Paula Steele, director at John Lamb Financial Solutions said she was not surprised by the FCA’s findings, which she believed was a “by-product of a fast growing industry that has commercialised equity release and in some cases forgotten to ensure that the long term effects are at the forefront of the advice”.

Likewise Martin Wade, director at Access Equity Release, said: “The market offers more choice now than ever before and as such, advisers need to be constantly improving their knowledge. The one size fits all approach of a lump sum with interest roll up is dangerously outdated”.

In a multi-firm review published earlier last week, the regulator highlighted three significant areas of concern about the suitability of advice, which it said increased the risk of harm to consumers.

Its concerns centred around the personalisation of advice, challenging customer assumptions and evidence of the suitability of advice - all of which were found to be lacking.

According to Ms Steele, targets for client numbers had a negative impact as interest in equity release has risen.

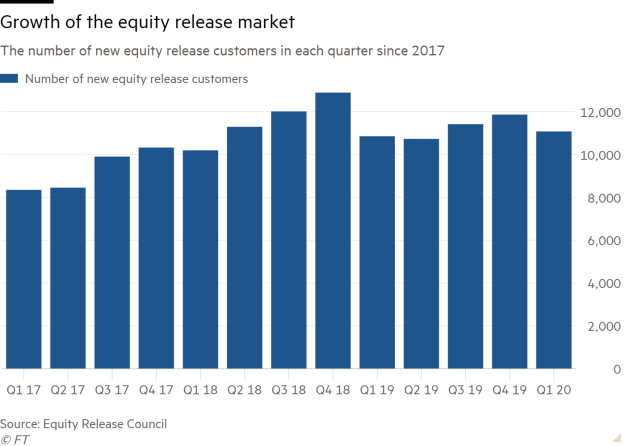

A report last month by equity release adviser Key found that while over-55s were borrowing lower sums with equity release, the number of customers taking out a loan had increased.

Ms Steele said: “The increasing interest in equity release has meant that advisers are busier than ever and in many cases tasked to see a certain amount of new clients each week. As most equity release meetings are conducted at the client’s home, advisers have to travel in order to meet with their clients which takes up valuable time”.

Ms Steele added: “Firstly, the main problem is that in some cases advisers aren’t able to spend enough time with their clients, getting to know them and understanding the bigger picture.

“Secondly, due to time constraints, generic documentation may be used to simplify the process, such as client fact-finds and suitability report templates.”

In its review of case files the FCA said it found a number that contained “standard generic text” to justify why customers did not want to consider alternatives to equity release.

The regulator encouraged firms to ensure the customer’s voice can “clearly be ‘heard’ in the file”.

It said that files should contain notes of the customer’s “own words, phrases and explanations… and not just responses recorded in the form of tick boxes or selected from a list of options”.

In response to the FCA’s review, David Thomas, chairman of the Society of Mortgage Professionals, said: “We accept that with the development of greater professional standards, there will be higher expectations... around advisers using more innovative ways to record clients’ decisions in their own words.”

However, Mr Thomas added that the challenge to advisers implied by this expectation should not be underestimated.

Mr Thomas said that advisers “can do more to record clients’ intentions, but they often have little certainty over what expectations adjudicators and supervisors will have in terms of evidence in ten years’ time, or even longer”.

He added: “As a result, we would like to work with the FCA to ensure that expectations for advisers are as clear as possible, and that incentives in the wider environment don’t make the challenge of giving good advice even harder”.

In addition to concerns around a lack of evidence to support the suitability of advice, the FCA uncovered examples where advisers had not challenged customers’ assumptions enough around lifetime mortgages.

According to Ms Steele, this was down to lack of experience. “Many advisers have excellent knowledge on equity release and have a genuine desire to help their clients, believing that a lifetime mortgage will help their clients meet their objectives.

“However, through lack of training or inexperience, they may not be digging deep enough when speaking with clients.”

Similarly Mr Wade said: “At a firm level, robust compliance and regular adviser training and clear oversight are essential. The ability to offer standard residential mortgages alongside equity release is important”.

A wider conversation

Ms Steele said that while most applications for equity release were lifetime mortgages, it should not only be seen as a mortgage product.

She added: “It would be wise to class it with later life planning as in the majority of cases this product will be in place until death and therefore greater amount of knowledge is needed to ensure that the product is not only suitable now, but also for the future”.

Ms Steele also said that in many cases, clients mistook the interest rate on a lifetime mortgage as the most important part when a product was recommended.

She said: “The most important part of the recommendation is ensuring that the product fits in line with the client’s future needs/changes and that it is the most suitable option available once all other areas have been explored”, adding that a “preferential interest rate [was] a bonus”.

The industry’s response

Commenting on the regulator’s review, David Burrowes, chairman of the Equity Release Council said: “The FCA’s report found that equity release is ‘working well for many consumers’ by helping to meet important social needs.

“We will continue to work with members and the wider market to make sure this is a universal characteristic, by developing and embedding best practice standards which we would like all firms to sign up.”

Mr Burrowes added: “The FCA’s findings will inform our ongoing work to support advice standards across the market”.

Advisers who are voluntary members of the Equity Release Council agree to abide by its rules and are signed up to its statement of principles. This includes that they will “seek to deliver suitable outcomes for customers from initial sale through every point of contact during the life of the product”.

In response to whether the council had any concerns about advisers abiding by its rules and principles in light of the FCA’s findings, Jim Boyd, its chief executive told FTAdviser: “We are confident the council’s standards are robust and provide the highest level of consumer protection of any later life property-based loan.

“We regularly seek the regulator’s input, including during last year’s standards update, and will carry out a thorough review to ensure all Council rules and guidance, supporting documents and resources reflect the FCA’s latest feedback.

“We would like to see all advice firms adopt these best practice standards for equity release and have already been working on a number of initiatives to support advice standards across the market, which will be published in the coming months.”

Additionally Will Hale, chief executive of equity release advice firm Key, told FTAdviser: “We welcome this report from the FCA and believe that it should serve as a call to action for continued focus on the quality of advice being delivered to customers across all parts of this sector”.

Mr Hale added: “We are also acutely aware that while older customers are not necessarily vulnerable, we may well see more of these customers when compared to other sectors of financial services – especially during the Covid-19 crisis.

“As such, we’ve increased the information we collect to help identify specific areas of vulnerability related to the current situation and adapted our advice philosophy to align to the unique market conditions with which we are faced.

“That said, there is still more to do and we know that as an industry, there is room for improvement. At Key, we are not complacent and we will be reviewing the FCA report in depth to see how we can continue to evolve our advice approach to ensure that we are delivering good outcomes for all customers.”

chloe.cheung@ft.com