Advisers and clients looking at the present economic climate in Britain may be tempted by the view that a lot of chickens are coming home to roost.

Long-term issues around the unwinding of quantitative easing, exiting the EU, sluggish productivity and wage growth, and demographics have combined to place policymakers in a bind, while investors are forced to question long-held assumptions around portfolio construction, bond yields and inflation.

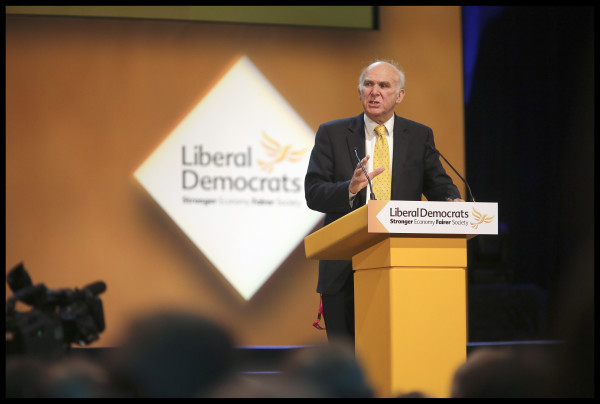

One individual who has been around since the conception of many of the received wisdoms that are being challenged is the former politician and professional economist Sir Vince Cable.

His career has taken him from advising African governments in the 1970s, to being a special adviser in a Labour government, and then secretary of state for business in the Conservative-Lib Dem coalition government from 2010-2015.

Although in his late 70s, he remains very active as an economist, holding academic positions at both the London School of Economics and Nottingham University, and has three different books coming out this year.

Of the present economic climate he is scathing of any plan to cut taxes unilaterally, saying of Conservative leadership candidate Liz Truss’s plans that: “If she thinks you can cut taxes without there being consequences, she is either economically illiterate or dishonest. I mean, one could cut VAT for example, and that would not be immediately inflationary, but the money would have to come from somewhere else.”

One of the areas of public policy that most pre-occupies investors today is the unwinding of quantitative easing by central banks globally. This has reduced liquidity in markets, pushed bond yields up and impacted equity markets.

And many associate the policy of quantitative easing with the steep rises in asset prices, including house prices, over the past decade, even when economic growth itself was meagre.

Cable defends the policy, saying the extra liquidity it provided to the banking system was needed, and, “it was a policy that originated in Japan, and was taken up by Bernanke in the US, who had studied the great depression and thought this would prevent the financial crisis turning into another depression, and it did, and it was applied in the UK as well. But the side effects have been strong. I don’t think any of us in the government at that time knew what the impact of QE would be.”

He acknowledges that by causing asset prices to rise, inequality increased, but he says the response should have been wealth taxes.

Cable says: “Myself and Adam Polson, who was on the Bank of England’s Monetary Policy Committee at this time, tried to get this addressed via the tax system. We also tried to change it so that, instead of just buying government bonds, the bank bought small business loans, as that would have eased credit conditions for them coming out of a recession. But Mervyn King, then governor of the Bank of England, would not do it as he felt it was too much intervention in the economy.”

Whatever his academic work and books, he will probably be best remembered by posterity for his role in government, when the suite of policies that critics labelled 'austerity' were implemented.

Mistakes were made

One of the books Cable will soon publish is a retrospective on that period, and he defends the economic decisions taken. He says: “I don’t believe in trashing the past. There were mistakes made by a lot of people in terms of regulation of the banks in the run up to the global financial crisis, but I think Gordon Brown and Alastair Darling did a good job at fixing that. The coalition government made mistakes, but we provided stability, we took decisions and stuck to them, unlike what has happened since. When we took over, there needed to be a confidence boost for sterling, and I think we provided that. People forget that the UK’s deficit was so large. I think other things could have been prioritised, but the general policy was the right one. The Labour leadership at that time just tried to pretend the deficit didn’t exist.”

Of the current policy options he says: “The Conservatives are obsessed with this thing called the Laffer Curve, which purports to show that all tax cuts pay for themselves. But while there are some circumstances where they do, it cannot be applied universally, which is what some of the Tory candidates have been trying to do.”

One of the ways in which the Laffer curve’s limitations can be exposed occurred during Cable's time in government. The top rate of income tax was cut and the revenue received from this group of taxpayers rose, appearing to justify the notion that tax cuts raise extra revenue. But Cable notes that the economy was recovering during this period, meaning that more people entered the higher tax band, and that generated the extra revenue, rather than the lower rate itself doing so.

Beginnings

All of those questions and jobs are a long way from where he started out in life. He grew up in York, where both his parents were factory workers. After graduating from Cambridge and completing a PhD at Glasgow University, his first job was working as an economic adviser to the government of newly independent Kenya, and later worked in the Latin America section of the UK foreign office, then as an adviser to the Labour government of the 1970s and as chief economist at Shell before being elected to parliament in 1997.

Most of those experiences gave him an interest in emerging markets, and he says: "Today, and for a long time actually, a disproportionate amount of my savings is invested in emerging markets. China is by some measures the biggest economy in the world now, and demand from China bailed out the rest of the world in the aftermath of the global financial crisis.

"They have done that despite having a GDP per capita of a quarter of that of the US, I cannot see any reason why that couldn’t become GDP per capita of half of that of the US, and if it did, that would represent a lot of growth in consumption there.”

Another of the apparent chickens coming home to roost is Brexit. Cable says: "There is no doubt that the trend rate of economic growth in the UK will be lower for the foreseeable future as a result of Brexit, but it could be that longer-term companies adapt and find new ways to do business.”

One of the three books he has coming out soon is the paperback version of his tome on China, The Chinese Conundrum.

Away from the academic world, he is a director of an unquoted company that invests in hydrogen. That business, Element 2, he expects to float on the stock market in the coming year, but he is very sceptical of the term ESG.

He says: “There are companies out there who say they are ESG-friendly, or do ESG, but then don’t pay taxes. There are companies which say the environmental stuff is their priority, but then they can’t buy the solar panels from China for social reasons. That’s why I am sceptical about the growth of the term. What I am doing with Element 2 is very practical, and I like that.”

Although almost 80, Cable remains a prolific commentator, and as advisers and their clients experience the current economic uncertainties unfolding, it is likely Cable's voice will be one of those that remains prominent.

David Thorpe is special projects editor of FTAdviser

david.thorpe@ft.com