efficient’ portfolio that best leverages the central investment thesis but will not be materially affected should it fail to deliver.

For instance, focusing on volatility as a primary measure of risk helps add alpha rather than beta to a portfolio.

This can be further enhanced by incorporating sensitivity analysis of investment ideas or portfolios under multiple scenarios. These analyses illustrate the level of risk taken in pursuit of returns and what can happen to a portfolio when the central thesis does not play out.

There are two kinds of scenario analysis. The first assesses portfolios’ sensitivity to volatility under different market conditions. The second is run by risk teams and is also known as stress testing.

Stress testing provides critical insight on when to reallocate or resize investment ideas, enabling managers to generate returns while acknowledging there will be periods of volatility and exogenous shocks to the market that cannot be predicted.

For much of the past decade, preaching the virtues of portfolio construction would have fallen on deaf ears as ultra-loose monetary policy has made it easy to generate decent returns through simple (and cheap) exposure to a variety of asset classes.

But Covid-19 – the impact of which has severely damaged companies, sectors and entire economies – has shifted the debate once more.

Building portfolios that can hold up in the most testing of circumstances is a matter of design, not good fortune; which results from sound investment and risk management processes and good, old-fashioned skill and judgement.

Unfairly miscast as an expensive ‘Cinderella science’ during the bull years, portfolio construction now has its chance to shine.

Josh Lohmeier is co-manager of the Aviva Investors global investment grade corporate bond fund and head of North American investment grade credit