The shares of the giant Scottish Mortgage investment trust have fallen heavily as result of the pronounced sell-off in technology linked equities and could now be a buy, according to Nick Wood, head of fund research at Quilter.

The Scottish Mortgage investment trust has a market cap of £19.2bn, making it by far the largest trust in the UK, and the only conventional investment trust in the FTSE 100.

The trust thrived over the past decade from its holdings in technology companies, and, over the past year, from its ownership of Tesla in particular.

But Tesla shares are down about 20 per cent in two weeks and shares in the Scottish Mortgage investment trust have fallen from £13.50 to £12.22 since the end of last week (February 19).

The shares of Amazon, which is the trust’s second largest holding have also fallen steeply in recent days.

Wood believes the share price decline makes this an attractive time to buy the shares.

He said: “Every year we get some sort of market correction that throws everyone off balance. It certainly appears as if the market could be shifting in sentiment given the rise in bond yields and the sell-off we are seeing in tech focused names.

"Indeed, should this be a prolonged sell-off there will be some who will think that tech has had its day in the sun, at least for now.

“However, while this might be the start of a short-term dip for the likes of Baillie Gifford and the more growth focused managers, it could present an attractive entry point for investors.

"Given the falls experienced and the volatility it is showing, should Scottish Mortgage fall to a discount then investors should consider this a buying opportunity given the long-term track record the team has exhibited, as well as the quality of the portfolio.”

Managed by James Anderson and Tom Slater of Baillie Gifford, the trust is the absolute best performer in the sector over one, three and five years.

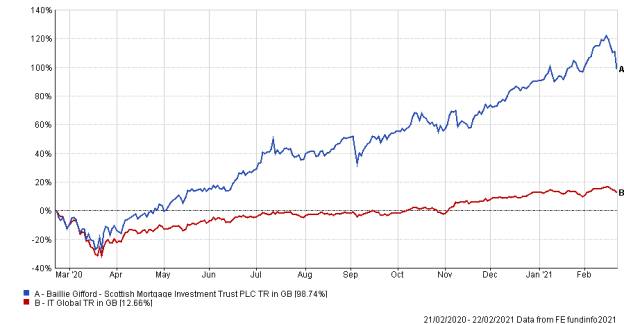

Over the past twelve months to February 23, it has returned 98 per cent, compared with 12 per cent for the average trust in the AIC Global sector in the same time period.

But as investor concern about higher inflation post-pandemic translated into higher bond yields, this put pressure on equities.

The yield on UK 10-year government bonds has more than doubled this month, and at 0.7 per cent, is around three times higher than was the case in August 2020, while the yield on the US 10-year government bond has also risen above 1 per cent this year.

The impact was particularly felt on technology shares, partly because those are the equities trading at the highest valuations and partly because many such stocks do not pay much of an income yield.

Investors placing a high valuation on technology shares are doing so in anticipation of future profits making today’s valuation look cheap. This is most effective as a style of investing when bond yields are low, as the sacrifice one is making by forgoing the guaranteed income of today in exchange for a potentially higher income tomorrow is small.

Higher bond yields make that sacrifice harder.

Adrian Lowcock, head of personal investing at Willis Owen, said: “What we are seeing is people reflecting their own experiences in the markets.

"There is a sense in the UK that we are entering a new phase of the pandemic, there is a date when the restrictions end. And that means many of the stocks that did well during the pandemic will do less well after it, while the stocks that suffered will do better.

"Many companies such as airlines and pubs, have been just surviving, but as they come back, they will actually grow, because they will gain market share from competitors that don’t survive, and they have also learned better to manage their costs.

"But I think while there is a period of underperformance for technology now, the longer-term technology theme is not going away, people who learned the advantage of online shopping won’t go back. And that means the technology stocks will come back in time.”

david.thorpe@ft.com