Pension freedom rules have led to savers withdrawing a total of £33bn from their pensions in five years but the average withdrawal amount is steadily decreasing.

Pension freedom rules mean those aged over 55 no longer have to purchase an annuity to access their pension income but can instead enter drawdown or take a cash amount.

Data published by HM Revenue & Customs today (January 30) showed in total, almost £33bn has been withdrawn from schemes since the introduction of the freedoms in April 2015.

From October to December 2019, £2.2bn was withdrawn from pensions flexibly, an 18 per cent increase from the £1.9bn taken in the same period in 2018.

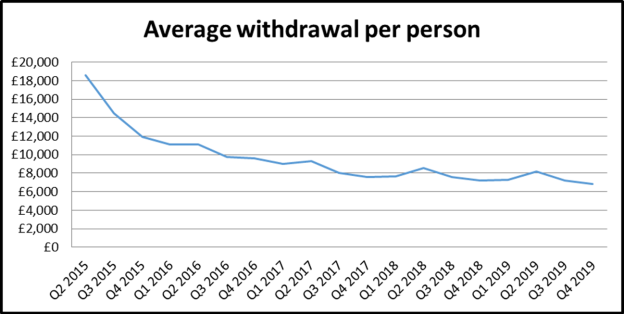

However the data showed the average amount withdrawn per individual from their pensions flexibly in Q4 2019 was £6,800, down 5 per cent from £7,200 in Q4 2018 and £7,250 in the previous quarter.

HMRC said average withdrawals have been falling steadily and consistently, with peaks in the second quarter of each year.

This was because people were phasing their withdrawals to minimise the amount of tax they have to pay, it stated.

The average withdrawal tends to be higher after the start of a new tax year as that is when individuals tend to plan their withdrawals.

Meanwhile, 327,000 individual withdrawals were made from pensions in Q4, a 24 per cent increase on the 264,000 in the same quarter last year.

Source: AJ Bell

Tom Selby, senior analyst at AJ Bell, said the industry was starting to see how savers were choosing to take their pensions using this new flexibility.

Mr Selby said: “It’s taken nearly five years but we are finally getting an idea of what ‘normal’ looks like in a world where people can spend their pension pot as they wish from age 55.

“While it’s hard to draw firm conclusions about the pension freedoms without knowing people’s other assets, income sources and individual circumstances, nothing we have seen suggests savers are broadly behaving in anything but a responsible manner.”

But Andrew Tully, technical director at Canada Life, said: “Treating your pension like a bank account shows no sign of abating, and if anything five years on from the pension freedoms it's only growing in popularity.

“Withdrawing cash can trigger unintended consequences, for example limiting the amount you can subsequently save into a pension. This can be very restrictive for people who are still working as HMRC restricts subsequent tax efficient pension savings to a very low £4,000 a year.

“Inevitably the significant amounts of cash leaving the pension system will in many cases be triggering large and often unexpected tax bills. But these tax bills don’t appear to be the natural brake on behaviour many predicted when the rules were changed. If anything people are seeking to strip cash from their pensions as rapidly as possible for fear of subsequent rule changes.”

Steven Cameron, pensions director at Aegon, said people should seek financial advice to ensure they leave enough funds behind to take later on in retirement.

Mr Cameron said: “Even in times of uncertainty as we’ve seen in recent months ahead of Brexit, there appears to be no resurgence of desire for the guaranteed income on offer from annuities. This may not be surprising though with interest rates continuing to languish at rock bottom levels, making the amount paid out from annuities look particularly unappealing.

“With people living longer, proper retirement planning is needed to safeguard people’s wealth, particularly if choosing to use flexible drawdown in retirement. Here, retirees remain invested in the stockmarket raising concerns over the impact a major fall could have on their retirement prospects including the risk of running out of money if they withdraw too much too soon.

“Seeking professional financial advice can give peace of mind that your financial affairs are being taken care of, whether that’s about having enough secure income to cover the basics, taking a sustainable regular income, or investing wisely.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.